A payment gateway is a technology that facilitates online transactions by acting as a mediator between merchants (sellers) and financial institutions (banks, credit card companies) involved in processing payments. Here’s how it typically works:

- Customer initiates payment: When a customer makes a purchase on an e-commerce website or app and selects a payment method (credit/debit card, digital wallets like PhonePe, net banking, etc.), the payment gateway securely collects the payment details.

- Encryption and transmission: The payment gateway encrypts the payment information to ensure it is transmitted securely from the customer’s device to the payment processor.

- Authorization request: The payment gateway sends this encrypted payment information to the relevant financial institution (bank or credit card company) for authorization.

- Authorization response: The financial institution checks the validity of the payment information (availability of funds, correct details, etc.) and sends back an authorization (or decline) response to the payment gateway.

- Transaction processing: If authorized, the payment gateway informs the merchant that the transaction is successful and initiates the transfer of funds from the customer’s account to the merchant’s account.

- Confirmation: The merchant receives confirmation of the successful transaction and can proceed to fulfill the customer’s order (e.g., shipping goods or providing services).

Payment gateways are crucial for online businesses as they ensure secure and efficient processing of payments, protecting sensitive financial information during the transaction. They also help merchants expand their customer base by accepting various payment methods and currencies, thereby enhancing convenience for customers and improving sales conversion rates.

Contents

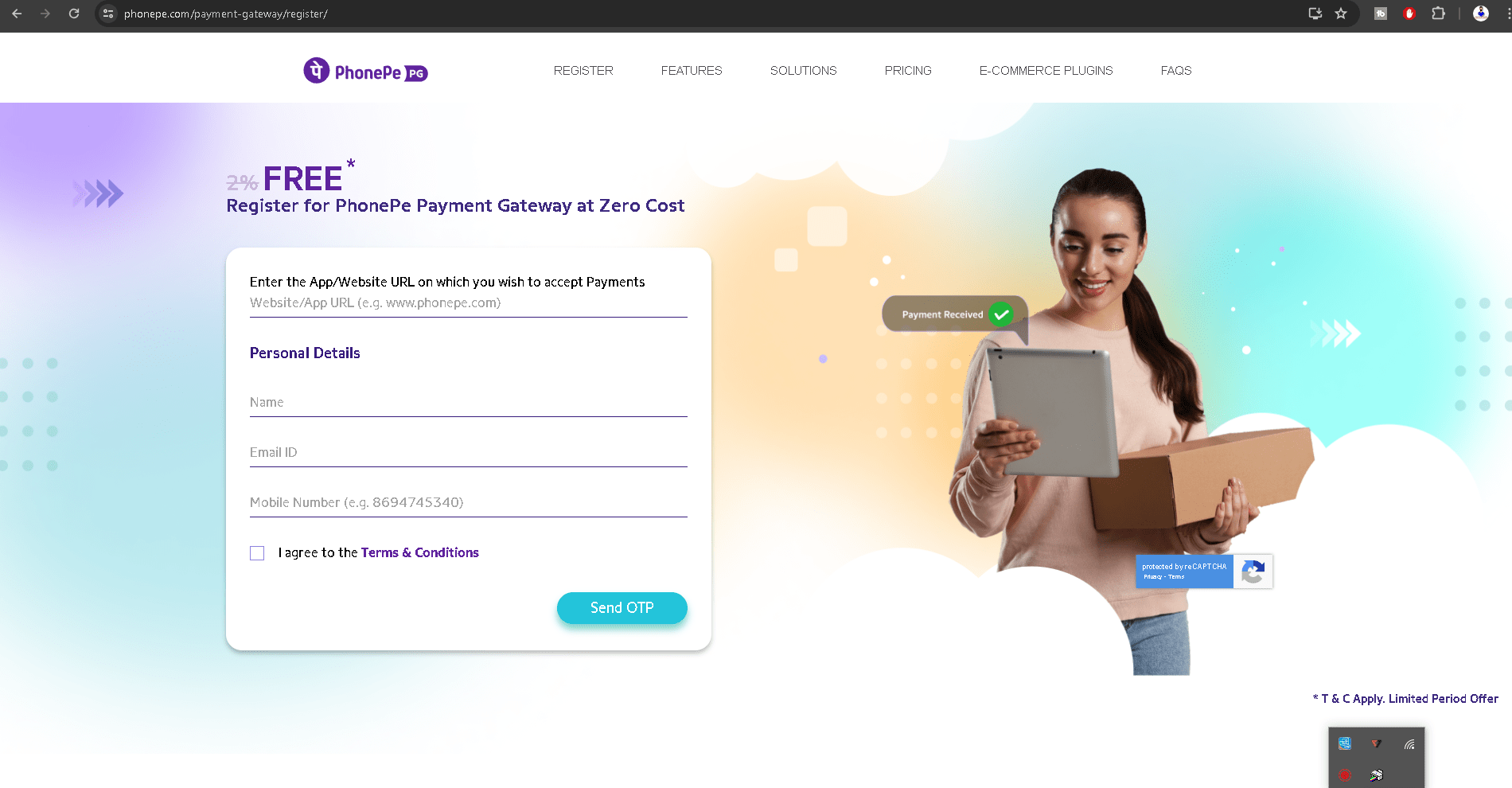

To register for the PhonePe Payment Gateway at zero cost, follow these steps:

- Visit the PhonePe for Business website: Go to the official PhonePe for Business website. You can usually find this by searching “PhonePe for Business” on a search engine.

- Sign up or Log in: If you are already registered with PhonePe for Business, log in using your credentials. If not, you will need to sign up and create an account.

- Provide Business Details: Fill out the necessary details about your business. This typically includes your business name, type of business, contact information, and other relevant details.

- Verify Business Information: PhonePe may require verification of your business details. This could involve providing documents such as business registration certificates, identification proof, and bank account details.

- Agree to Terms and Conditions: Review and agree to the terms and conditions set by PhonePe for using their payment gateway services.

- Integration: After your registration is approved, you will receive instructions on how to integrate PhonePe payment gateway into your website or app. PhonePe usually provides APIs and documentation to help with this process.

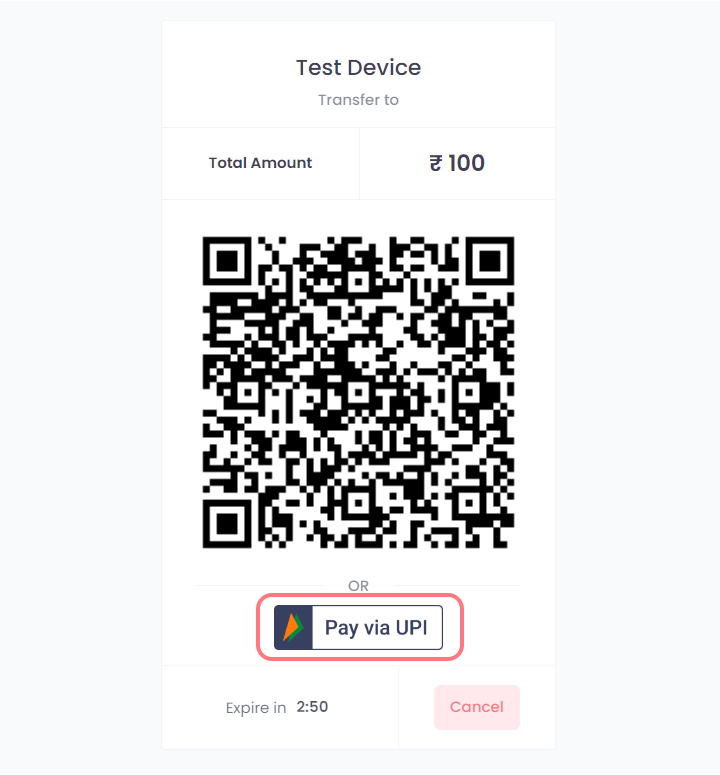

- Testing: Before going live, you may want to test the integration to ensure everything works smoothly.

- Go Live: Once testing is successful, you can start accepting payments through PhonePe.

PhonePe generally does not charge setup fees or annual maintenance fees for their payment gateway services, but transaction fees may apply. It’s always a good idea to check their current fee structure and terms before proceeding.

https://www.phonepe.com/payment-gateway/register

What is the PhonePe Payment Gateway advantage?

Built by India’s most trusted digital payments partner, with PhonePe Payment Gateway, you can process all your online payments with a 100% secure and seamless platform. PhonePe PG is equipped to handle large-scale transactions with industry best success rates.

What additional features do I get with PhonePe Payment Gateway?

The PhonePe Payment Gateway provides a secure, seamless, and effortless checkout experience for your customers. PhonePe ensures guaranteed 100% uptime with intelligent downtime detections. You can also access best-in-class payment solutions like Quick Checkout, Payment Links & Fast Forward, get access to a powerful dashboard with reports, transaction history, refunds and much more.

How do I integrate PhonePe Payment Gateway with my website?

PhonePe offers multiple payment gateway integration APIs for both platforms, Website & Mobile Applications. The integration methods vary depending on your platform and requirements.

Options to integrate PhonePe Payment Gateway with your website:

- PhonePe Standard Checkout: You can integrate PhonePe Payment Gateway without needing a PCI DSS Certificate for debit & credit cards integration.

- PhonePe Custom APIs: For more tailored solutions, in-case you have a custom checkout experience, you can use Custom APIs. For debit and credit cards integration, a PCI DSS Certificate is required.

- Ready to use plugins for major E-Commerce platforms like OpenCart, WooCommerce, Shopify etc. are available, please refer to the next FAQ for the same.

If you require further assistance or guidance, don’t hesitate to contact our support team at:

merchant-pgsupport@phonepe.com

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |