PRODUCT DESCRIPTION

INTRODUCTION

Permanent Account Number (PAN) is a code that acts as an identification for individuals or corporates in India, especially for those who pay Income Tax. Understanding its value, Pan Card is used as a document for identity verification in many corporate and government divisions across India.

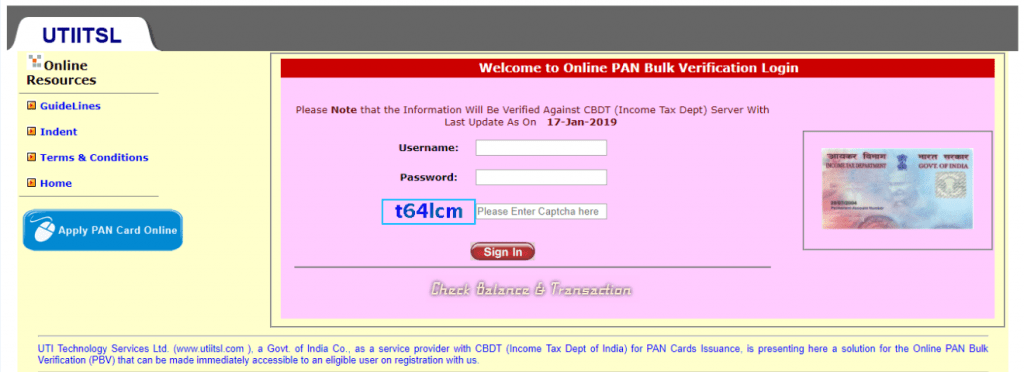

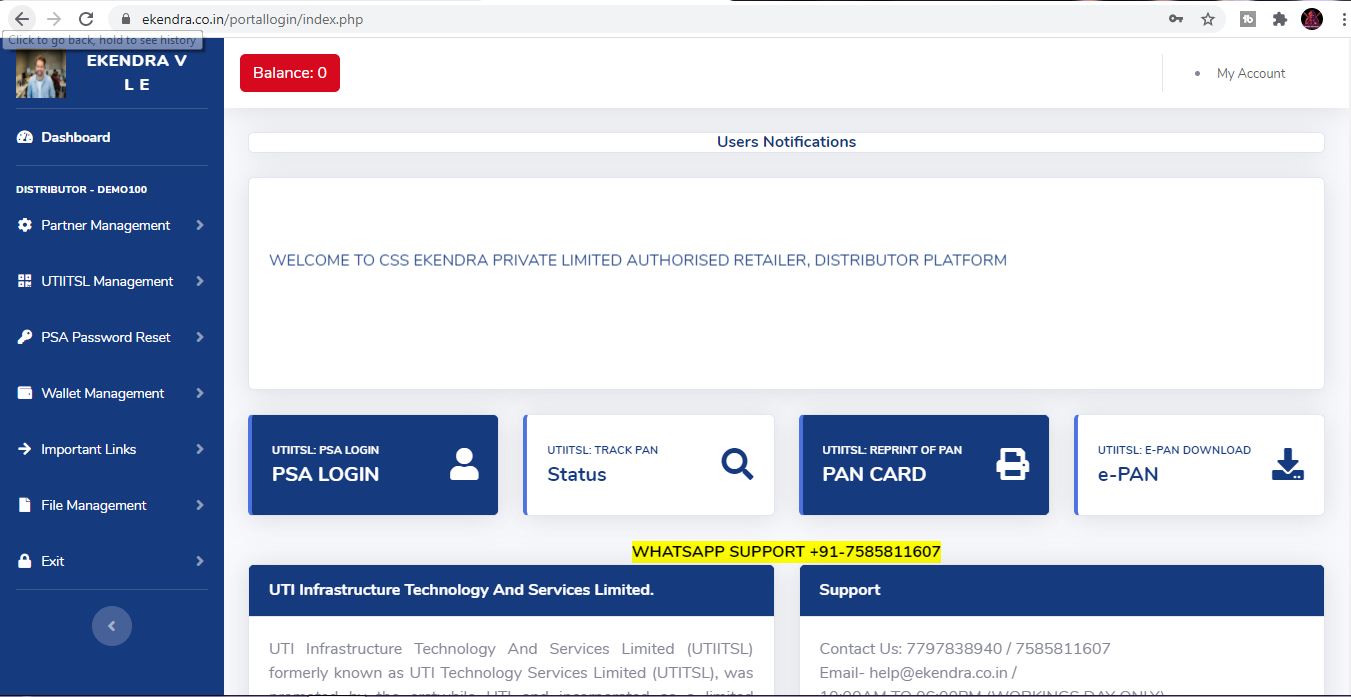

PAN verification by Permanent Account Number. Verification of PAN through API is very important for organizations and entities that regulated to do so. If the entity has relevant information, it can complete the verification process successfully. The Income Tax Department had permitted certain bodies to introduce an online PAN verification API system that will enable certain organizations to verify PAN information.

It is a service which validates the PAN Information by providing the name and its activation status as an output.

FEATURES

- Check account activation status

- Elimination of forged PAN Cards

- Validate previous customers’ PAN Card who were on-boarded holding PAN as a manually verified document

USAGE

- PAN verification compliances following organizations and institutions can absorb these services to digitize their process end to end.

- PAN Card API serves as an identity confirming document. Organizations use our services to validate the identity of their customers before providing their financial services.

PROCESS

- Input: The Permanent Account Number is shared by the customer

- AadhaarAPI technology pushes the fetched details to PAN Central Database for validation

- In return, the response is the name of the PAN Cardholder, the activation status and the last modified date.