How to File TAX information W-8BEN TAX FORM in Google AdSense | Youtube Blog & Admob 2021

All monetizing creators on YouTube, regardless of their location in the world, are required to provide tax info. Please submit your tax info as soon as possible. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 24% of your total earnings worldwide.

Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding.

Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

U.S. tax requirements for YouTube earnings

Google may begin withholding U.S. taxes on earnings you generate from viewers in the U.S. as early as June 2021. Please submit your U.S. tax info in AdSense as soon as possible. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 24% of your total earnings worldwide. If you’re a creator in the U.S., you may have already submitted your tax info. Check your tax info in your AdSense account to be sure..

Why Google withholds U.S. taxes

Google has a responsibility under Chapter 3 of the U.S. Internal Revenue Code to collect tax info, withhold taxes, and report to the Internal Revenue Service (the U.S. tax authority, also known as the IRS) when a YPP creator on YouTube earns royalty revenue from viewers in the U.S. If you have earnings from viewers in the U.S., Google may begin deducting taxes (known as withholding) as early as June 2021.

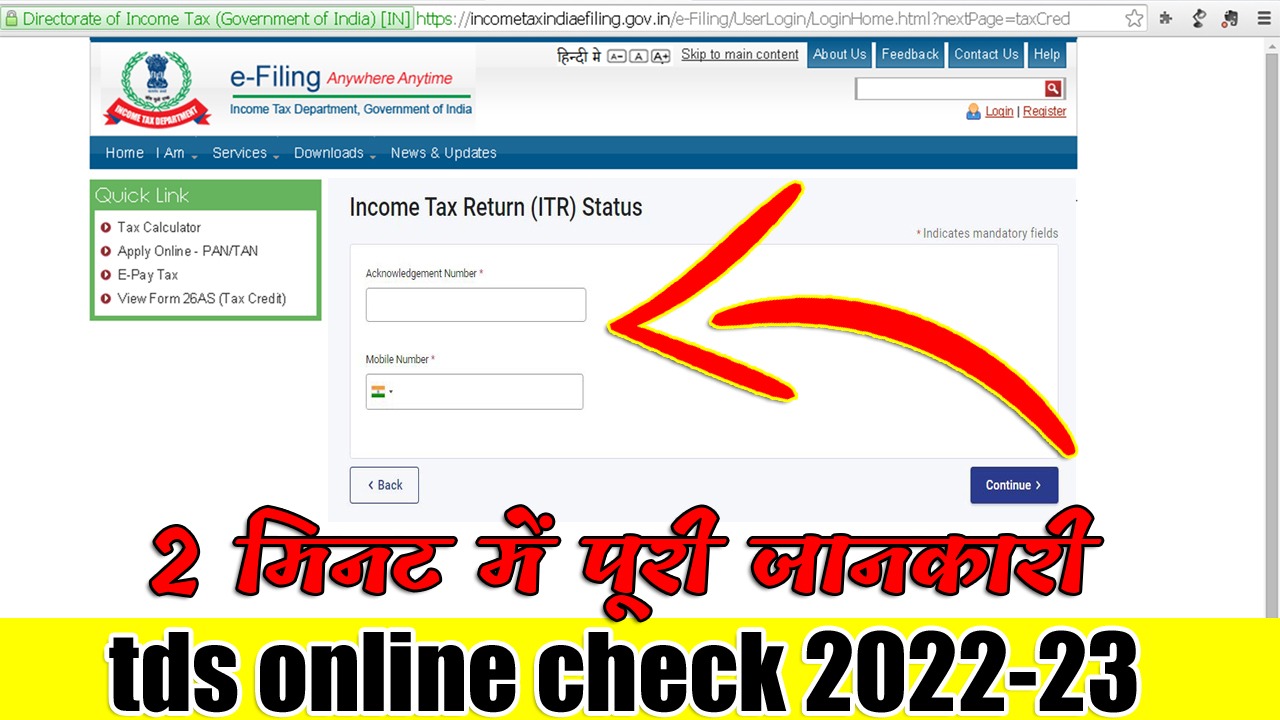

1, Sign in to your AdSense account.

2, Click Payments.

3, Click Manage settings.

4, Scroll to “Payments profile” and click edit Edit next to “United States tax info”.

5, Click Manage tax information.

6, On this page you’ll find a guide that will help you to select the appropriate form for your tax situation.

Tip: After you submit your tax information, follow the instructions above to check the “United States tax info” section of your Payments profile to find the tax withholding rates that may apply to your payments.

You’ll also be able to make any edits in case your individual or business circumstances change. If you’ve changed your address, make sure your updated permanent address is the same in both sections: “Permanent residence address” and “Legal address”. This will ensure that your year-end tax forms (e.g., 1099-MISC, 1099-K, 1042-S) are delivered to the correct location. If you’re in the US, you must resubmit your W-9 form with your updated legal address

- Anza Energy Football shoes

- Anza Zomba football boots

- Free recharge agent with high margin

- Top 5 Free Responsive Bootstrap 5 HTML5 Admin Template

- DarkPan – Free Bootstrap 5 Admin Dashboard Template

BC Exam best payment gateway best payment gateway in india Cheapest Coupon Rate Admin Panel UTI Citizenship Amendment Bill Coupon Rate Admin Panel UTI csc CSC BC csc center csc registration csc vle Digipay digipay lite aeps digipay lite kyc digipay lite kyc kaise kare digipay lite money transfer digipay new update ekendra Epson epson l3110 resetter epson resetter fino payment bank fino payment bank account opening fino payment bank csp fino payment bank csp kaise le fino payment bank csp registration MobiKwik Payment Gateway myTech Trips pan card PayKun payment Payment Gateway payment gateway api Paytm Payment Gateway payumoney Razorpay Razorpay Early Razorpay Early Settlements reset epson upi upi payment utiitsl uti pan card uti psa uti psa admin