Consent Letter For GST Registration: Format and Requirements

A consent letter for GST (Goods and Services Tax) registration is typically required when an entity is registering for GST and there are multiple stakeholders involved, such as partners, directors, or proprietors. This letter serves as formal consent from all relevant parties for the registration process to proceed. Below is a sample format for a consent letter for GST registration:

A consent letter for GST (Goods and Services Tax) registration is typically required when an entity is registering for GST and there are multiple stakeholders involved, such as partners, directors, or proprietors. This letter serves as formal consent from all relevant parties for the registration process to proceed. Below is a sample format for a consent letter for GST registration:

[Your Name/Company Name] [Your Address] [City, State, Zip Code] [Email Address] [Contact Number] [Date] [Recipient Name] [Title/Position] [Company Name (if applicable)] [Address] [City, State, Zip Code]

Subject: Consent for GST Registration

Dear [Recipient Name],

I, [Your Name/Authorized Person’s Name], hereby provide my consent for the registration of [Your Company Name/Your Individual Name] for Goods and Services Tax (GST) with the appropriate authorities.

I understand that this registration is necessary for compliance with the tax laws and regulations in [Country/State], and I acknowledge and accept the responsibilities associated with being registered for GST.

I confirm that all the information provided for the GST registration process is accurate and complete to the best of my knowledge, and I undertake to inform the relevant authorities promptly of any changes to this information in the future.

Furthermore, I authorize [Authorized Representative’s Name, if applicable] to act on behalf of [Your Company Name/Your Individual Name] in all matters related to GST registration, including but not limited to filing returns, making payments, and representing us before the tax authorities.

Please find attached the necessary documents and information required for the GST registration process.

Thank you for your attention to this matter. Should you require any further clarification or documentation, please do not hesitate to contact me at the provided contact details.

Yours sincerely,

[Your Name/Authorized Person’s Name] [Your Position/Title (if applicable)]Please note that the above template is a general guideline, and you may need to customize it according to your specific circumstances, such as the legal requirements in your jurisdiction and any additional details relevant to your situation. It’s advisable to consult with a legal or tax professional for precise guidance tailored to your needs.

Contents

Meaning of GST consent letter or NOC

Many businesses are carrying out their work from home as they do not have a registered commercial place of business. If such premises on which work is being carried out is owned, then a document supporting the taxpayer’s ownership is to be uploaded at the time of registration.

If the premises are rented, then a valid rent/lease agreement is to be uploaded. If it’s neither owned nor rented, then such taxpayers are required to submit a consent letter at the time of upload of their proof of place of business.

It is a No Objection Certificate (NOC) from the owner of the premises stating that he doesn’t have any objection to the taxpayer using the premises for carrying out business. Under GST, there is no specific format for the consent letter. It can be any written document.

Who must sign the consent letter?

The owner of the premises should sign a consent letter. In some cases, GST officers ask for a consent letter on a stamp paper, and the same should be notarised as well. However, one can upload the consent letter without even printing it on stamp paper. If a GST officer specifically asks for the content letter to be printed on stamp paper, the taxpayer can get the needful done.

Format of a consent letter

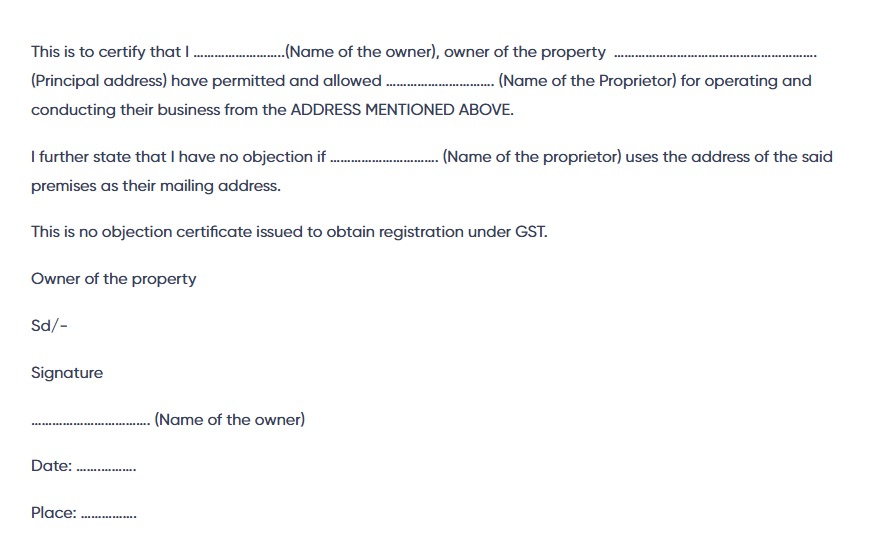

CONSENT LETTER

TO WHOMSOEVER IT MAY CONCERN

This is to certify that I ……………………..(Name of the owner), owner of the property …………………………………………………. (Principal address) have permitted and allowed …………………………. (Name of the Proprietor) for operating and conducting their business from the ADDRESS MENTIONED ABOVE.

I further state that I have no objection if …………………………. (Name of the proprietor) uses the address of the said premises as their mailing address.

This is no objection certificate issued to obtain registration under GST.

Owner of the property

Sd/-

Signature

……………………………. (Name of the owner)

Date: …….……….

Place: …………….

Download GST Consent Letter

Please click on the below link to download the Word format of the GST Consent letter.

Contain Table:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |