The number of transactions on the Unified Payments Interface (UPI) platform is fast catching up. The ease in making fund transfers even without using credit cards is making people adapt to this new mode of money transfer through mobile phones.

However, as with most financial technology, comes the risk of losing money, especially when adequate safeguards are not taken by the users. UPI fraud cases seem to be increasing.

HDFC Bank in a recent cautionary notice to customers has revealed the modus operandi used by fraudsters in making unauthorized access to one’s mobile phone and the precautions that need to be taken.

BY DOWNLOADING APP

The fraudsters get hold of your number from somewhere and then call you posing as a representative of a bank or any other financial institution. They will tell you that a certain amount of money needs to be transferred to your bank account or credit card or the reason cited could be a different one.

If you had registered a genuine complaint with your telecom company, they will apply the same technique. And for that, they will ask you to download an App which essentially will give remote access to your mobile phone.

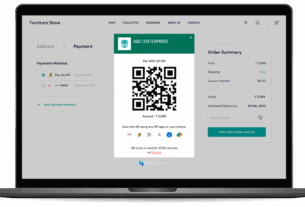

HDFC in its notice to customers has informed, “One of the recent techniques involves a fraudster taking unauthorized access to a victim’s mobile device to carry out fraudulent transactions via UPI using the AnyDesk, Team Viewer or any other third party App.”

Once downloaded, the user will ask you to share the OTP and grant certain permissions to access your device. In the process, the fraudster has full control of your phone and can make financial transactions i.e transfer funds from your bank account to his or her own account.

UPI AND COLLECT REQUEST

In UPI, you can send money to someone whose VPA or other details are known to you. However, if someone initiates a ‘Collect Request’, you can authorize the same and the funds from your account will go into the sender’s account. If one unknowingly ‘Confirms’ such Collect Request from a fraudster, the account will be debited immediately. HDFC reveals the modus operandi in such instances — “Send Collect request” to your VPA and ask you to approve or authenticate it on the respective UPI apps to get reversal or refunds.”

UPI FRAUD PREVENTION

To avoid a UPI fraud, there are a few important things to keep a note of. The next time you receive a call asking you to download any app or share any confidential financial information, you know who is calling. Also, if you receive an SMS with a link or a phone number from a banking institution, ignore and delete it unless you are sure about the source.

Banks, credit card issuers or any financial institutions do not make such calls or send SMS of such nature. Try not to disclose your phone number especially on social media to avoid any UPI fraud transaction.

I was suggested this website through my cousin. I’m now not

certain whether or not this put up is written through him as no one else recognize such unique about

my trouble. You’re incredible! Thanks!