Cashfree is another popular payment gateway in India, known for its ease of use, competitive pricing, and wide range of features. Here’s a detailed overview of what Cashfree offers and how to set it up for your business:

Contents

Key Features of Cashfree:

- Multiple Payment Options: Supports various payment methods including credit/debit cards, net banking, UPI, wallets, and more.

- Quick Settlements: Offers fast settlement cycles, often within 24 hours.

- Easy Integration: Provides plugins, APIs, and SDKs for seamless integration with websites and mobile apps.

- Smart Routing: Optimizes transaction success rates by routing payments through the best performing payment channels.

- Global Payments: Allows businesses to accept international payments.

- Recurring Payments: Supports subscription-based payments and automated recurring billing.

- Payouts: Enables bulk disbursals and instant refunds directly to bank accounts, UPI IDs, or wallets.

- Comprehensive Dashboard: Offers detailed reports and analytics for tracking transactions.

- Security: Compliant with PCI-DSS standards and uses robust encryption to ensure transaction security.

Setting Up Cashfree Payment Gateway for Your Business:

Step 1: Sign Up

- Visit Cashfree Website: Go to the Cashfree official website.

- Sign Up: Click on the “Get Started” or “Sign Up” button and fill in the required details such as your email, phone number, and business information.

Step 2: Verification and Documentation

- Business Details: Provide detailed information about your business, including business type, name, and address.

- Upload Documents: Submit necessary documents such as:

- PAN Card of the business owner

- GST Registration Certificate

- Bank Account Statement or Cancelled Cheque

- Proof of Business (e.g., Business Registration Certificate)

- Address Proof (e.g., utility bill, rental agreement)

Step 3: Integration

- Choose Integration Method: Decide on the integration method suitable for your business:

- Hosted Payment Page: Redirects customers to Cashfree’s secure payment page.

- Embedded Checkout: Embeds the payment form on your website.

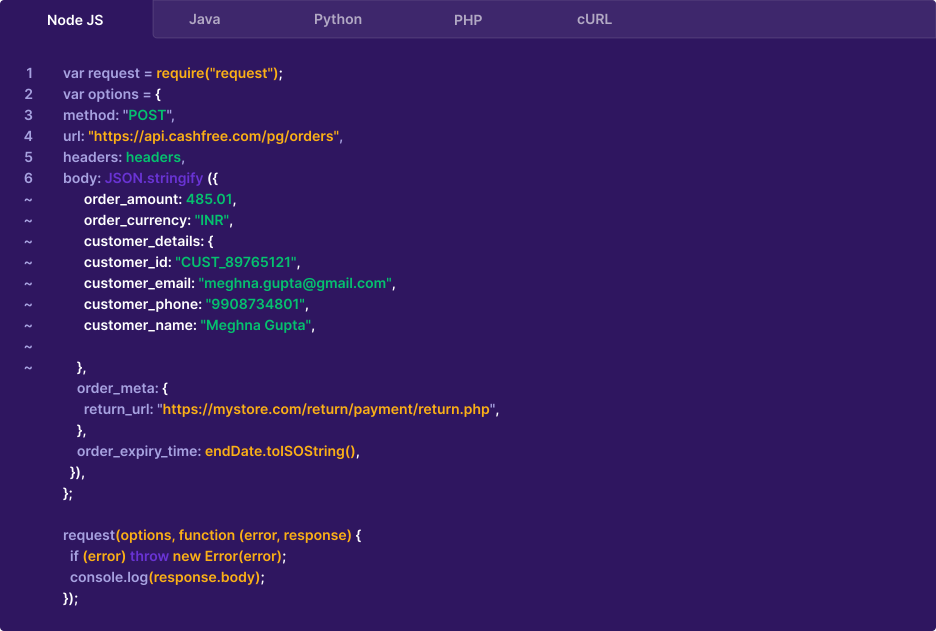

- APIs and SDKs: For custom integration with your website or mobile app.

- Technical Integration:

- Download Plugins: If you are using platforms like Shopify, WooCommerce, or Magento, you can download and install Cashfree plugins.

- Use APIs: For custom integration, use Cashfree’s APIs. Detailed documentation is available on the Cashfree website.

- Test Environment: Use the sandbox environment provided by Cashfree to test the integration before going live.

Step 4: Configure Payment Methods

- Payment Options: Enable the desired payment options such as credit/debit cards, net banking, UPI, and wallets.

- Customize Payment Page: If using a hosted payment page, customize it to match your brand’s look and feel.

Step 5: Go Live

- Test Transactions: Perform test transactions to ensure everything is functioning correctly.

- Activate Account: Once testing is complete and all documentation is verified, Cashfree will activate your account.

- Live Transactions: Start accepting live transactions on your website or app.

Step 6: Monitor and Manage

- Dashboard Access: Use the Cashfree dashboard to monitor transactions, view reports, and manage refunds.

- Customer Support: Utilize Cashfree’s customer support for any issues or queries.

Additional Tips:

- Security: Ensure your website or app complies with security standards to protect customer data.

- Communication: Keep your customers informed about the payment options and security measures in place.

- Updates: Regularly check for updates from Cashfree regarding new features, security patches, and compliance requirements.

By following these steps, you can efficiently set up Cashfree as your payment gateway and start accepting payments online.

Cashfree Payment Gateway Pricing

Cashfree offers competitive and transparent pricing for its payment gateway services. The charges can vary depending on the payment method, transaction volume, and specific needs of the business. Here is a general overview of Cashfree’s pricing structure:

Transaction Fees

- Domestic Payments:

- Credit Cards: Typically around 2.00% per transaction.

- Debit Cards: Approximately 0.40% to 1.75% per transaction, depending on the card type.

- Net Banking: Around 1.75% per transaction.

- UPI: Generally about 0% to 1% per transaction.

- Wallets: Usually around 2.50% per transaction.

- International Payments:

- Credit and Debit Cards: Around 3.50% per transaction.

- Currency Conversion Charges: Additional fees may apply for currency conversion.

Additional Charges

- GST: A Goods and Services Tax (GST) of 18% is applicable on the transaction fees.

- Refund Charges: There may be a fee for processing refunds, which is typically a fixed amount per transaction.

- Chargeback Fees: Fees for chargebacks may apply if a customer disputes a transaction.

- Settlement Fees: Fees for transferring funds to the merchant’s bank account, though Cashfree often offers quick settlements with minimal fees.

- Payouts: Fees for disbursing funds to bank accounts, UPI IDs, or wallets; typically nominal and dependent on the volume and frequency of payouts.

Custom Pricing

- High Volume Merchants: Businesses with a high volume of transactions may be eligible for lower rates. Cashfree often provides custom pricing packages tailored to the specific needs of larger merchants.

- Special Offers: Cashfree may run promotional offers that include discounts on transaction fees or other charges.

Promotions

- Zero Setup Fees: Cashfree often promotes zero setup fees to attract new merchants.

- Zero Maintenance Fees: Generally, Cashfree does not charge ongoing maintenance fees.

Getting a Quote

To get the most accurate and up-to-date pricing tailored to your business needs, it’s best to contact Cashfree directly. You can reach out to their sales team through their website or customer support channels to discuss your specific requirements and negotiate custom pricing.

By understanding these charges and discussing your specific needs with Cashfree, you can ensure that you get the best possible pricing for your business.

Payment Gateway:

- TOP 10 BEST PAYMENT GATEWAY IN INDIA (2020)

- PhonePe Payment Gateway

- PayKun – Best Payment Gateway For India 2021

- UPIGateway

- Freecharge PG

- PayU – Payment Gateway

Credit Card:

- Kotak upi rupay credit card apply online

- HDFC Bank UPI RuPay Credit Card

- IDFC FIRST Power Rupay Credit Card

- PCI DSS

Banking:

- Register to IndusNet Online Banking

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2024-25

- Documents Required for Opening a Current Account Online

- csc digipay lite commission 2023-2024

- DigiPay v7.3

- Airtel Payment Bank CSP

- SBI CSP Commission Structure

- SBI CSP – How to register sbi csp

- Fino CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- Fino Payment Bank Commission 2023-2024

- Instant PIN Generation for Debit Card

- BOB CSP Browser Settings

- 7 Points on UPI Payments

- 5 Best Refer and Earn UPI Apps: Earn Free Cash Online

Other’s:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |