The SBI SimplyCLICK Credit Card is a credit card offered by the State Bank of India (SBI). It is designed to cater to the needs of online shoppers and frequent internet users, providing various benefits and rewards for online transactions. Here are some key features of the SBI SimplyCLICK Credit Card:

- Online Shopping Rewards: The card offers accelerated rewards points for online spending. Users can earn higher rewards for transactions made on online retail platforms such as Amazon, Flipkart, etc.

- Welcome Benefits: New cardholders may be eligible for welcome benefits, such as gift vouchers or bonus rewards points upon card activation and meeting certain spending criteria.

- Milestone Benefits: Users may receive additional benefits upon reaching certain spending milestones. These benefits could include bonus rewards points, cashback, or vouchers.

- Fuel Surcharge Waiver: Cardholders may enjoy a waiver on fuel surcharges at petrol pumps across India, subject to terms and conditions.

- Annual Fee: The card may come with an annual fee, which could be waived off or adjusted based on the user’s spending patterns and loyalty.

- Easy Redemption: Accumulated rewards points can be easily redeemed for a variety of options, including merchandise, gift vouchers, statement credit, or airline miles.

- Insurance Coverage: Some SBI SimplyCLICK Credit Cards may offer insurance coverage, such as air accident insurance or purchase protection insurance, providing cardholders with added security and peace of mind.

- Global Acceptance: The card is generally accepted worldwide, allowing users to make transactions internationally.

It’s important to note that specific features and benefits may vary based on the card variant and terms and conditions set by SBI. Prospective applicants should carefully review the terms, fees, and benefits associated with the card before applying.

Contents

- 1 The Ultimate Guide to SBI SimplyCLICK Credit Card: Unlocking Rewards and Benefits

The Ultimate Guide to SBI SimplyCLICK Credit Card: Unlocking Rewards and Benefits

Introduction: Discover the Power of SBI SimplyCLICK Credit Card

In today’s fast-paced world, having a credit card that aligns with your lifestyle and spending habits is crucial. Enter the SBI SimplyCLICK Credit Card – a powerful financial tool designed to cater to the needs of modern consumers. With its array of benefits and rewards, this credit card stands out as a top choice for individuals seeking convenience and value.

Key Features of SBI SimplyCLICK Credit Card

1. Online Shopping Rewards

The SBI SimplyCLICK Credit Card is tailored for the digital age, offering lucrative rewards for online purchases. Cardholders earn accelerated rewards points when they shop at leading e-commerce platforms, including Amazon, Flipkart, and more. This feature appeals to the growing trend of online shopping, allowing users to maximize their spending while enjoying attractive benefits.

2. Milestone Rewards

To further incentivize card usage, SBI SimplyCLICK Credit Card offers milestone rewards to its users. By reaching specified spending thresholds, cardholders unlock bonus rewards, ranging from cashback to gift vouchers. This encourages responsible spending while providing tangible benefits for loyal customers.

3. Fuel Surcharge Waiver

Commuting expenses can add up quickly, especially with rising fuel prices. However, SBI SimplyCLICK Credit Card alleviates this burden by offering a fuel surcharge waiver at select petrol pumps. This perk translates to significant savings for cardholders, making it an attractive feature for frequent drivers.

4. Contactless Payments

In today’s digital landscape, security and convenience are paramount. With SBI SimplyCLICK Credit Card’s contactless payment feature, users can enjoy hassle-free transactions while safeguarding their financial information. This technology enhances the overall payment experience, ensuring seamless transactions at POS terminals worldwide.

How to Apply for SBI SimplyCLICK Credit Card

Applying for the SBI SimplyCLICK Credit Card is a straightforward process that can be completed online or through designated SBI branches. To expedite the application process, follow these simple steps:

- Visit the official SBI website or nearest branch.

- Navigate to the credit cards section and select SBI SimplyCLICK Credit Card.

- Fill out the online application form with accurate personal and financial details.

- Submit the necessary documents, including proof of identity, address, and income.

- Await approval from SBI’s credit card department.

- Upon approval, collect your SBI SimplyCLICK Credit Card and start enjoying its benefits.

Conclusion: Elevate Your Financial Journey with SBI SimplyCLICK Credit Card

In conclusion, the SBI SimplyCLICK Credit Card emerges as a formidable choice for individuals seeking a rewarding and versatile credit card experience. With its host of features, including online shopping rewards, milestone bonuses, fuel surcharge waiver, and contactless payments, this card caters to the diverse needs of modern consumers. By harnessing the power of SBI SimplyCLICK Credit Card, users can unlock a world of convenience, savings, and rewards, making it a valuable addition to their financial arsenal.

Contain Table:

Credit Card:

- Kotak upi rupay credit card apply online

- HDFC Bank UPI RuPay Credit Card

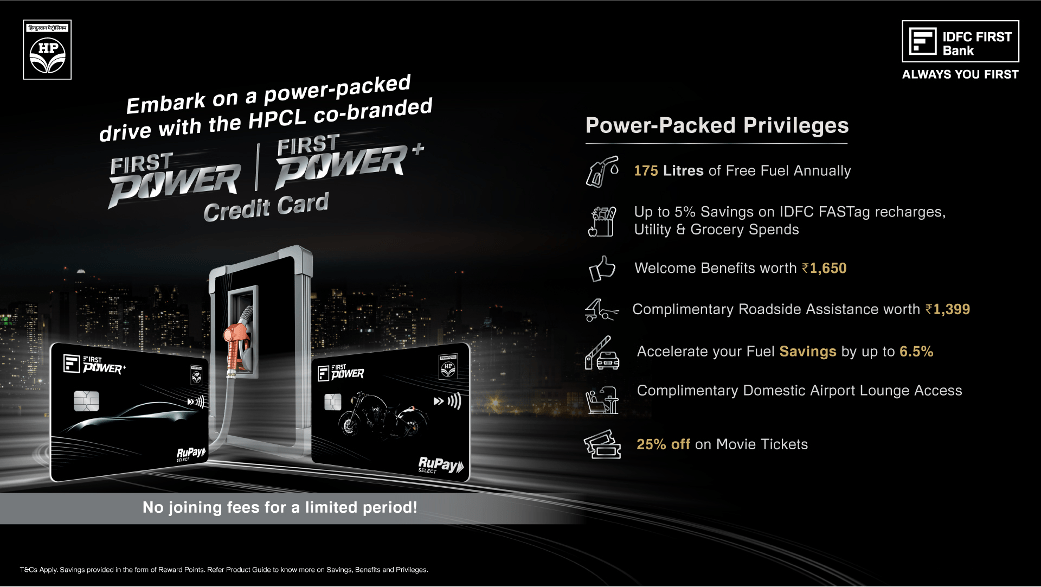

- IDFC FIRST Power Rupay Credit Card

- PCI DSS

Banking:

- Register to IndusNet Online Banking

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2024-25

- Documents Required for Opening a Current Account Online

- csc digipay lite commission 2023-2024

- DigiPay v7.3

- Airtel Payment Bank CSP

- SBI CSP Commission Structure

- SBI CSP – How to register sbi csp

- Fino CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- Fino Payment Bank Commission 2023-2024

- Instant PIN Generation for Debit Card

- BOB CSP Browser Settings

- 7 Points on UPI Payments

- 5 Best Refer and Earn UPI Apps: Earn Free Cash Online

Other’s:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |