CSP (Customer Service Point) is a program launched by the State Bank of India (SBI) that allows individuals or small businesses to act as an agent of the bank and provide a range of banking services to customers in their local area. The SBI CSP program is aimed at increasing the availability of banking services in remote or underserved areas, and also provides an opportunity for individuals or small businesses to earn an income by acting as a CSP.

The services that can be provided by an SBI CSP include:

- Opening new bank accounts

- Depositing and withdrawing cash

- Balance inquiry

- Printing of mini statement

- Fund transfer

- Bill payments

- Provide new ATM card/pin

- Sale of FASTag

- Sale of insurance and mutual funds

To become an SBI CSP, an individual or small business must meet certain eligibility criteria, such as having a minimum educational qualification, and must also go through a training and certification process. Once certified, the CSP is provided with a point-of-sale (POS) device, a computer, and a printer, as well as other necessary equipment and software, to enable them to provide the services to customers.

It is worth noting that, becoming a CSP is not a guarantee of earning as it depends on the location of the CSP, the demand for the services provided, and the effort put in by the CSP.

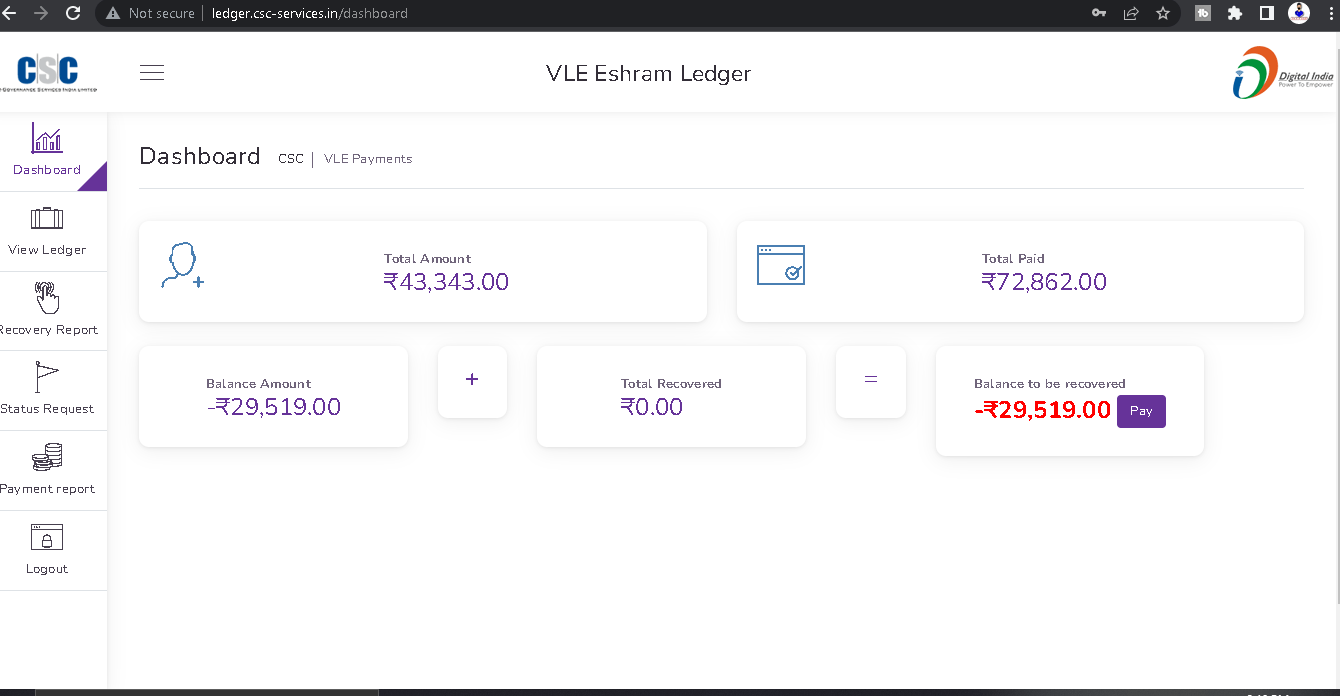

The State Bank of India (SBI) sets certain limits on the amount of cash that can be deposited or withdrawn by a Customer Service Point (CSP) agent in a single transaction or in a day. These limits are put in place to ensure the security of cash transactions and to prevent fraud.

The exact limits may vary depending on the specific CSP agent and the location, but generally, the deposit limit per transaction is around Rs. 49,999 and the withdrawal limit per transaction is around Rs. 24,999. The daily deposit and withdrawal limits may be around Rs. 2,50,000 and Rs. 1,25,000 respectively.

It’s worth noting that, these limits may change over time based on the bank’s policies and regulations. CSP agent should check with the bank for the current limits.

Additionally, the CSP agent should also maintain the cash balance in the CSP unit, as per the guidelines provided by the bank, otherwise bank may deactivate the unit.

To register as a Customer Service Point (CSP) agent for the State Bank of India (SBI), you will need to follow these general steps:

- Meet the eligibility criteria: To become an SBI CSP agent, you must meet certain eligibility criteria set by the bank, such as having a minimum educational qualification, a valid PAN card, and a clean financial and criminal background.

- Find a suitable location: You will need to find a suitable location for your CSP unit, such as a shop or office in a convenient and easily accessible location in your local area.

- Fill out the application form: You will need to fill out an application form, which can be obtained from the nearest SBI branch or downloaded from the bank’s website.

- Submit the application form: Once the application form is filled out, you will need to submit it along with the required documents, such as your PAN card, educational qualification certificates, and other ID proof as per the bank’s requirement.

- Undergo training: After your application is accepted, you will need to undergo a training program to learn about the services offered by the CSP and how to use the equipment and software provided by the bank.

- Get certified: After completing the training, you will need to pass an exam to get certified as a CSP agent.

- Set up your CSP unit: After getting certified, you will be provided with a point-of-sale (POS) device, a computer, and a printer, as well as other necessary equipment and software, to enable you to provide the services to customers.

It’s worth noting that, the process of becoming a CSP agent may vary slightly depending on the specific bank, and can take several weeks or months to complete. The bank will also charge some fees for the registration and equipment. Additionally, SBI may conduct a background check on the applicant and the location of the CSP.

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |

1 thought on “SBI CSP – How to register sbi csp”

Comments are closed.