UPI (Unified Payments Interface) is a real-time payment system developed by the National Payments Corporation of India (NPCI) that facilitates inter-bank transactions by instantly transferring funds between two bank accounts on a mobile platform. A UPI gateway is a service provided by a bank or a third-party payment service provider that allows merchants to accept payments from customers via the UPI system. It acts as a bridge between the merchant’s website or mobile app and the UPI system, allowing customers to make payments using their UPI ID or virtual payment address (VPA).

To use a UPI gateway to accept payments from customers, you would typically need to follow these steps:

- Sign up with a UPI gateway provider: You will need to find a bank or third-party payment service provider that offers a UPI gateway service, and sign up for it.

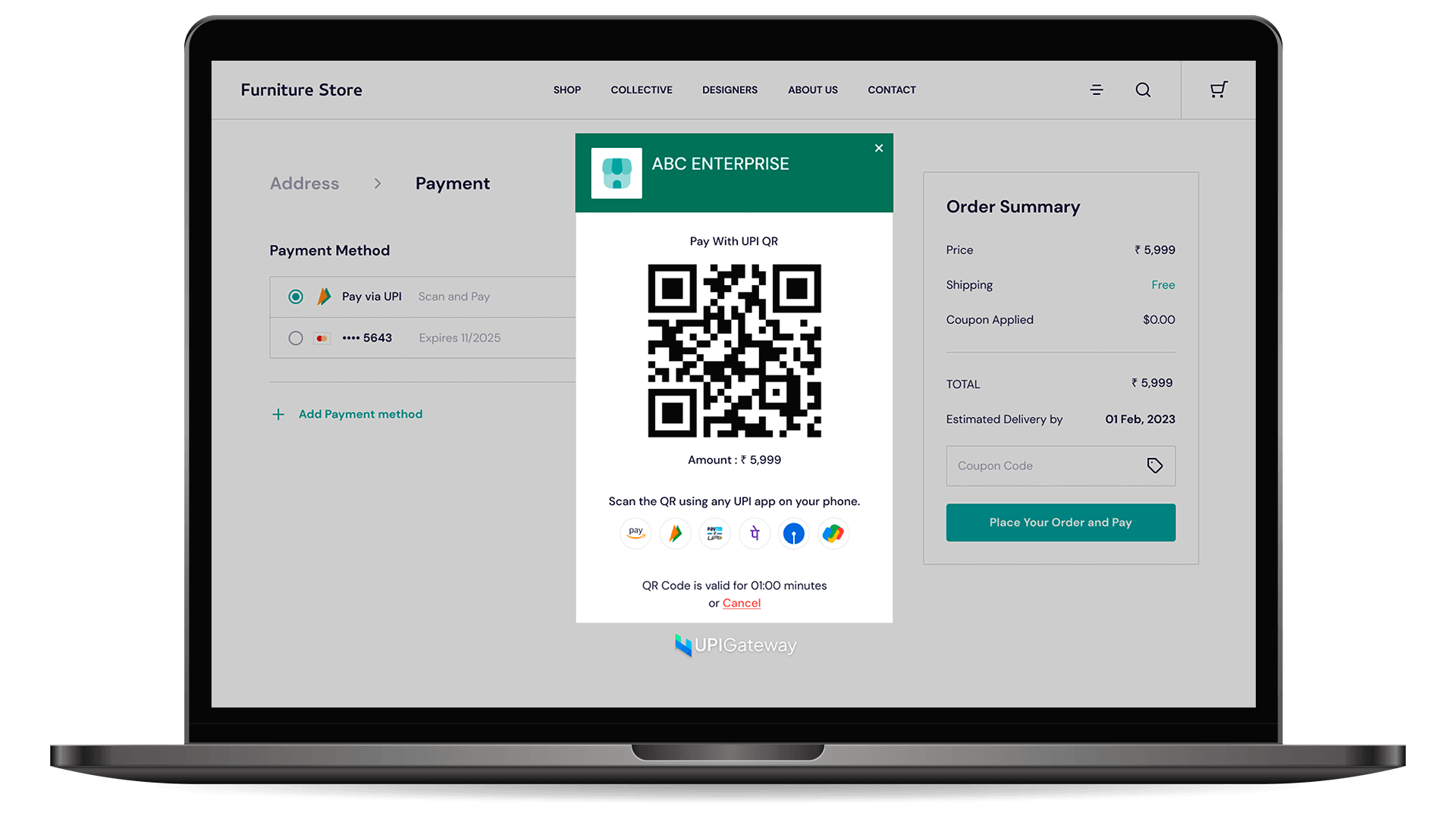

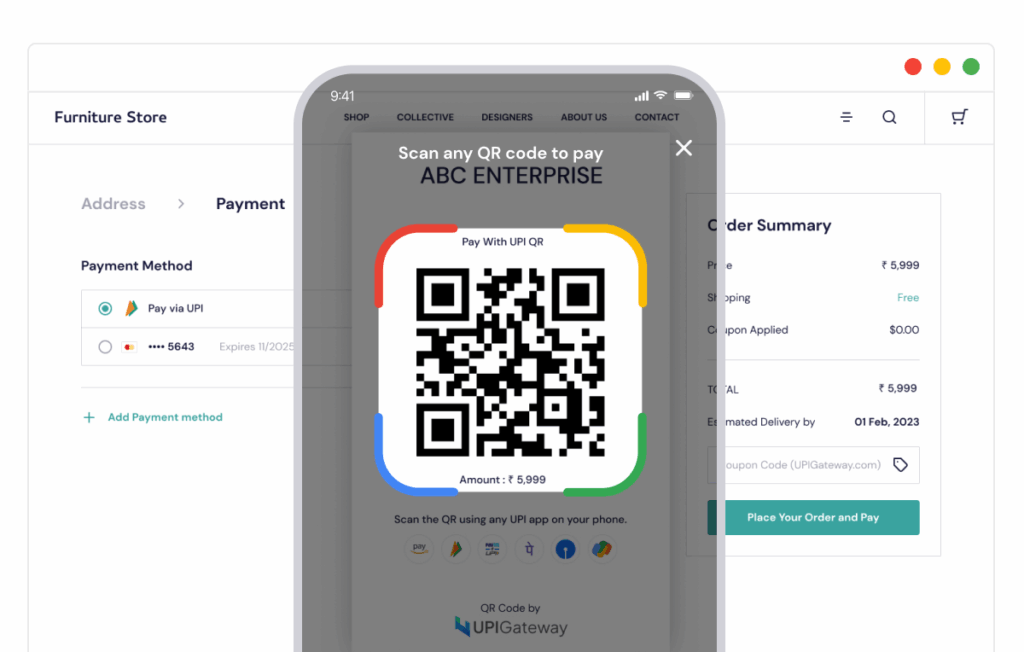

- Integrate the UPI gateway into your website or mobile app: The UPI gateway provider will give you a set of instructions and tools to integrate their service into your website or mobile app. This typically involves adding some code snippets or using a pre-built plugin.

- Add a UPI payment option to your checkout process: Once the UPI gateway is integrated, you can add a UPI payment option to your checkout process, allowing customers to make payments using their UPI ID or virtual payment address (VPA).

- Verify and settle transactions: Your UPI gateway provider will verify and settle the transactions, and transfer the funds to your bank account.

- Track your transaction

It is important to note that, different UPI gateway provider may have different process, it is recommended to follow the instruction from the gateway provider you signed up with.

There are several UPI apps available in India, each with their own features and benefits. Some of the most popular UPI apps include:

- BHIM (Bharat Interface for Money): Developed by the National Payments Corporation of India (NPCI), BHIM is a government-backed UPI app that is widely used and accepted by merchants.

- Google Pay (formerly Tez): A UPI app developed by Google, Google Pay is popular for its user-friendly interface and rewards program.

- PhonePe: Developed by Flipkart, PhonePe is known for its wide range of services including bill payments, mobile recharges, and insurance premium payments.

- Paytm: One of the most popular mobile wallet and e-commerce payment system in India, Paytm also has a UPI app that allows users to link their bank accounts and make payments.

- Amazon Pay UPI: Amazon also has its own UPI app which is widely accepted by merchants, it is also integrated with amazon account for easy access.

It’s worth noting that, the best UPI app may vary depending on personal preference and the specific needs of the user. Some users may prefer an app with a simple and user-friendly interface, while others may prioritize security or the availability of specific services.

Using UPI (Unified Payments Interface) to make payments is relatively simple and straightforward. Here are the general steps to follow:

- Download and install a UPI app: You will need to download and install a UPI app on your smartphone, such as BHIM, Google Pay, PhonePe, Paytm or Amazon Pay UPI.

- Register your bank account: Once the app is installed, you will need to register your bank account with the app. This typically involves providing your name, mobile number, and account details.

- Create a UPI ID or Virtual Payment Address (VPA): After registering your bank account, you will be prompted to create a UPI ID or Virtual Payment Address (VPA). This is a unique identifier that can be used to make and receive payments.

- Link your bank account: You will need to link your bank account with the app, which typically involves entering your account number and confirming it with an OTP (One Time Password) sent to your mobile number.

- Making payments: To make a payment, you will need to enter the recipient’s UPI ID or VPA and the amount you want to pay. The payment will be confirmed with a transaction password or fingerprint/face recognition, and the funds will be transferred instantly.

- Receiving payments: To receive payments, you will need to share your UPI ID or VPA with the sender. The sender can then use this to make a payment to your account.

It’s worth noting that, the steps may vary slightly depending on the UPI app you are using. It is recommended to follow the instruction provided by the app.

Accept Payments Directly to your Bank Account At 0% Transaction Fee

| Create an account | Click here |

| Pricing | Click here |

A payment gateway is a service that allows merchants to accept payments from customers for goods or services. It acts as a bridge between the merchant’s website or mobile app and the customer’s bank account, allowing customers to make payments using their credit or debit card, electronic checks, or other forms of electronic payment.

When a customer initiates a transaction on a merchant’s website or mobile app, the payment gateway processes the payment details by encrypting sensitive information, such as credit card numbers, to ensure secure transmission of data. The payment gateway then communicates with the customer’s bank or card issuer to verify the authenticity of the transaction, and sends the necessary information to the merchant’s acquiring bank. Once the transaction is approved, the funds are transferred to the merchant’s account.

It’s worth noting that payment gateway is different from UPI gateway, UPI gateway is used specifically for transactions made via UPI in India while payment gateway is used more widely for various types of transactions globally.

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |

- Anza Energy Football shoes

- Anza Zomba football boots

- Free recharge agent with high margin

- Top 5 Free Responsive Bootstrap 5 HTML5 Admin Template

- DarkPan – Free Bootstrap 5 Admin Dashboard Template

- Sneat – Free Responsive Bootstrap 5 HTML5 Admin Template

- Mazer – Free Bootstrap 5 HTML5 Admin Dashboard Template

- KaiAdmin – Free Responsive Bootstrap 5 Admin Dashboard Template

- DattaAble – Free Responsive Tailwind CSS Admin Template

- QR Code Generator – Customizable QR Codes with Logo