The IDFC FIRST Power RuPay Credit Card is a financial offering from IDFC FIRST Bank, designed to provide customers with a range of benefits and features tailored to their needs. This credit card is powered by RuPay, offering users the convenience and security of RuPay’s payment network along with various rewards and privileges.

Contents

- 1 Key features of the IDFC FIRST Power RuPay Credit Card may include:

- 2 IDFC FIRST Power Rupay Credit Card: Redefining Financial Freedom

- 3 Understanding the Benefits

- 4 Seamless Transactions, Unmatched Convenience

- 5 Empowering Financial Independence

- 6 Exclusive Privileges

- 7 FAQs (Frequently Asked Questions)

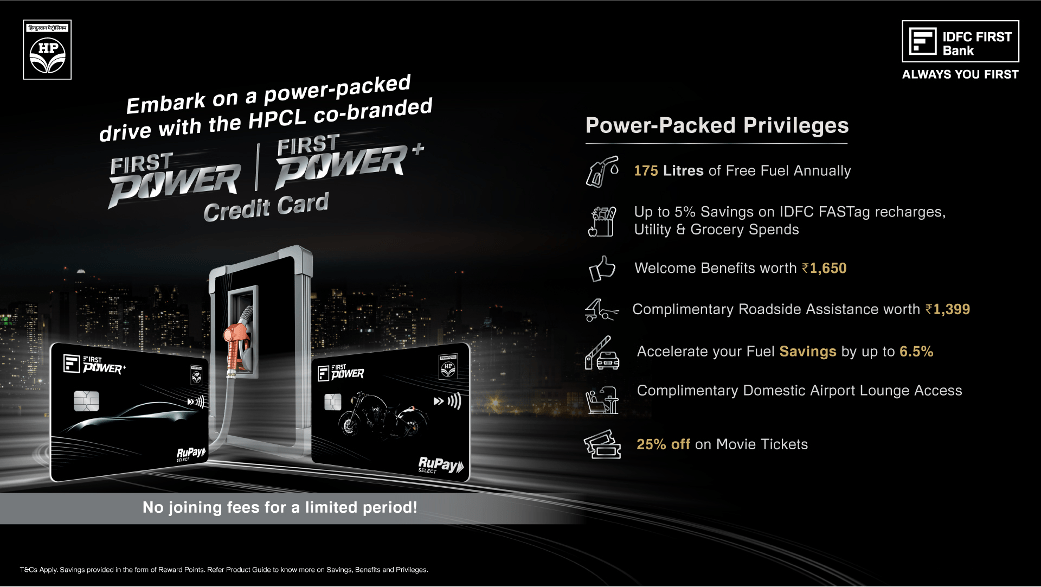

Key features of the IDFC FIRST Power RuPay Credit Card may include:

- RuPay Network: As a RuPay-powered card, it offers users access to a wide network of merchants and ATMs across India, facilitating seamless transactions and cash withdrawals.

- Rewards Program: The credit card may come with a rewards program that allows users to earn points on their card spends. These points can be redeemed for a variety of rewards, including gift vouchers, merchandise, or even cashback.

- Lifestyle Benefits: Cardholders may enjoy lifestyle benefits such as discounts on dining, shopping, travel, and entertainment at partner merchants, enhancing their overall experience.

- Zero Lost Card Liability: IDFC FIRST Bank typically offers zero lost card liability to protect customers against unauthorized transactions in case of card loss or theft, providing added security and peace of mind.

- Contactless Payments: The IDFC FIRST Power RuPay Credit Card may support contactless payments, enabling quick and secure transactions at eligible merchants by simply tapping the card on a compatible POS terminal.

- EMV Chip Security: The card is equipped with an EMV chip that enhances security by generating dynamic data for each transaction, reducing the risk of fraud associated with counterfeit cards.

- Online Account Management: Cardholders can conveniently manage their credit card account online through the bank’s website or mobile app, enabling them to track transactions, pay bills, and access statements anytime, anywhere.

Overall, the IDFC FIRST Power RuPay Credit Card offers a blend of convenience, security, and rewards, making it a valuable financial tool for customers looking for a reliable credit card solution.

Introduction:

In today’s fast-paced world, having a reliable and efficient credit card is essential for managing finances. The IDFC FIRST Power Rupay Credit Card emerges as a game-changer, offering a plethora of benefits tailored to meet the diverse needs of consumers. From cashback rewards to travel privileges, this credit card empowers individuals to take control of their financial destiny.

IDFC FIRST Power Rupay Credit Card: Redefining Financial Freedom

Unlocking the Potential of Financial Freedom

In today’s dynamic economic landscape, financial freedom is not just a luxury but a necessity. The IDFC FIRST Power Rupay Credit Card serves as a catalyst in this pursuit, offering unparalleled flexibility and convenience.

Understanding the Benefits

Experience the Power of Rewards

The IDFC FIRST Power Rupay Credit Card rewards users with exclusive cashback offers and discounts, making every transaction a rewarding experience. From everyday purchases to special occasions, earn rewards effortlessly.

Seamless Transactions, Unmatched Convenience

With seamless integration into various payment ecosystems, the IDFC FIRST Power Rupay Credit Card ensures hassle-free transactions across online and offline platforms. Say goodbye to cumbersome payment processes and embrace a world of convenience.

Empowering Financial Independence

The IDFC FIRST Power Rupay Credit Card empowers individuals to make informed financial decisions by providing real-time insights into spending patterns and budget management. Take control of your finances and embark on a journey towards financial independence.

Exclusive Privileges

Experience the Power of Exclusivity

As a cardholder, unlock a world of exclusive privileges, including access to premium lounges, complimentary travel insurance, and personalized customer support. Elevate your lifestyle and enjoy unparalleled benefits with the IDFC FIRST Power Rupay Credit Card.

FAQs (Frequently Asked Questions)

What are the eligibility criteria for applying for the IDFC FIRST Power Rupay Credit Card?

To apply for the IDFC FIRST Power Rupay Credit Card, individuals must meet the following eligibility criteria:

- They must be Indian residents aged between 21 and 65 years.

- They should have a stable source of income.

- They must have a good credit score.

How can I apply for the IDFC FIRST Power Rupay Credit Card?

You can apply for the IDFC FIRST Power Rupay Credit Card online through the official website of IDFC FIRST Bank. Alternatively, you can visit the nearest IDFC FIRST Bank branch to submit your application.

What documents are required for the application process?

The documents required for applying for the IDFC FIRST Power Rupay Credit Card include:

- Proof of identity (Aadhar card, passport, driving license, etc.)

- Proof of address (utility bills, rent agreement, etc.)

- Proof of income (salary slips, income tax returns, etc.)

How long does it take for the credit card application to be processed?

The processing time for the IDFC FIRST Power Rupay Credit Card application may vary depending on various factors. Typically, it takes 7 to 10 working days for the application to be processed.

What is the credit limit offered with the IDFC FIRST Power Rupay Credit Card?

The credit limit offered with the IDFC FIRST Power Rupay Credit Card is determined based on the applicant’s creditworthiness, income, and repayment history. It may vary from individual to individual.

Is there an annual fee associated with the IDFC FIRST Power Rupay Credit Card?

Yes, the IDFC FIRST Power Rupay Credit Card may have an annual fee. However, the fee structure and waivers may vary based on promotional offers and cardholder privileges.

Conclusion:

The IDFC FIRST Power Rupay Credit Card stands as a beacon of financial empowerment, offering users a myriad of benefits and privileges. From cashback rewards to exclusive discounts, this credit card redefines the way individuals manage their finances. Take the first step towards financial freedom and unlock a world of possibilities with the IDFC FIRST Power Rupay Credit Card.

Contain Table:

Credit Card:

- Kotak upi rupay credit card apply online

- HDFC Bank UPI RuPay Credit Card

- IDFC FIRST Power Rupay Credit Card

- PCI DSS

Banking:

- Register to IndusNet Online Banking

- BOB Kiosk Banking, BOB CSP, BC Commission chart 2024-25

- Documents Required for Opening a Current Account Online

- csc digipay lite commission 2023-2024

- DigiPay v7.3

- Airtel Payment Bank CSP

- SBI CSP Commission Structure

- SBI CSP – How to register sbi csp

- Fino CSP Lite Login

- Fino Payment Bank CSP Login

- how to apply fino payment bank csp

- Fino Payment Bank Commission 2023-2024

- Instant PIN Generation for Debit Card

- BOB CSP Browser Settings

- 7 Points on UPI Payments

- 5 Best Refer and Earn UPI Apps: Earn Free Cash Online

Other’s:

- Beyond the Beast: Jay Leno Tames the F-150 Raptor R and Unveils Its True Power

- Clash of Titans: Warriors vs. Nuggets – The Ultimate NBA Showdown Unveiled!

- United States one-dollar bill

- South Texas College – Pecan Campus

- How to disable right-clicking on a website using JavaScript?

- Unlocking Craig Brown’s Secrets to Success: The Ultimate Guide

- Unsolved Mystery: The Fate of the Five Men Aboard the Missing Titanic Tourist Submersible

- The NCAA Women’s Basketball Champion

- Dodgers

- Indian Premier League 2024

- Real-Time Billionaires

- Bernard Arnault & family

- Los Angeles Lakers

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |