PayU is a popular payment gateway known for offering solutions tailored to various business needs. A key feature is its zero setup and maintenance fees, making it an attractive option for businesses looking to minimize upfront costs. Here’s a brief overview:

Contents

Key Features of PayU:

- Zero Setup Fees: No initial cost to start using the PayU payment gateway.

- Zero Maintenance Fees: No ongoing fees to maintain the service.

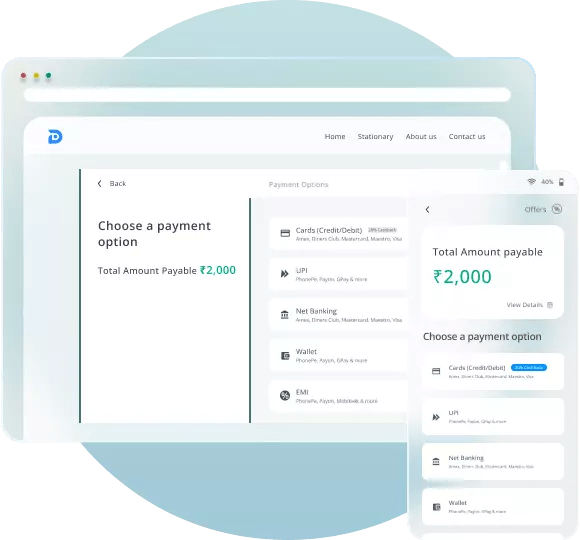

- Multiple Payment Options: Supports various payment methods including credit/debit cards, net banking, UPI, and wallets.

- Global Reach: Allows businesses to accept payments from customers worldwide.

- Secure Transactions: Ensures the security of transactions with robust encryption and fraud detection mechanisms.

- Easy Integration: Offers plugins and APIs for easy integration with websites and mobile apps.

- Comprehensive Dashboard: Provides a detailed dashboard for tracking payments, refunds, and other metrics.

- Customer Support: Provides support to resolve issues and ensure smooth operation.

What is a payment gateway?

A payment gateway is a technology that facilitates online transactions between customers and merchants. It acts as a bridge between the customer’s bank and the merchant’s bank, ensuring that sensitive information such as credit card details is securely transmitted and processed. Here’s a more detailed breakdown:

Key Functions of a Payment Gateway:

- Encryption: Secures sensitive data like credit card numbers, ensuring that it cannot be intercepted during transmission.

- Authorization: Verifies that the customer’s payment method is valid and that sufficient funds are available.

- Transaction Processing: Facilitates the transfer of funds from the customer’s account to the merchant’s account.

- Order Management: Keeps track of the transactions and communicates the payment status to the merchant and customer.

- Fraud Prevention: Implements various measures to detect and prevent fraudulent transactions.

How a Payment Gateway Works:

- Customer Places Order: The customer selects products or services and proceeds to checkout on the merchant’s website.

- Payment Information Entered: The customer enters their payment details (e.g., credit card information).

- Data Transmission: The payment gateway encrypts and transmits the payment data to the acquiring bank (the merchant’s bank).

- Authorization Request: The acquiring bank sends the transaction details to the card network (e.g., Visa, MasterCard) for authorization.

- Issuing Bank Response: The card network routes the request to the issuing bank (the customer’s bank), which approves or declines the transaction.

- Approval/Decline Notification: The issuing bank sends the response back through the card network to the acquiring bank, which then informs the payment gateway.

- Completion of Transaction: The payment gateway communicates the approval or decline status to the merchant and the customer, completing the transaction process.

- Settlement: If approved, the funds are transferred from the customer’s account to the merchant’s account, usually taking a few business days.

Benefits of Using a Payment Gateway:

- Security: Protects sensitive information and reduces the risk of fraud.

- Convenience: Allows customers to make payments quickly and easily online.

- Efficiency: Streamlines the payment process for merchants, improving cash flow.

- Global Reach: Enables businesses to accept payments from customers around the world.

- Compliance: Helps merchants comply with financial regulations and industry standards.

Payment gateways are essential for any business that wants to accept online payments, providing a secure and efficient way to handle transactions.

What are PayU payment gateway charges?

PayU’s payment gateway charges can vary based on factors such as the type of business, the volume of transactions, and the specific services chosen. However, here’s a general idea of the charges you might expect:

Standard Charges:

- Transaction Fees:

- Credit and Debit Cards: Typically ranges from 2% to 3% per transaction.

- Net Banking: Generally around 2% to 3% per transaction.

- UPI (Unified Payments Interface): Often lower, usually around 0% to 2% per transaction.

- Wallets: Similar to credit/debit cards, often around 2% to 3% per transaction.

- International Cards:

- Generally higher, around 3% to 5% per transaction due to additional processing involved.

- GST:

- Goods and Services Tax (GST) is applicable on the transaction fees, usually at 18%.

Additional Fees:

- Refund Charges: There may be a fee for processing refunds.

- Chargeback Fees: If a customer disputes a transaction, there might be a chargeback fee.

- Currency Conversion: For international transactions, there might be currency conversion charges.

- Settlement Fees: Charges for transferring funds to the merchant’s bank account.

Custom Pricing:

- High Volume Merchants: Businesses with a high volume of transactions may be eligible for lower rates.

- Custom Solutions: Depending on the specific needs of the business, PayU might offer custom pricing packages.

Promotions:

- Zero Setup Fees: PayU often promotes zero setup fees and zero maintenance fees for new merchants.

- Offers and Discounts: Periodic offers and discounts on transaction fees for specific payment methods or during promotional periods.

It’s important to contact PayU directly or visit their official website to get the most accurate and up-to-date information on their charges, as they can provide a tailored quote based on your specific business needs.

How to setup PayU payment gateway for your business?

Setting up the PayU payment gateway for your business involves several steps. Here’s a comprehensive guide to help you through the process:

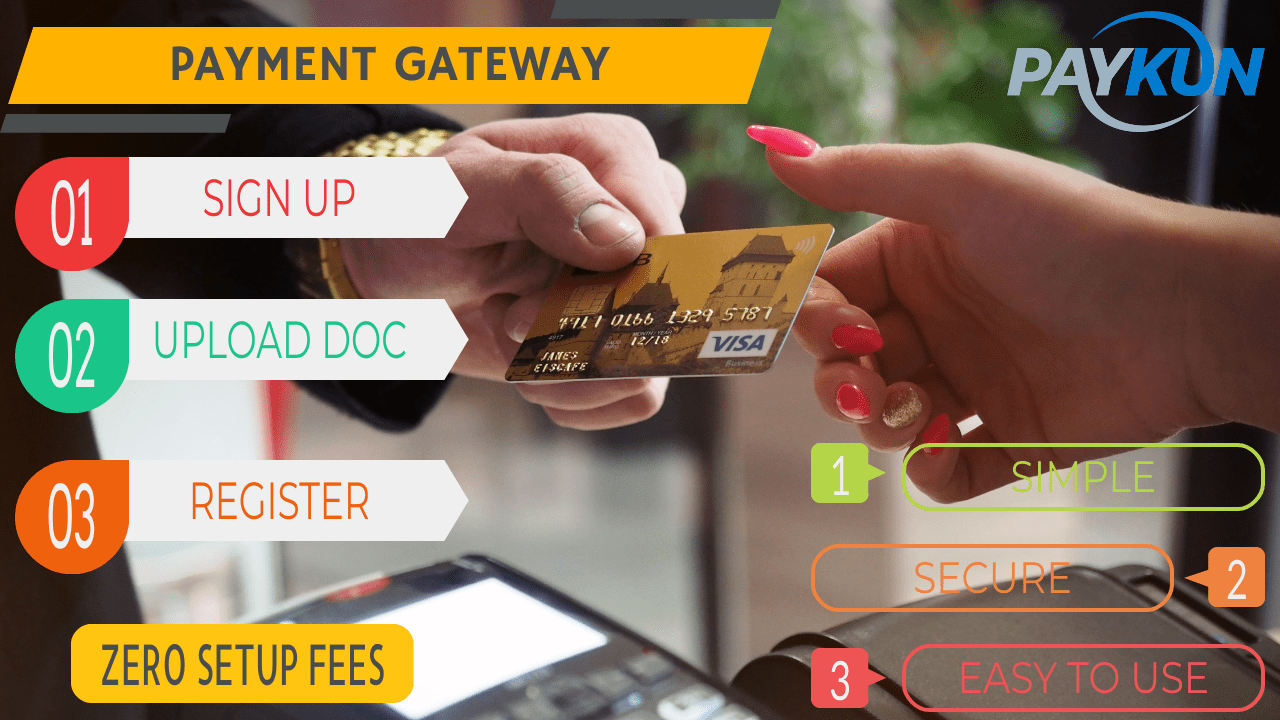

Step 1: Sign Up

- Visit PayU Website: Go to the PayU official website.

- Sign Up: Click on the “Sign Up” or “Get Started” button and fill in the required details, including your email, phone number, and business information.

Step 2: Verification and Documentation

- Business Details: Provide detailed information about your business, including the type of business, business name, and address.

- Upload Documents: Submit necessary documents such as:

- PAN Card of the business owner

- GST Registration Certificate

- Bank Account Statement or Cancelled Cheque

- Proof of Business (e.g., Business Registration Certificate)

- Address Proof (e.g., utility bill, rental agreement)

Step 3: Integration

- Choose Integration Method: Decide how you want to integrate PayU with your business. Options include:

- Hosted Payment Page: Redirects customers to PayU’s secure payment page.

- Embedded Checkout: Embeds the payment form on your website.

- APIs and SDKs: For more customized integration with your website or mobile app.

- Technical Integration:

- Download Plugins: If you are using platforms like Shopify, WooCommerce, or Magento, you can download and install PayU plugins.

- Use APIs: For custom integration, use PayU’s APIs. Detailed documentation is available on the PayU website.

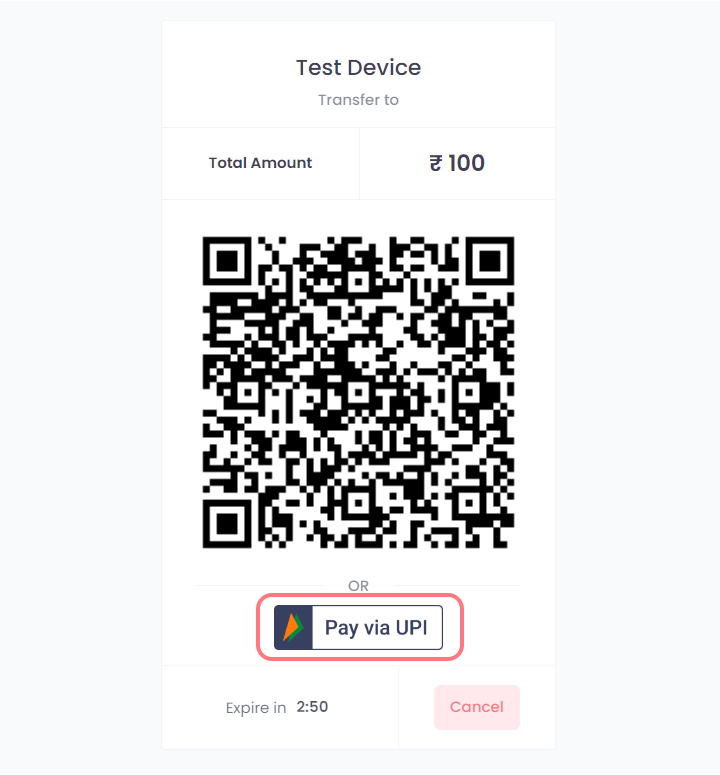

- Test Environment: Use the sandbox environment provided by PayU to test the integration before going live.

Step 4: Configure Payment Methods

- Payment Options: Enable the desired payment options such as credit/debit cards, net banking, UPI, and wallets.

- Customize Payment Page: If using a hosted payment page, customize it to match your brand’s look and feel.

Step 5: Go Live

- Test Transactions: Perform test transactions to ensure everything is functioning correctly.

- Activate Account: Once testing is complete and all documentation is verified, PayU will activate your account.

- Live Transactions: Start accepting live transactions on your website or app.

Step 6: Monitor and Manage

- Dashboard Access: Use the PayU dashboard to monitor transactions, view reports, and manage refunds.

- Customer Support: Utilize PayU’s customer support for any issues or queries.

Additional Tips:

- Security: Ensure your website or app complies with security standards to protect customer data.

- Communication: Keep your customers informed about the payment options and security measures in place.

- Updates: Regularly check for updates from PayU regarding new features, security patches, and compliance requirements.

By following these steps, you can seamlessly set up PayU as your payment gateway and start accepting payments online.

Payment Gateway:

- TOP 10 BEST PAYMENT GATEWAY IN INDIA (2020)

- PhonePe Payment Gateway

- PayKun – Best Payment Gateway For India 2021

- UPIGateway

- Freecharge PG

Credit Card:

- Kotak upi rupay credit card apply online

- HDFC Bank UPI RuPay Credit Card

- IDFC FIRST Power Rupay Credit Card

- PCI DSS

Banking:

- Register to IndusNet Online Banking

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2024-25

- Documents Required for Opening a Current Account Online

- csc digipay lite commission 2023-2024

- DigiPay v7.3

- Airtel Payment Bank CSP

- SBI CSP Commission Structure

- SBI CSP – How to register sbi csp

- Fino CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- Fino Payment Bank Commission 2023-2024

- Instant PIN Generation for Debit Card

- BOB CSP Browser Settings

- 7 Points on UPI Payments

- 5 Best Refer and Earn UPI Apps: Earn Free Cash Online

Other’s:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |