New Pan Card Apply through OTP/Biometric

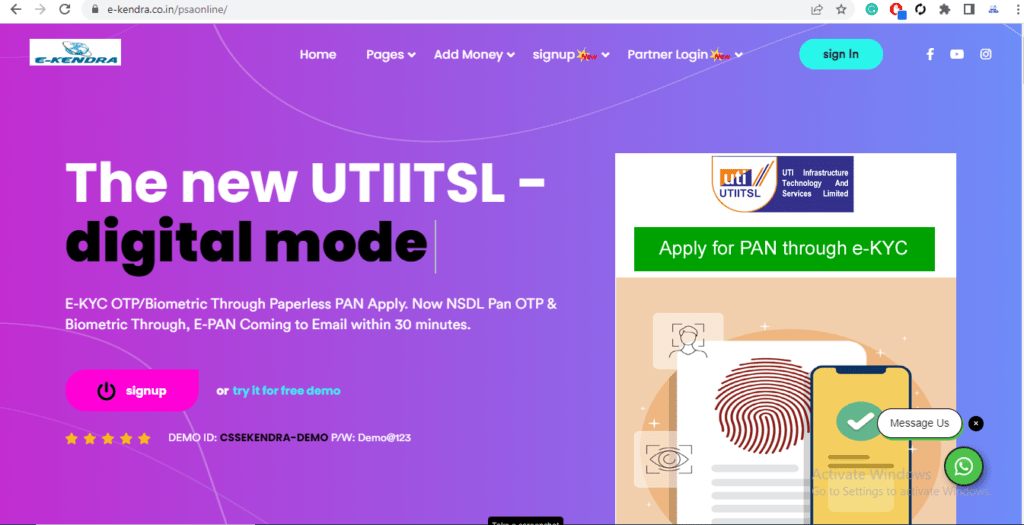

- step 1: visit the website https://e-kendra.co.in/psaonline/

- step: 2: click the “sign in” option

- step 3: login agent portal with your agent code

URL: https://www.psaonline.utiitsl.com/psapanservices/forms/login.html/loginHome

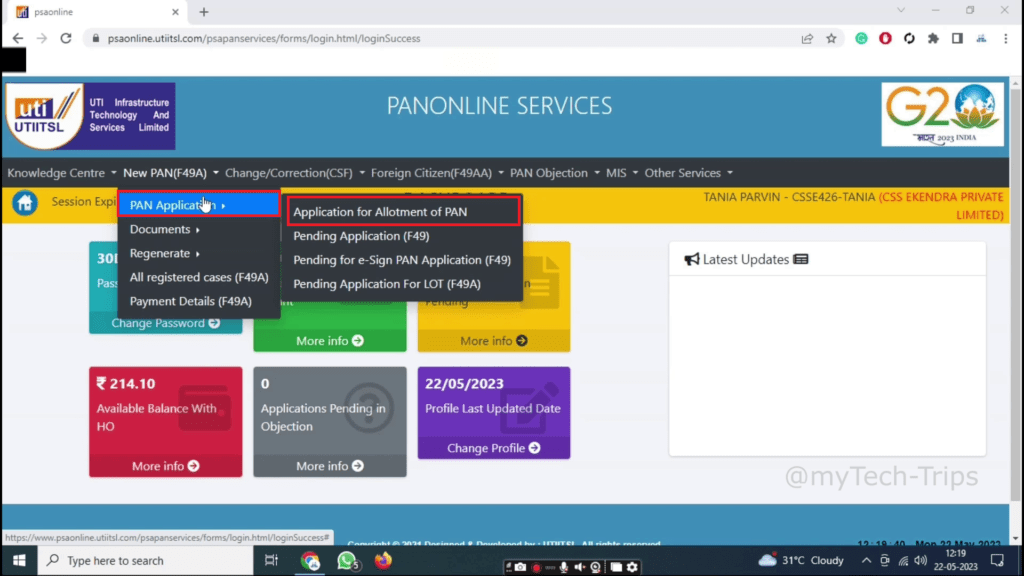

- step 4: click “New PAN (49A)”

- click “PAN Application”

- click “Application for Allotment of PAN”

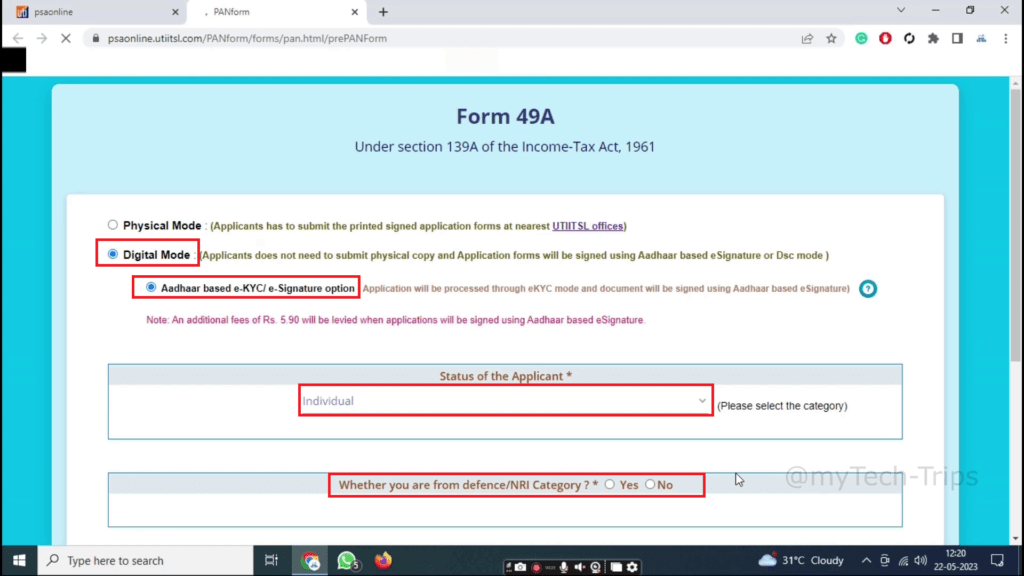

- step 5: select “Digital Mode”

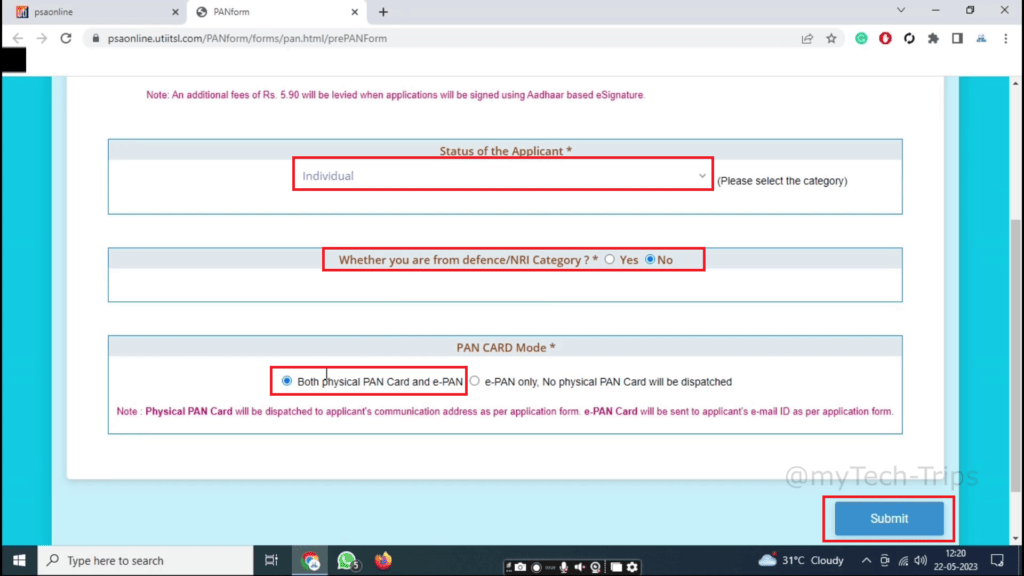

- select “Status of the Applicant”

- Whether you are defence/NRI? Select No.

- step 6: PAN CARD Mode

- select “Both physical PAN Card and e-PAN”

- Note: If you select “e-PAN only, No physical PAN Card will be dispatched”

- click the “Submit” button

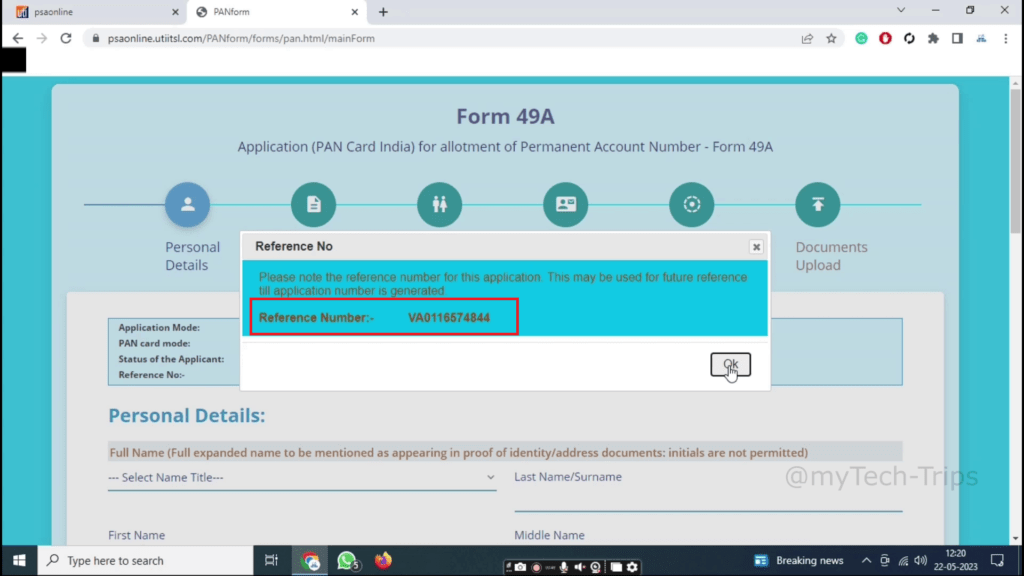

- step 7: copy the reference number and click “OK”

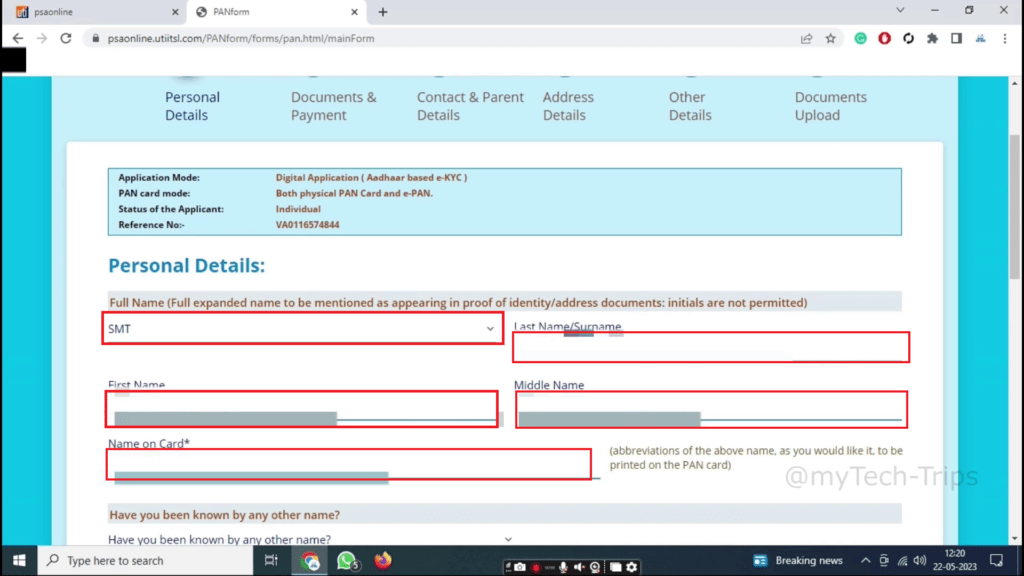

- step 8: type “Personal Details”

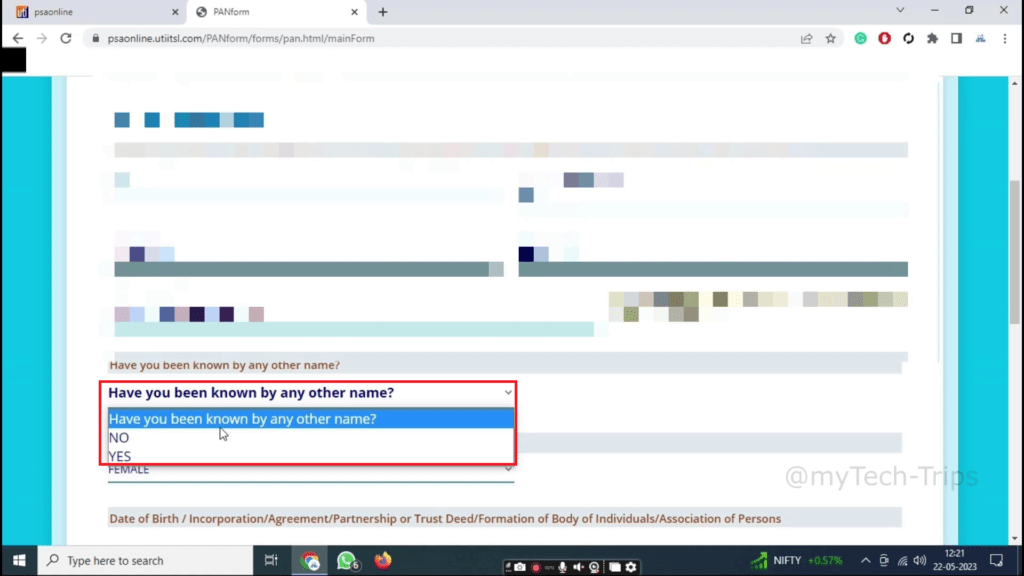

- step 9: Have you been known by any other name? select “NO”

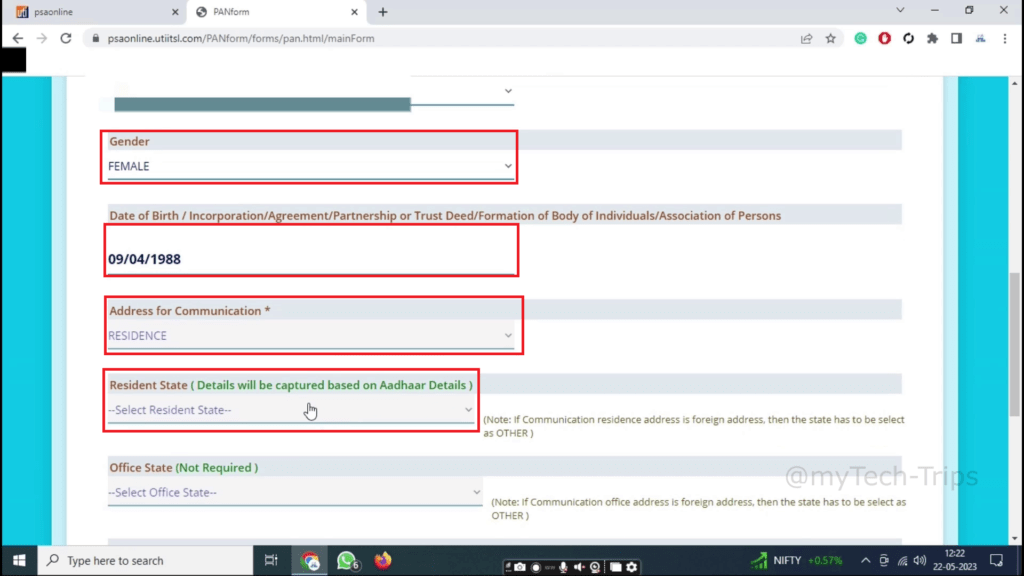

- step 10: select “Gender” and “Date of Birth”

- Address for communication select “RESIDENCE”

- Resident State “select your state”

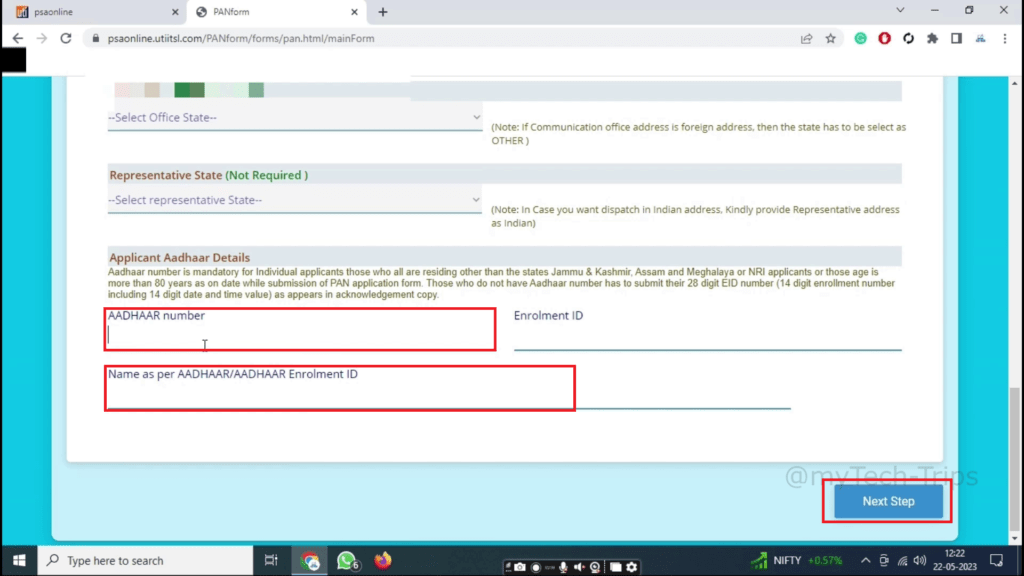

- step 11: Type “AADHAAR number” and “Name as per AADHAAR”

- click “Next Step”

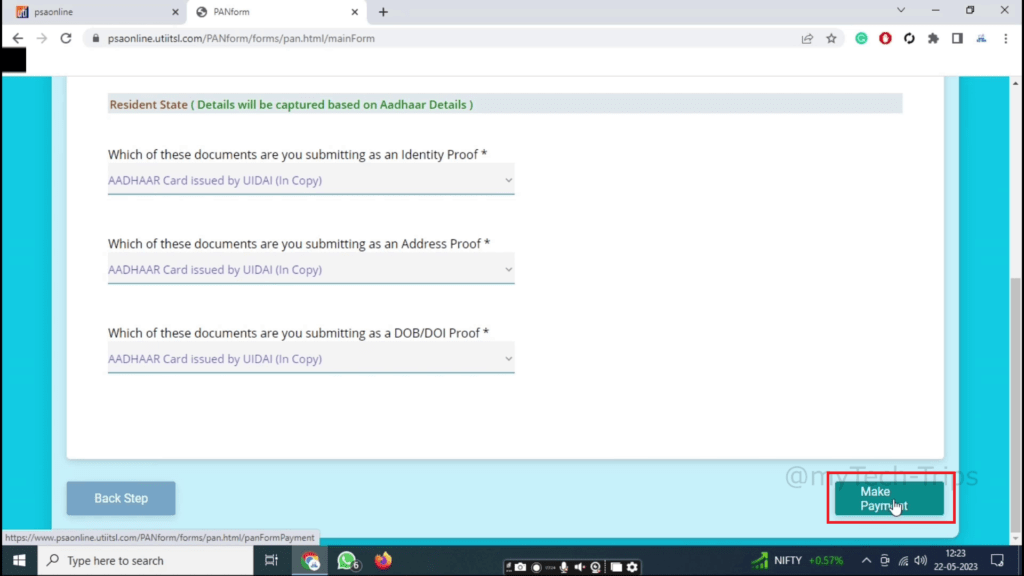

- step 12: click the “Make Payment” option

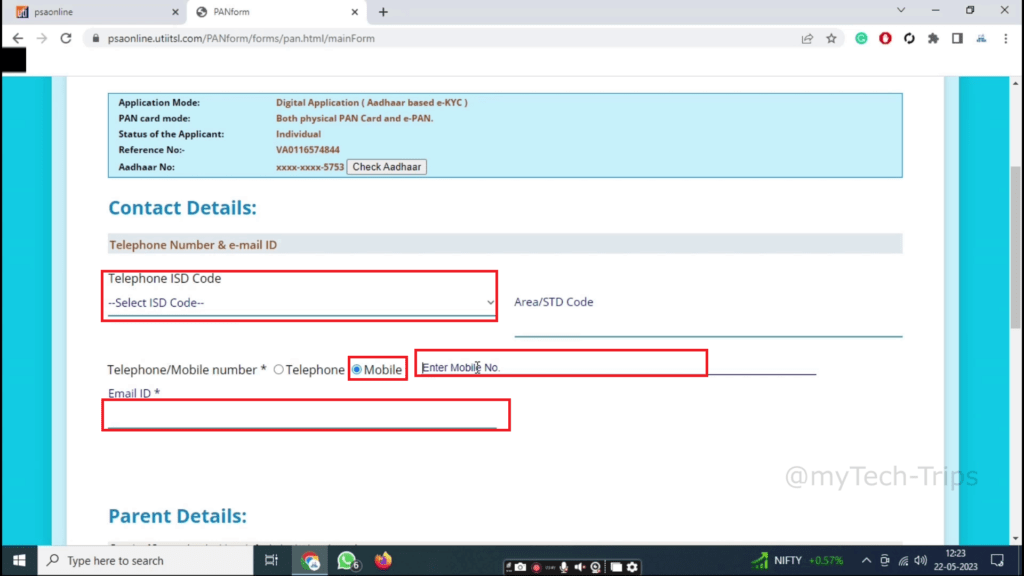

- step 13: Type contact details

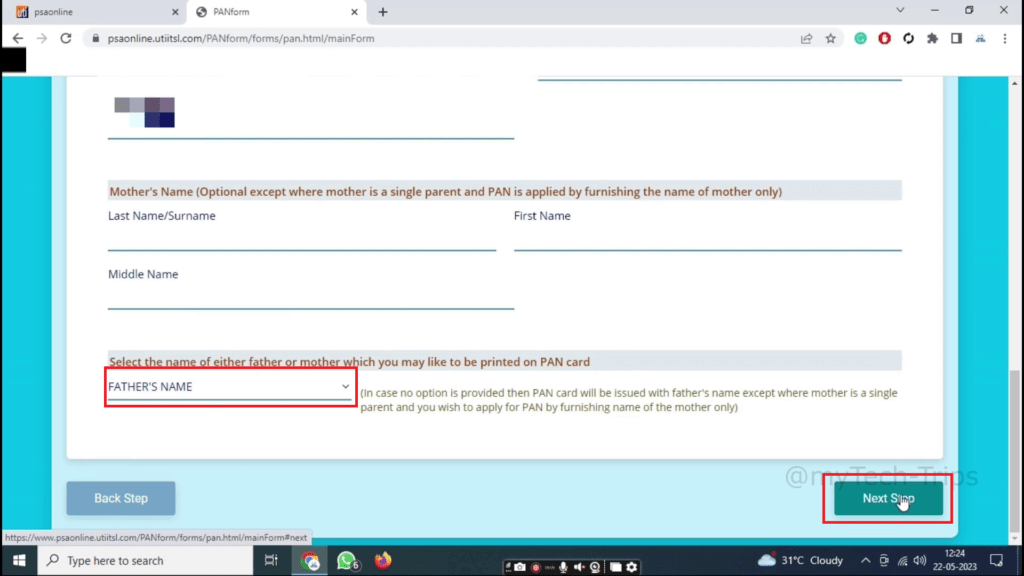

- step 14: Type parent details and select the mode which you may like to be printed on PAN card

- click “Next Step”

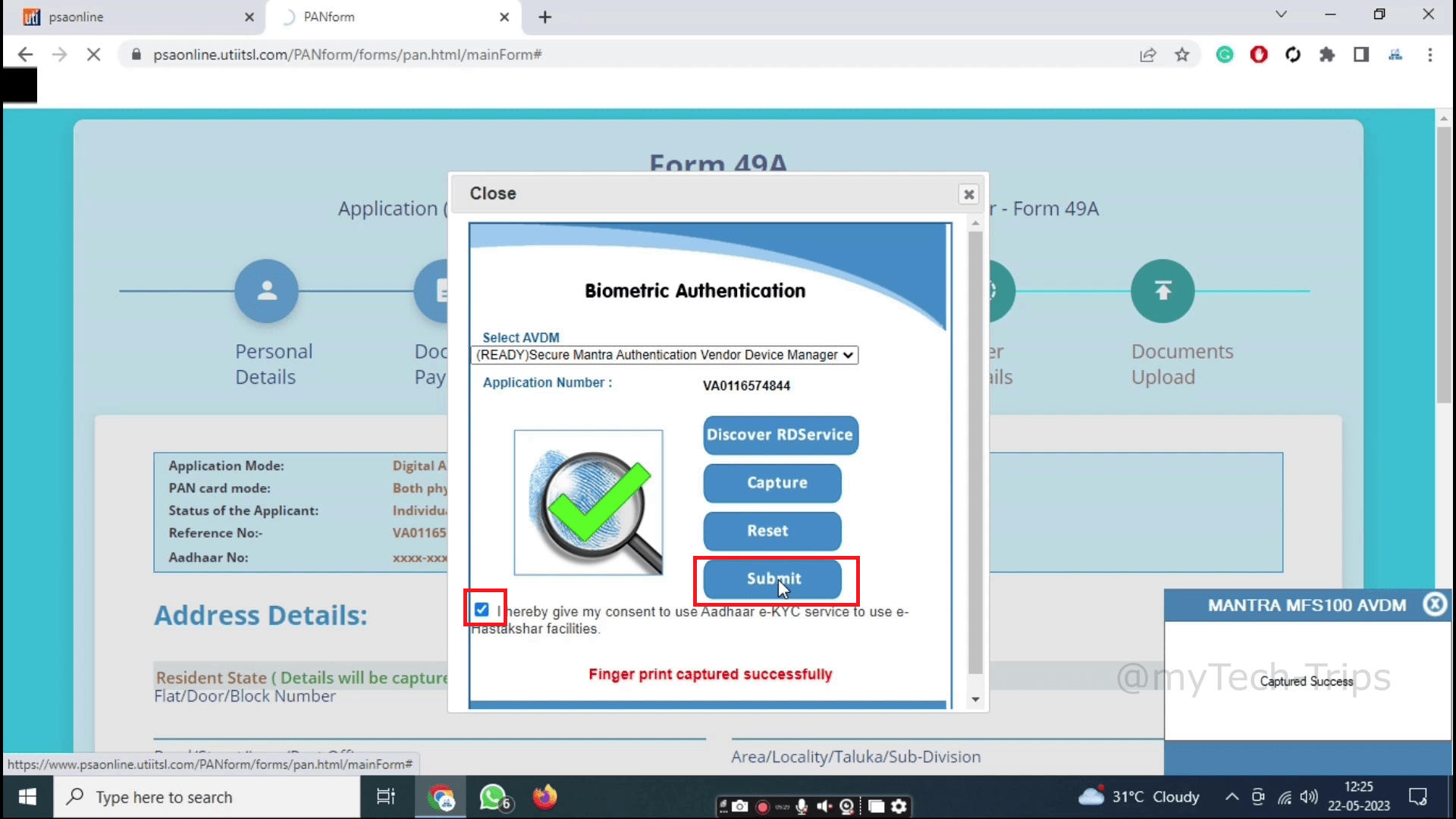

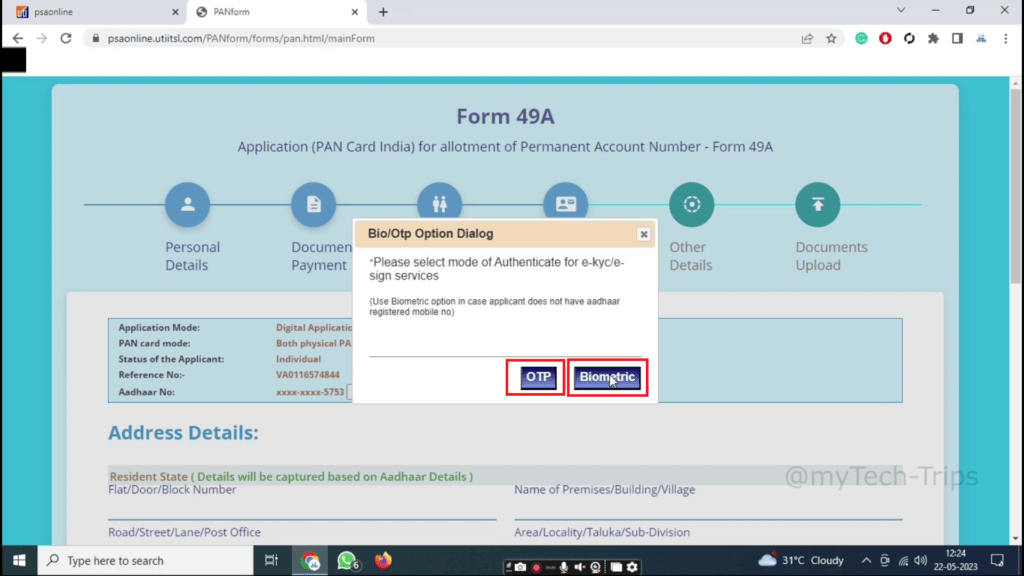

- step 15: select option OTP/Biometric

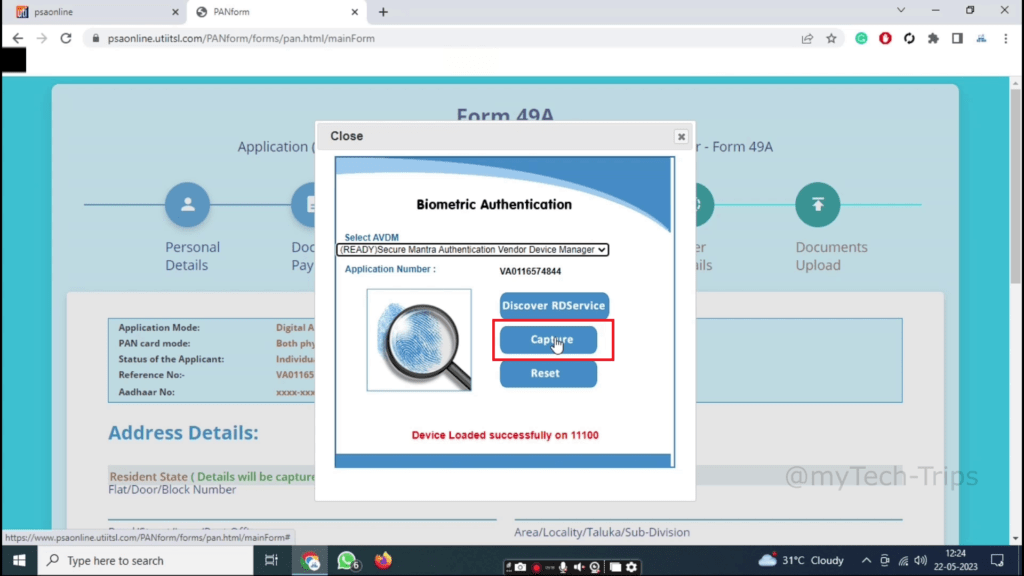

- step 16: click the Discover RDService button and click the “Capture” button

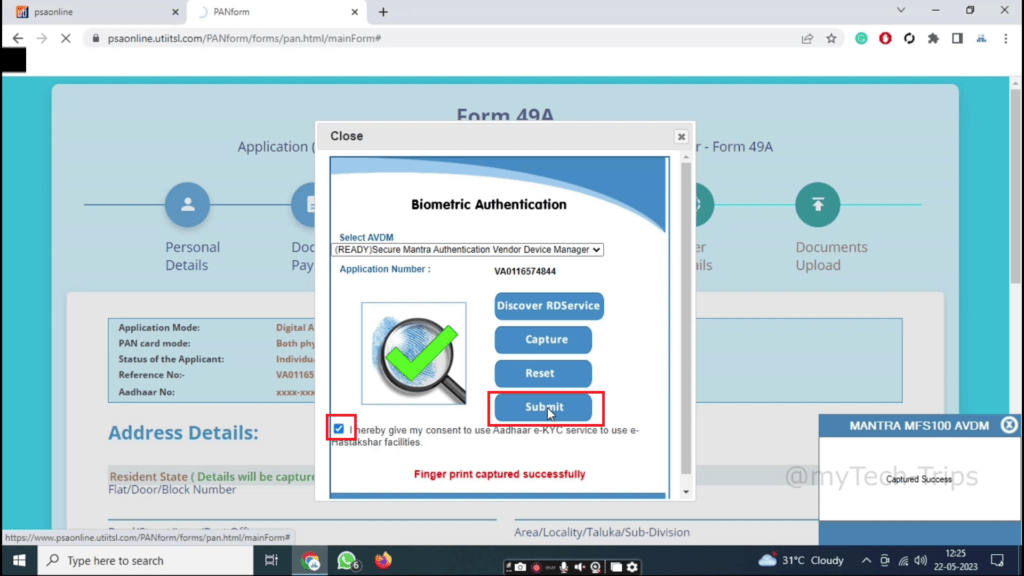

- step 17: I agree and click the “Submit” button

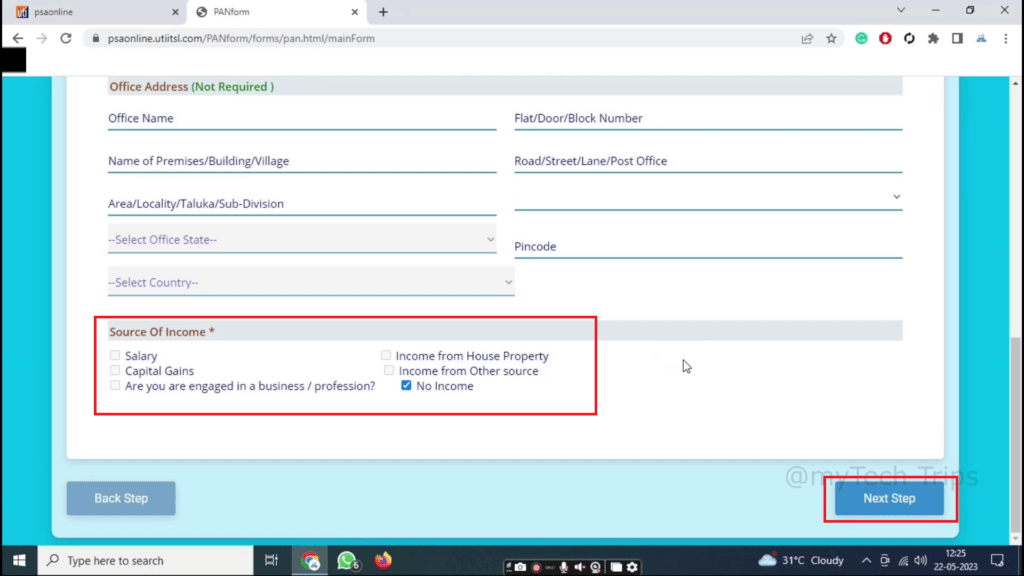

- step 18: select Source of Income and click “Next Step”

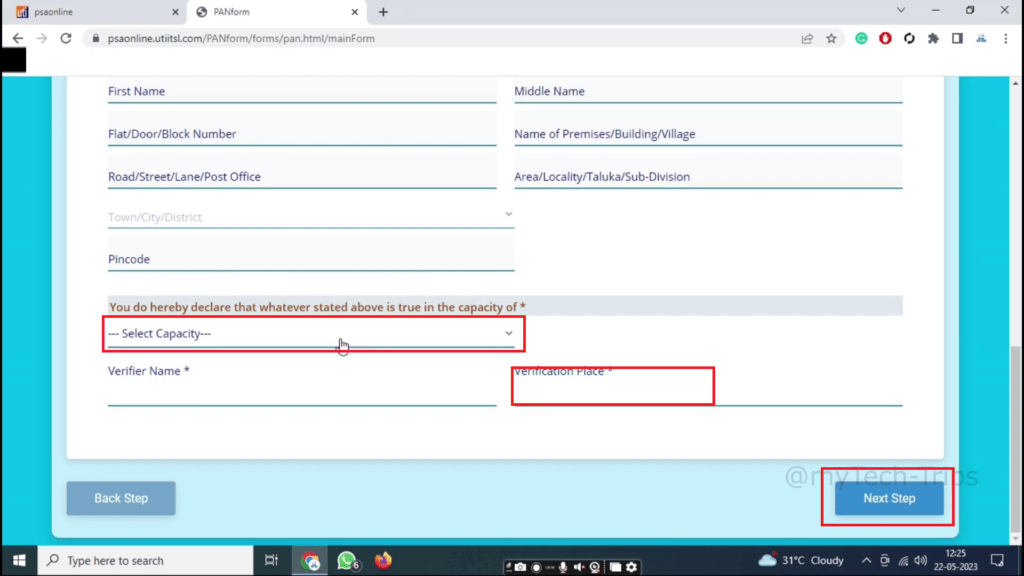

- step 19: “select capacity” and type Verification Place

- and click “Next Step”

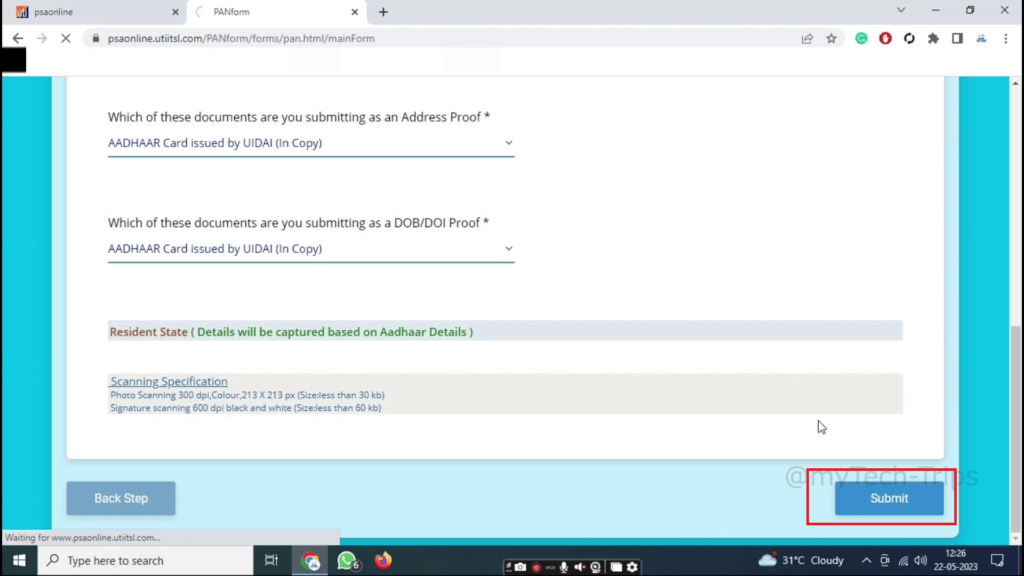

- step 20: click the “Submit” button

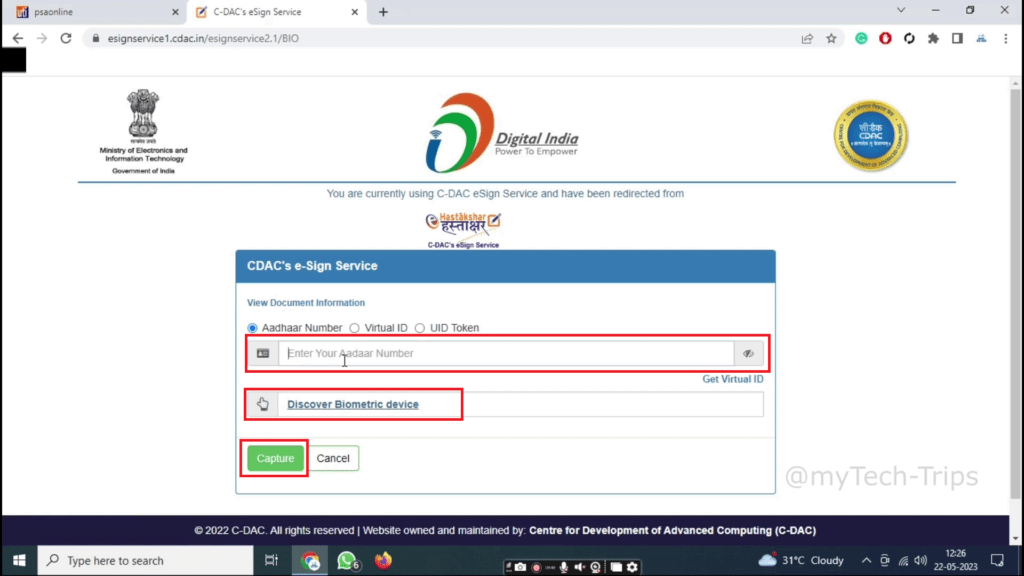

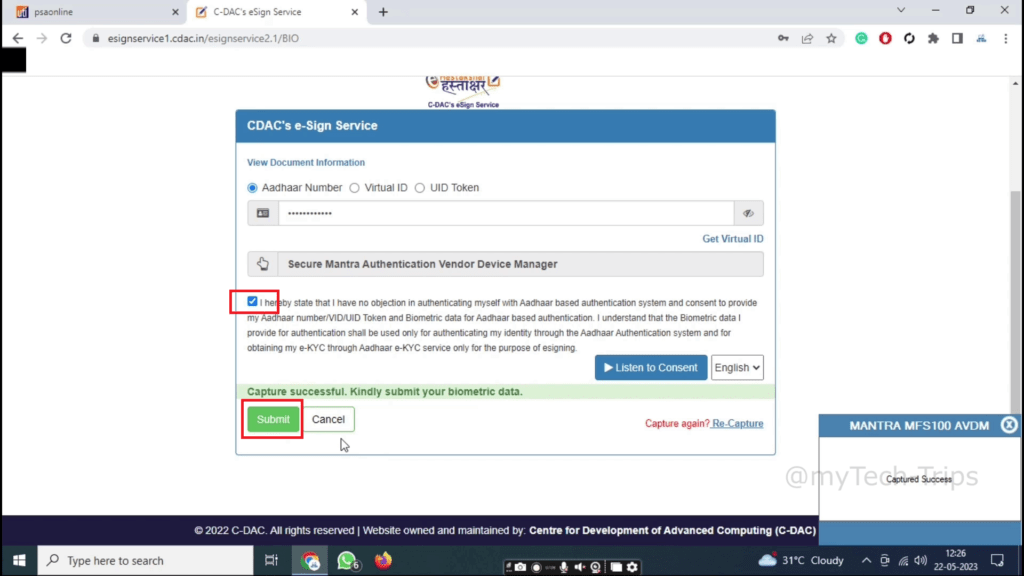

- step 21: type AADHAAR number and click Discover Biometric device

- click “Capture”

- step 22: I agree and click the “Submit” button

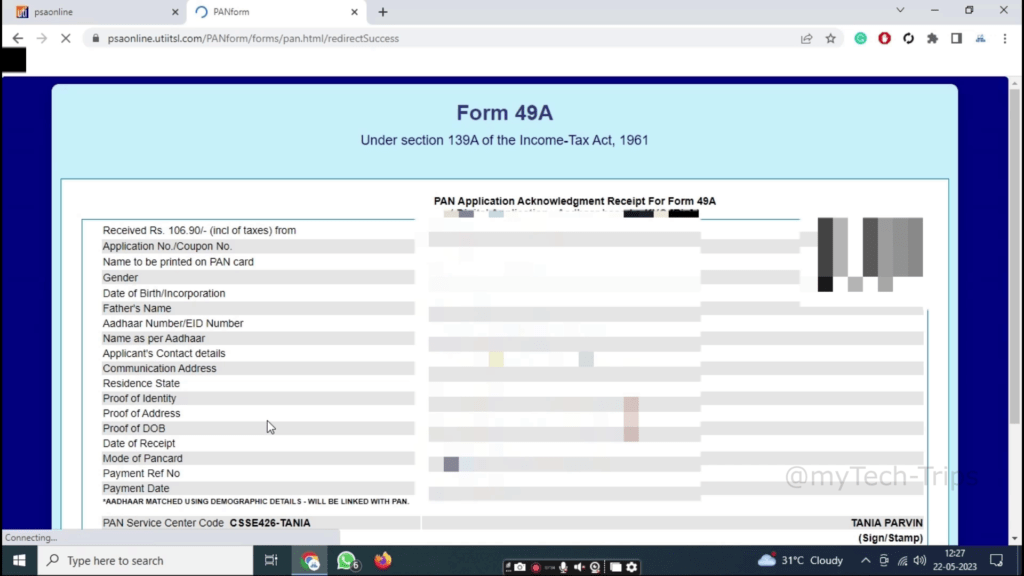

- Note: wait a few seconds automatically redirect to acknowledge page

Complete Application

Thank you!

Contain table:

- SBI CSP – How to register sbi csp

- Fino Payment Bank CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- BOB CSP Browser Settings

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2021-22

- CSC Registration

- VLE Eshram payment and recovery details

- Digipay lite id password kasie banaye

- Business Correspondents – कौन बन सकता है? – Axis Bank Through CSC

- IIBF Exam Registration

- Digipay Micro Atm Booking Order Start

- CSC VLE Insurance Training And Certification

- IRCTC Ticket Booking through CSC

To apply for an eKYC (electronic Know Your Customer) PAN (Permanent Account Number), you typically need to follow these steps:

- Visit the official website of the UTIITSL.

- Look for the eKYC PAN section or search for “Apply for eKYC PAN.”

- Click on the relevant link to begin the application process.

- Fill out the required information, such as your personal details (name, date of birth, address, etc.), contact information, and Aadhaar number.

- Verify your Aadhaar details by following the provided instructions. This may involve linking your Aadhaar number with your mobile number and verifying it through an OTP (One-Time Password) sent to your registered mobile number.

- Once your Aadhaar details are verified, review the information you have entered in the application form and make any necessary corrections.

- Submit the application form and note down the acknowledgment number or application reference number for future reference.

- After successful submission, your eKYC PAN application will be processed by the Income Tax Department.

- You will receive an e-PAN card via email at the email address associated with your Aadhaar within a few days, provided your application is approved.

- You can also track the status of your eKYC PAN application on the Income Tax Department’s website using the acknowledgment number or application reference number.

It’s important to note that the process and requirements may vary, so it’s always a good idea to refer to the official website of the Income Tax Department of India for the most up-to-date and accurate information regarding the eKYC PAN application process.

A PAN card (Permanent Account Number card) is a unique identification number issued by the Income Tax Department of India to individuals, companies, and entities. It serves as a proof of identification and is used for various financial and tax-related purposes. Here are some key points about the PAN card:

- Unique Identification: The PAN card contains a ten-digit alphanumeric number assigned to each individual or entity. This number remains the same throughout the lifetime of the cardholder, regardless of any changes in personal information.

- Identification for Tax Purposes: The primary purpose of the PAN card is to track financial transactions and ensure tax compliance. It is used when filing income tax returns, conducting high-value financial transactions, opening bank accounts, and for various other financial activities.

- Personal Information: The PAN card typically includes details such as the cardholder’s full name, date of birth, photograph, signature, and the PAN number. It also mentions the issuing authority and the card’s validity.

- Mandatory for Certain Transactions: The PAN card is mandatory for specific financial transactions, including the purchase or sale of immovable property above a certain threshold, opening a bank account, applying for a loan, investing in mutual funds, and other significant financial activities.

- Widely Accepted: PAN cards are widely accepted as proof of identity and are required by various organizations, government agencies, and financial institutions in India.

- Application Process: To obtain a PAN card, an individual needs to apply through the prescribed application form and submit necessary supporting documents, such as proof of identity, proof of address, and proof of date of birth. The application can be submitted online or at authorized PAN service centers.

- PAN Verification: The Income Tax Department provides an online facility to verify the authenticity of a PAN card. This helps organizations and individuals confirm the validity of a PAN card provided by someone.

It is important to keep the PAN card safe and secure, as it contains sensitive personal information and can be used for financial transactions and identity verification.

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |