To apply for the Kotak UPI RuPay credit card online, you can follow these steps:

- Visit the official website of Kotak Mahindra Bank or go directly to the page where credit card applications are accepted.

- Look for the section or link that says “Apply for Credit Card” or something similar.

- Select the Kotak UPI RuPay credit card from the list of available credit cards.

- Fill out the online application form with your personal details, including your name, contact information, address, employment details, income details, etc.

- Upload any required documents, such as identity proof, address proof, income proof, etc., as specified by the bank.

- Review the information you’ve provided for accuracy and completeness.

- Submit the application.

- After submitting the application, you may receive a confirmation message or email with further instructions.

- Wait for the bank to process your application. This usually takes a few days to a couple of weeks.

- Once your application is approved, the bank will dispatch your Kotak UPI RuPay credit card to your registered address.

- Upon receiving the credit card, follow the instructions provided to activate it.

Remember to carefully read the terms and conditions associated with the credit card before applying. Additionally, make sure you meet the eligibility criteria set by Kotak Mahindra Bank for obtaining the credit card.

Contents

- 1 Kotak UPI RuPay Credit Card Apply Online

- 2 Kotak UPI RuPay Credit Card Apply Online: Your Ultimate Guide

Kotak UPI RuPay Credit Card Apply Online

| Heading | Subheading |

|---|---|

| Introduction | – Overview of Kotak UPI RuPay Credit Card |

| Understanding Kotak UPI RuPay Credit Card | – Benefits of Kotak UPI RuPay Credit Card – Eligibility Criteria – Documents Required |

| How to Apply Online | – Step-by-Step Guide to Applying Online |

| Features and Rewards | – Key Features of Kotak UPI RuPay Credit Card – Rewards and Cashback Offers |

| Comparisons with Other Cards | – Comparison with Other UPI Cards |

| Security Measures | – Security Features and Fraud Protection |

| Customer Reviews and Ratings | – Testimonials from Users |

| Frequently Asked Questions (FAQs) | – FAQ 1: How to check the status of my application? – FAQ 2: What is the credit limit offered? – FAQ 3: Is there an annual fee? – FAQ 4: Can I apply for the card offline? – FAQ 5: How to reset the PIN? – FAQ 6: What to do if my card is lost or stolen? |

| Conclusion | – Summarization and Final Thoughts |

Kotak UPI RuPay Credit Card Apply Online: Your Ultimate Guide

Introduction

In today’s digital age, financial transactions have become increasingly convenient, and the Kotak UPI RuPay Credit Card stands as a testament to this. Offering a seamless blend of cutting-edge technology and financial services, this card provides users with a hassle-free experience for making payments online and offline. Let’s delve deeper into what makes this card a standout choice for individuals seeking convenience and reliability in their financial transactions.

Understanding Kotak UPI RuPay Credit Card

Benefits of Kotak UPI RuPay Credit Card

The Kotak UPI RuPay Credit Card comes packed with a plethora of benefits. From cashback offers on utility bill payments to rewards on online shopping, this card caters to a wide range of lifestyle needs. Additionally, users can enjoy exclusive discounts at partner merchants, making every purchase a rewarding experience.

Eligibility Criteria

To apply for the Kotak UPI RuPay Credit Card, individuals need to meet certain eligibility criteria. This typically includes age requirements, minimum income criteria, and credit score benchmarks. By ensuring eligibility, applicants can streamline the application process and increase their chances of approval.

Documents Required

Applying for the Kotak UPI RuPay Credit Card requires the submission of certain documents. These may include proof of identity, address verification, and income documents. Ensuring the availability of these documents beforehand can expedite the application process and minimize delays.

How to Apply Online

Applying for the Kotak UPI RuPay Credit Card online is a simple and straightforward process. Follow these steps to get started:

- Visit the Kotak Mahindra Bank website.

- Navigate to the credit cards section.

- Select the Kotak UPI RuPay Credit Card.

- Click on the ‘Apply Now’ button.

- Fill out the online application form with accurate details.

- Upload the required documents.

- Review the information provided and submit the application.

Features and Rewards

Key Features of Kotak UPI RuPay Credit Card

- Contactless Payments: Enjoy the convenience of making secure transactions with just a tap.

- Online Account Management: Monitor your card activity and track expenses with ease through the online portal.

- Travel Benefits: Avail of travel insurance and complimentary lounge access at select airports.

Rewards and Cashback Offers

Earn reward points on every transaction and redeem them for a variety of options, including gift vouchers, airline miles, and cashback. Additionally, the card offers exclusive cashback offers on select categories such as dining, groceries, and fuel.

Comparisons with Other Cards

When compared to other UPI cards in the market, the Kotak UPI RuPay Credit Card stands out due to its competitive interest rates, extensive reward program, and robust security features. By offering a holistic blend of benefits and convenience, it emerges as a top choice for discerning customers.

Security Measures

The safety and security of cardholders are of paramount importance, and the Kotak UPI RuPay Credit Card prioritizes this through advanced security features such as:

- EMV Chip Technology: Provides enhanced protection against counterfeit fraud.

- Real-time Fraud Monitoring: Alerts users to suspicious activity on their accounts, ensuring prompt action against unauthorized transactions.

Customer Reviews and Ratings

Don’t just take our word for it! Here’s what some of our satisfied customers have to say about their experience with the Kotak UPI RuPay Credit Card:

- “I’ve been using the Kotak UPI RuPay Credit Card for over a year now, and I couldn’t be happier with its convenience and rewards.”

- “The customer service provided by Kotak Mahindra Bank is top-notch. Any issues or queries are promptly addressed, making the overall experience seamless.”

Frequently Asked Questions (FAQs)

- How to check the status of my application? Applicants can track the status of their application online through the bank’s website or by contacting customer support.

- What is the credit limit offered? The credit limit offered varies based on individual creditworthiness and income levels.

- Is there an annual fee? The Kotak UPI RuPay Credit Card may come with an annual fee, which is communicated to the applicant at the time of application.

- Can I apply for the card offline? Yes, applicants can visit their nearest Kotak Mahindra Bank branch to apply for the card offline.

- How to reset the PIN? Cardholders can reset their PIN through the bank’s online portal or by visiting an ATM.

- What to do if my card is lost or stolen? In case of loss or theft, cardholders should immediately report the incident to the bank’s customer support to block the card and prevent unauthorized usage.

Conclusion

In conclusion, the Kotak UPI RuPay Credit Card offers a seamless blend of convenience, security, and rewards, making it the ideal choice for individuals seeking a hassle-free payment solution. With its innovative features, robust security measures, and attractive rewards program, this card sets the standard for modern banking experiences. Apply online today and embark on a journey of financial empowerment!

Contain Table:

Credit Card:

- Kotak upi rupay credit card apply online

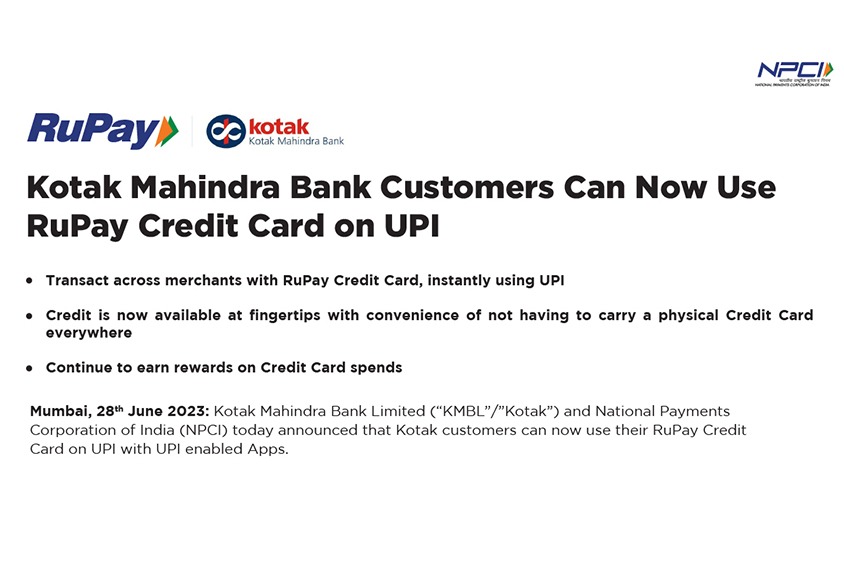

- HDFC Bank UPI RuPay Credit Card

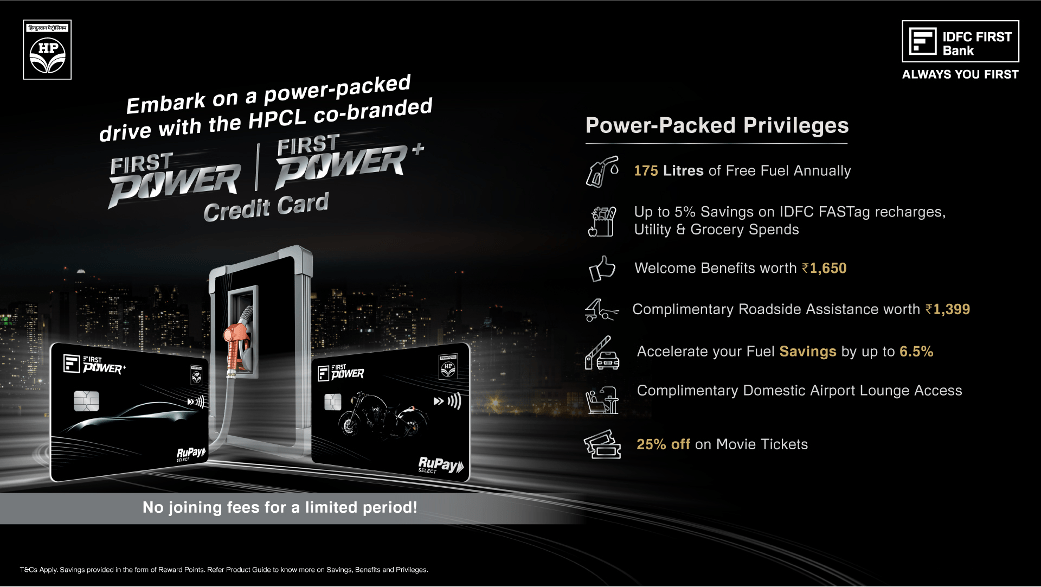

- IDFC FIRST Power Rupay Credit Card

- PCI DSS

Banking:

- Register to IndusNet Online Banking

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2024-25

- Documents Required for Opening a Current Account Online

- csc digipay lite commission 2023-2024

- DigiPay v7.3

- Airtel Payment Bank CSP

- SBI CSP Commission Structure

- SBI CSP – How to register sbi csp

- Fino CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- Fino Payment Bank Commission 2023-2024

- Instant PIN Generation for Debit Card

- BOB CSP Browser Settings

- 7 Points on UPI Payments

- 5 Best Refer and Earn UPI Apps: Earn Free Cash Online

Other’s:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |