CSC RAP Exam Questions And Answers 2023 PDF New, CSC Insurance RAP (Rural Authorised Person) Exam Live Questions and Answers 2023, CSC RAP Exam Answer Key 2023 PDF Download, Common Service Centre (CSC) RAP Exam 2023 Answer Key PDF in Hindi and English Download.

| No. of Questions | 100 |

| Mark per Correct Question | 1 |

| Passing Marks | 35 |

| No. of Module | 16 |

| Exam Duration | 60 Minutes |

| Exam Timing | 10:00 AM to 04:00 PM |

Rural Authorized Person (RAP) is an individual who has a license to solicit or negotiate an Insurance policy with a client on behalf of the insurance companies. VLEs can now become a Rural Authorized Person (RAP) to be able to sell Insurance products through CSC Portal. To become a RAP VLE has to complete the RAP training modules and pass in RAP exam conducted by NIELIT.

Benefits of becoming a RAP

- Online hassle free licensing

- Existing agents of Insurance companies can have RAP license

- Over the counter policy issuance

- Access to multiple companies under one portal

- Instant commission for all products sold

- VLE’s can sell both Life & General Insurance products.

Steps for VLE to become a licensed RAP

- Register for RAP through https://insurance.csccloud.in/ You need copies of address proof, Photo ID proof, copy of PAN card and education proof for upload during the registration process.

- Pay fees of Rs 350/- towards Examination & Licensing using Registration number received. Note : From the registration date it takes one week time to get the RAP username and password (after verifying the details updated on RAP portal). If in case VLE is not able to clear/appear for exam, they need to pay the fee for every exam. The Fee needs to be paid using your e-wallet.

- VLE gets Login ID & password for RAP training from Team Insurance, CSC SPV

- VLE to Complete Pre-licensing Education, online modules of examinations. Completion Certificate shall be issued after completion of online modules. Training assessment and modules can be accessed using Google Chrome Browser.

- After completing the modules and assessment VLE to appear for online examination that can be given from their center or home. VLE should have access to internet and web camera.

Procedure to Appear for Exam

- Open the link https://insurance.csccloud.in/ and click on “Online Insurance Exam”.

- Enter your cSC ID, Registration number and Captcha code.

- You will be directed to the exam website.

- Take your picture using web camera and submit.

- Show a Photo ID in front of the webcam and click the snapshot of your Photo ID for Authentication and to start your RAP exam.

- VLE will get the marks scored after submitting the exam.

- The passing score for each examination is 35 percent. Candidates who pass the examination will receive a score report that reads “pass” and no numeric score will be reported. Candidates who fail the examination will receive a score report that reads “fail” and no numeric score will be reported.

From the exam pass date, it takes 10-15 days for service to be activated on VLE portal. The iris devise and hard copy of license is either sent to state coordinator or by other means. VLE should send all the below documents to CSC.

- Acceptance Letter (Signed)

- RAP Terms & Conditions (Signed)

- RAP License (Signed)

- Signed copy of

- ID Proof

- Address Proof

- PAN Card

- Educational Proof

- Copy of Proof of Surrender of License (If Holding Existing License)

- 1 Passport Size Colored Photograph

Table Of Contents

- CSC Registration

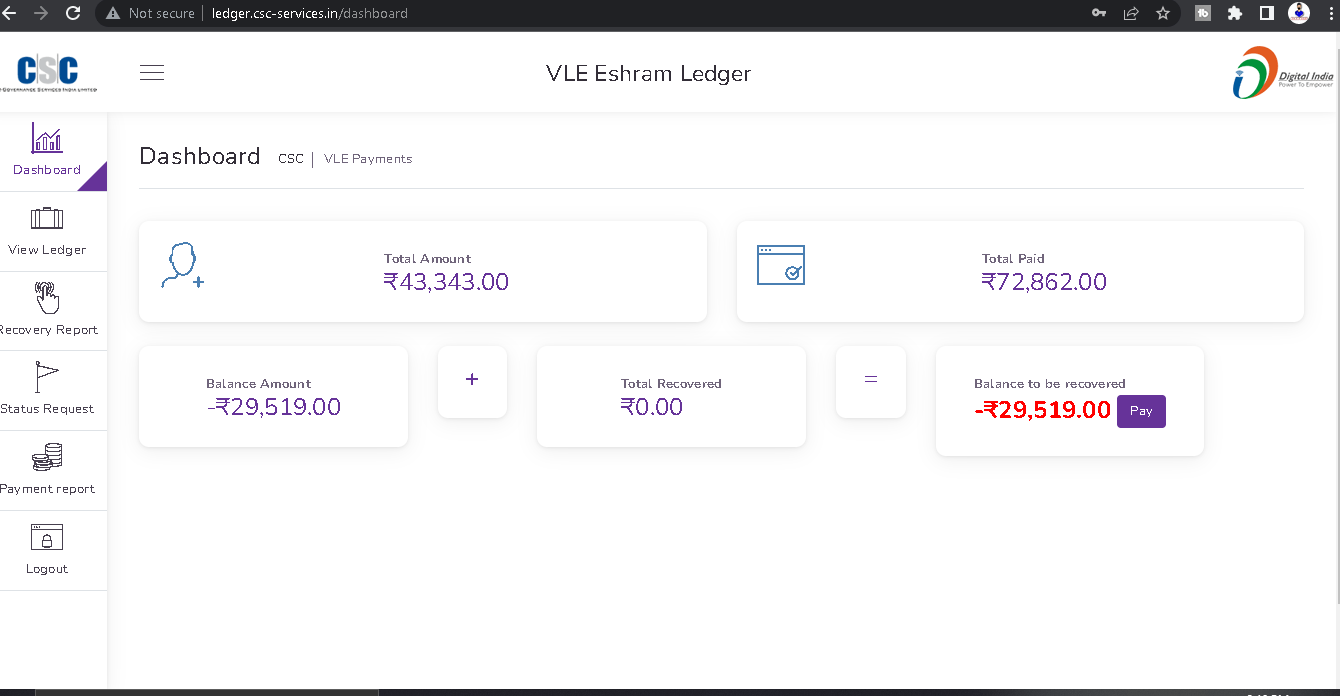

- VLE Eshram payment and recovery details

- Digipay lite id password kasie banaye

- Business Correspondents – कौन बन सकता है? – Axis Bank Through CSC

- IIBF Exam Registration

- Digipay Micro Atm Booking Order Start

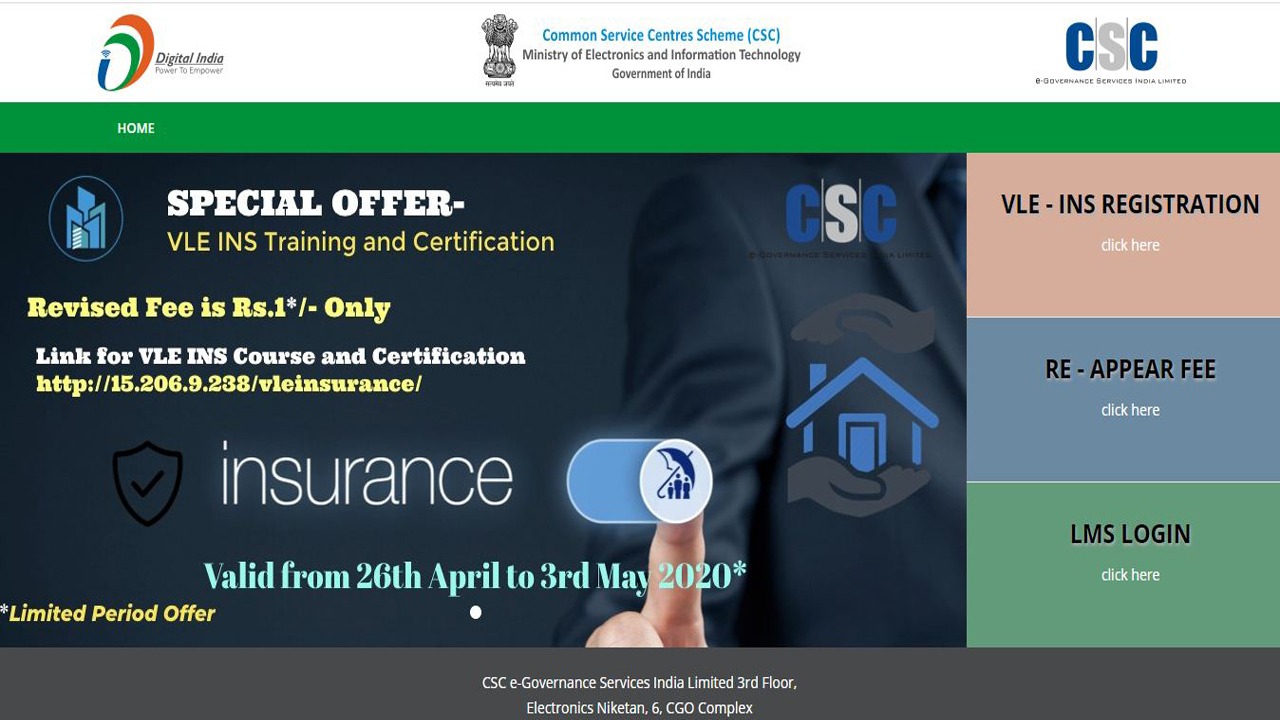

- CSC VLE Insurance Training And Certification

- IRCTC Ticket Booking through CSC

Q. What is the maximum cover that can be provided in micro-insurance?

Ans. 50,000

Q. The Non-Government Organisations (NGOs) help the insurance industry

immensely in:

Ans. Promotional activities

Q. While recommending a solution to the client the advisor should establish the link between

client needs and

Ans. product features

Q. …….. means before loss what was his financial status and for the same

financial status to bring him is called:

Ans. An indemnity

Q. The constituents who participate in deeper penetration of micro insurance and awareness

of insurance in rural areas are

Ans. he Regulator IRDA

Q. In life insurance industry which mechanism operates so as to enable the individuals to

reduce the impact of risks

Ans. Transfer of risk

Q. Reinsurance means

Q. In fact finding why client’s income analysis is necessary

Ans. To do financial planning according to the needs of the client

Ans. Purchase of additional insurance by an insured person

Q. A married couple having 9 year old child have to consider life insurance health insurance

child investment & retirement plans for their better future as a family but at present condition

which aspect should be kept at lowest priority?

Ans. Life insurance

Q. Which of the following is not a benefit of online insurance sales?

Ans. Benefit of low cost are passed on to Agents

Q. Bancassurance as envisaged in India means

Ans. Designing and marketing of insurance products by commercial banks

Q. With profit policies can be given to

Ans. Individual

Q. The fund governed by the rules and regulations of the Employees Provident fund and

Miscellaneous provisions Act 1952 When will it be paid to the employees

Ans. any of the above

Q. The Non Government Organisations (NGO) help the Insurance Industry immensely in

Ans. Linking buyers and sellers

Q. Which of the following statement does not characterize the Professional Insurance market

Ans. Will have profit making as its only motive.

Q. The person seeking insurance policy is called as

Ans. Policyholder

Q. How long a quotation will be valid

Ans. 15 days

Q. When does cooling off period begin in an insurance policy?

Ans. When premium is paid

Q. Samir is married with dependant parents and no child which should be his priority

Ans. inheritance planning

Q. The object of a contract should be to create

Ans. A legal relationship

Q. Mrs. Sheela received some amount out of her husband�s death. In such a situation what

will be her prime focus?

Ans. Insurance

4Q. Insurance Agents are

Ans. Intermediaries

5Q. Mr.Varun who owns a multi-chain company would like to take an insurance.

What will be the best option for him from the following?

Ans. He can take company insurance

Q. Ajay and Vijay both are unmarrie Ajay has dependant Parent. Which need Ajay must take

care of a priority although that will not be a priority for Vijay?

Ans. Health insurance for parents

Q. Mr.Shanth has taken an endowment policy of 15 years with ABC insurance company. He

has paidpremium for 4 years and he could not pay premium for 5th and 6th year. In the 7th

year he approaches the company to renew the policy. Now which of the following options is

applicable?

Ans. The policy will be renewed on the existing terms and conditions.

6Q. Insurance c option because:

Ans. Insurance products offer flexibility to the policyholders

Q. The principle of utmost good faith puts a duty of disclosure on insurers also�. With

respect to this statement identify the most appropriate statement:

Ans. The agent should disclose the commission also if asked by the customer

Q. An Insurer advertises through daily news paper. What type of marketing is this ?

Ans. Direct Selling

7Q. Amit is looking for term insurance plan for protection of his family he is

advised to approach for:

Ans. Life Insurance

Q. In which of the recognized life stages an individual does not required any protection cover

Ans. A. childhood

Q. Mohit has two kinds one of 6 years and other 8 years. He is the earning member and not

having life cover. Beofre advising him to take health policy what he should be advised?

Ans. Health policy for child

Q. Mr. X fact find shows he need a term insurance for his future income protection A family

health plan to cover medical needs a children�s plan to cover his son�s education and a

endowment policy for his daughter�s marriage. Which of these is the first priority?

Ans. Medical Insurance

Q. What is the maximum level of complaint that can be considered and taken action by

ombudsmen

Ans. 20 Lac

9Q. Which of the following is not a type of insurance organization?

Ans. Ombudsman

10Q. The constituents who participate in deeper penetration of micro-insurance

and awareness of insurance in rural areas are:

Ans. Non- Governmental Organizations

11Q. In life insurance business if a person is working in calculating premium

rates of insurance products then he is mostly likely a member of:

Ans. Insurance institute of risk management

12Q. A Risk transfer provides a sense of:

Ans. Financial security

13Q. _ is an insurer for the insurance company:

Ans. Reinsurance company

Q. A policy holer submits cancellation of his term insurance policy the insurer accepts the

form and fails to give the benefits and the policy holder writes to IRDA post which the

settlement should be within

Ans. 30 days

Q. The regulations issued by the IRDA require that the decision on the proposal must be

conveyed to the proposer within

Ans. 15 days of receiving the proposal

14Q. Mr. Mahesh is a software engineer. He has taken a term insurance for Rs.

30,00,000/- for 30years. This is an example for:

Ans. Risk transfer

15Q. Currently, major percentage of insurance sales in India takes place

through

Ans. Individual insurance agents

Q. Karthik written to his insurer about non settlement of a maturity claim as per regulations

the insurer has to reply to this within how many working days

Ans. 10

16Q. I.R.D.A was incorporated as a Statutory body in:

Ans. Dec-1999

17Q. What facility do insurers use to cover risks beyond their exposure

limits:

Ans. Both a & b

18Q. One of the most sought after advantage of Insurance is:

Ans. Tax benefits on payment of premium and all the pay-outs

19Q. Vinay doesn’t want to take insurance on himself. He feels that his family

will survive with the funds available in the bank and monthly rentals received

from village. This comes under Risk __:

Ans. Retaining

20Q. Why is Insurance required?

Ans. All of the above

21Q. The main role of an underwriter in a non-life insurance company is

normally to: Ans. assess the acceptability of particular risks

22Q. The concept of insurance involves a transfer of:

Ans. Risk

23Q. How are perils and hazards normally distinguished under term insurance

policies?

Ans. Perils are risks that policyholders will die before a specified date and

hazards are factors which could influence that risk.

24Q. In insurance terms, the risk of suffering a disability is best described as

what type of risk?

Ans. Financial.

25Q. For a household insurance policy, insurable interest need only exist at

outset and at what other point?

Ans. The date a claim occurs.

26Q. Rahul is employed by Sunny. In respect of this employment, Rahul

automatically has insurable interest in Sunny’s life up to what limit, if any?

Ans. Rahul’s monthly salary.

27Q. Akshat is a relatively cautious person. In insurance terms, this will normally

increase the likelihood that he will:

Ans. require insurance cover

28Q. Arun started a 20-year term insurance policy. Once established, when, if at

all, is the insurer next entitled to ask him for proof of continuing good health?

Ans. When a lapsed policy is revived.

29Q. Once an absolute assignment is effected under a life insurance policy, who

will be the titleholder(s) of this policy?

Ans. The assignee in all cases.

30Q. How long is the free look-in period under a term insurance policy from the

date of receipt of the policy document?

Ans. 15 days.

31Q. A life insurer issued a quotation on 10 February, guaranteed for 14 days,

which was accepted by the customeron day 10. Consequently, the insurer can

only decline this risk if the:

Ans. material facts change.

32Q. A policy document for a money-back policy includes the statement ‘the

proposal and declaration signed by the proposer form the basis of the contract’.

In which main section of the policy document will this normallyappear?

Ans. Preamble.

33Q. The consequences of these risks which will affect specific individuals or

local communities in nature are called as?

Ans. particular risk

34Q. Pooling of insurance applies to?

Ans. All Type insurance (Only life insurance, only non-life insurance)

35Q. Both the parties to a contract must agree and understand the same thing

and in the same sense which is called

Ans. Consensus ad idem.

36Q. A contract exists between insurer and proposes when

Ans. A proposal has been accepted by insurer.

37Q. A life insurance policy can only be made paid up if what policy feature

exists?

Ans. Savings element.

38Q. The main reason why a life insurance proposal form often asks for the

proposer’s height is to enable a reasonable comparison with the proposer’s:

Ans. weight.

39Q. The concept of indemnity is based on the key principle that policyholders

should be prevented from:

Ans. profiting from insurance.

40Q. Where annually increasing flexible premiums operate under a life

insurance policy, what rate of increase will generally apply?

Ans. 5.0%

41Q. The amount paid out by the insurer under a 30-year life insurance policy

exceeded the sum insured plus revisionary bonuses. The excess is likely to result

from?

Ans. terminal bonus.

42Q. What normally happens to the sum insured under a life insurance policy

once the period of the lien expires?

Ans. It increases.

43Q. The main protection need of a 19-year-old is most likely to be:

Ans. self-protection.

44Q. The need for investment advice from an insurance agent normally results

from what overriding key factor?

Ans. Lack of market knowledge.

45Q. When undertaking financial planning for individuals without capital, what

savings need is likely to beaddressed in every single case?

Ans. Emergency funds.

46Q. Naveen is addressing his income needs by investing directly in corporate

bonds. In what form will he receivethis income?

Ans. Interest payments.

47Q. Raunak recently arranged a life insurance policy under which he is classed

as the master policyholder. This addresses his role as:

Ans. an employer.

48Q. Nikhil is looking for tax-efficient savings methods for his disposable

income. He is considering an equity-linked savings scheme, national savings

certificates and an endowment insurance policy. Premiums for which of these

investments are allowed to be deducted from his taxable income?

Ans. The equity-linked savings scheme, the national savings certificates and the

endowment insurance policy.

49Q. An investor holds a wide range of shares. If the Reserve Bank of India

announces a series of significantinterest rate increases, the prices of these

shares are most likely to

Ans. decrease.

50Q. The changes in healthcare costs over recent years has had what general

impact on healthcare insurance?

Ans. A rise in the need for cover.

51Q. What is the main objective of taking the life insurance policy?

Ans. Protection

52Q. Any assets, which are no longer suitable or are earning fewer returns than

expected, should be?

Ans.Cashed in for investment into other assets.

53Q. The business of insurance is connected with?

Ans. Economic value of assets.

54Q. Appointer’s Role

Ans. When nominee is minor

55Q. Payment of premium and sum assured are laid down in

Ans. Operative clause

56Q. Which clause lays down the mutual obligation the parties regarding,

payment of premium by life assured & payment sum assured by?

Ans. Operative clause

57Q. The general need for a pension policy results from the existence of what

key problem?

58Ans. Anticipated fall in income.

58Q. The sole focus during a client’s fact-find session was healthcare

requirements and estate planning. Which main life stage is he most likely to fall

into?

Ans. Retirement.

59Q. Apart from the salary level, what other key feature of Alok’s job is likely to

have a major impact on the level ofhis pension, life insurance and health

insurance needs?

Ans. Whether the job is in the public or private sector.

60Q. In the context of financial planning, how is the difference between real

needs and perceived needs bestdescribed?

Ans. Real needs are actual needs and perceived needs are based on a client’s

thoughts and desires.

61Q. To fulfil the ‘know your customer’ procedures, at what stage in the financial

planning process is theinsurance agent most likely to request a copy of the

customer’s photograph?

Ans. At the end of the presentation meeting.

62Q. An agent has recommended an investment product with non-guaranteed

benefits. The benefit illustration passed to his client will therefore use assumed

annual growth rates of:

Ans. 6% and 10%

63Q. The main purpose of including commission details in the documentation to

clients is to increase:

Ans. transparency.

64Q. Yash pays health insurance premiums for himself, his wife and his two

children aged 13 and 8. Premiums for which of these individuals will qualify as

deductible from Yash’s taxable income?

Ans. Yash, his wife and both his children.

65Q. A client has been recommended a low-risk investment product by his

insurance agent, but the client insiststhe agent arranges for the money to be

invested in a higher risk product. What action should the agent take?

Ans. Carry out these instructions, but document that this contradicts the

recommendation.

66Q. An insurance agent has advised a client to surrender an existing

investment product and start a newinvestment product. What key indicator

should be used to determine whether this advice was ethical?

Ans. The best interests of the client.

67Q. What key impact will low persistency levels have on insurance

policyholders?

Ans. A reduction in benefits.

68Q. A claim under a term insurance policy is submitted by an individual who

has substantially understated his age.As an alternative to paying out the full

claim the insurer is most likely to take what action?

Ans. Reject the claim on the grounds of misrepresentation.

69Q. On the maturity of an endowment policy, a reduced sum insured is paid

out. What is the most likely reasonfor this?

Ans. The policy was made paid up during the policy term.

70Q. What key event is most likely to prevent insurers from ensuring that each

insured person brings a fairpremium to the pool for the risk presented?

Ans. A fraudulent claim.

71Q. An insurance agent served an insurer continually and exclusively for 20

years, after which he retired fromwork. In accordance with Section 44 of the

Insurance Act 1938, renewal commission due to him after the termination of his

agency can only be withheld if:

Ans. there is fraud involved.

72Q. Legislation gives which body the power to specify a code of conduct for

surveyors and loss assessors?

Ans. Insurance Regulatory and Development Authority.

73Q. What key legacy has been left by the activities of the Tariff Advisory

Committee?

Ans. Standard policy wordings.

74Q. Raju died 5 years before the end of his 30-year endowment insurance

policy. What factor most likely causedthe insurer to investigate the claim using

the early death claim procedures?

Ans. The policy had lapsed and was revived shortly before he died.

75Q. Apart from conducting a comprehensive fact-find, the other main action

that an insurance agent can take atoutset to minimise the risk of subsequently

receiving a customer complaint is to:

provide detailed disclosures.

76Q. An award made by the Insurance Ombudsman will only be binding on the

insurer if the:

Ans. complainant accepts this decision.

77Q. A policyholder asked his insurance agent for guidance on submitting a

claim for the maturity benefit under hislife insurance policy. Due to pressure of

work, the agent declined to assist. Consequently, this action is deemed to be a

breach of the:

Ans. Insurance Regulatory and Development Authority’s Code of Conduct.

78Q. During the process of applying for life insurance, the customer discloses

confidentially to the insurance agentthat he had a mild stroke four months ago,

however this was NOT mentioned on the application form. In accordance with

the Insurance Regulatory and Development Authority’s Code of Conduct, how

should the insurance agent deal with this information?

Ans. Notify the insurer of this matter.

Q. The plan which provides only maturity benefit and no death cover is called

Ans. Endowment

Q. Which feature of an insurance policy will address the problem of Inflation?

Ans. Increase in Bonus

Q. Hari wants a constant life cover till his 31st birthday. But he cant afford to pay high

premiums. The best suited products for him would be

Ans. Term plan

Q. What are the variants of Endowment Plans?

Ans. Money back & Term insurance

Q. The section of the Income Tax providing exemption for maturity benefits received under a

life insurance policies is

Ans. 80C

Q. Which types of needs assume top priority?

Ans. Low priority needs

Q. A group of people insured in a policy . They belong to which category

Ans. Employees

Q. During a fact finding process the need analyzed were income replacement and children�s

education but the customer insists on only a child plan for the time being and asks the agent

to give him a child plan. The agent should

Ans. Give a child plan and revisit the client on a later date

Q. State which of the following statements are correct?

Ans. both statements are correct

Q. Rahul has taken a joint life policy with his wife. Who is responsible for premium payment

?

Ans. Both a & b

Q. If the client does not wish to proceed with the recommendations right at the moment the

agent should

Ans. Should ask for a future date from the client

Q. If the client accepts the recommendation then the agent should ask the client

Ans. All of the above

Q. An agent should disclose the commission if

Ans. the commission is low

Q. Checking Clients’ commitment to needs means

Ans. Reminding Clients of needs that were agreed during Fact find process

Q. What are the key aspects of advisors do for better persistency?

Ans. Selling product as per need & policy servicing

Q. Churning is bad based on which aspect

Ans. Insurance companies get good branding

Q. Micro insurance is transacted by

Ans. Life Insurers only

Q. 14 What key impact will the agent have in low persistency?

Ans. Will have impact in his commission

79Q. Which of the following cannot be insured?

Ans. Speculative risk

80Q. Mr. Kunal used to participate in Car race. While taking up the Insurance

policy he disclosed this information. What kind of hazard does it refers to:

Ans. Occupational Hazard

81Q. On 6 th August, there was a typhoon. Mr.Augustin who had insurance died in

typhoon. Now how willthe insurance company categorise this risk?

Ans. Under the category of Pure risk

82Q. Law of large numbers is worked out by which of the following?

Ans. Pooling of risk

83Q. Pure risks are those risks where there is:

Ans. Loss or no loss

84Q. The type of risk that can be insured against is:

Ans. Pure Risk

85Q. Mr.Kunal used to participate in Car race. While taking up the Insurance

policy he disclosed this information. What kind of hazard does it refers to:

Ans. Physical hazardorOccupational Hazard

86Q. Which statement is correct?

Ans. lung cancer is peril and smoking is a hazard

87Q. There are two different groups of 100 people. The first group isbetween 30-

39 years of age. Of these one person dies before the age26 Probability of death

in this case is 1%. The second group is aged 60-69 years of these 15 die before

the age of the probability of death in this case is 15%.

Ans. This shows that frequency of death is high in higher age

88Q. Insurance contract is valid because?

Ans. Contract enforceable by law

89Q. Which of the following types of insurances is not a contract of

indemnity:

Ans. Life Insurance

90Q. Ajay does not consume alcohol for a month to not detect during medical

test is:

Ans. Concealment of a material fact

91Q. Amit is illiterate. He wants to take policy his friend Surya help him in

knowing the question and filling the proposal form. What extra requirement is

required in this case:

Ans. Left thumb Impression of Amit along with a declaration of his friend

92Q. Insurance companies apply law of _ to determine the cost of total

annual claims:

Ans. Large numbers

93Q. Mr. Josh was filling the proposal form but as his mother was sitting beside

him even though hedrinks and smokes he ticked “NO” in smoking & drinking

column of proposal form. This indicates?

Ans. He has breached the duty of disclosure by concealing the facts

94Q. Which of the following is not a type of bonus?

Ans. Inception bonus

95Q. The most important features of a Valid contract are:

Ans. Consideration and legality of object

96Q. Rohit is working as sales manager with an FMCG company. His job requires

him to travel across states. He is planning of covering his additional risk involved

while traveling and a saving plan. What suggestion would you give him as an

agent?

Ans. To purchase an accidental rider with a saving insurance plan.

97Q. To sale focus during a client’s fact find session was healthcare

requirements and estate planning.

Ans. Retirement

98Q. In which at the recognized life stages an individual does not require any

protection cover

Ans. Childhood

99Q. Ajay and Vijay both are unmarried. Ajay has dependant parent. Which need

Ajay must take care of on priority, although that will not be a priority for Vijay.

Ans. Health insurance for parents

100Q. Mr. Nikhil makes an offer of Rs 20 lacs SA to Insurance Co. XYZ.

Inresponse to this Insurance co. XYZ offers a SA to the tune of max. Rs10 lacs

(counter offer). At this stage Nikhil and Company X can enterinto a valid

contract?

Ans. Nikhil and Insurance Co. can enter into a valid contract if Nikhil

unconditionally accepts the offer.

101Q. Policy taken by husband and wife jointly is called as…..:

Ans. Joint life policy

102Q. Mr.Akash filled the proposal form but before submitting to the company

he discussed with theagent that he is not sure whether he can pay for 15 years.

This attitude affects which part of thecontract?

Ans. Capacity to contract

103Q. Human life is exposed to different type of risks. Which of these risks is

not currently covered by Indian insurers?

Ans. Unemployment not caused by disability

104Q. Rishabh Agarwal is a 40 years businessman. He leads a healthylifestyle.

Every morning he practices yoga and abstains from smoking tobacco and

alcohol. There is a family history of diabetes and both hisparents suffer from it.

But Rishabh himself is not diagnosed withdiabetes. Based on this case which of

the following statement is true?

Ans. He can be given insurance as he maintains a healthy lifestyle

105Q. Which of the following cannot be insured?

Ans. Speculative risk

106Q. If a person consumes alcohol regularly and does not disclose the same in

proposal form – what is the type of hazard?

Ans. Moral

107Q. In insurance terms the risk of suffering a disability is best described as

what type of risk?

Ans. Financial.

108Q. Akshat is a relatively cautious person. In insurance terms this will normally

increase the likelihood that he will:

Ans. require insurance cover

109Q. Level of risk is determined by:

The probability of the occurrence of a certain event and the extent of losses

likely to Ans. be suffered due to the occurrence of the event.

110Q. Which of the following risks are insurable?

Ans. Financial Risk

111Q. Insurance Companies provide cover only for:

Specified Risks

112Q. Insurance relates to:

Ans. Pooling of risk

113Q. Loss of Life needs:

Ans. To provide a steady source of income to dependants after death

114Q. A hazard can be defined as:

Ans. A condition that either increases the chance of a peril happening or cause

its effect to be worse

115Q. Which of the following is individual’s assets?

Ans. His properties

116Q. The type of risk that can be insured against is:

Ans. Pure Risk

117Q. Which category of insurance has nature of low frequency but high

severity?

Ans. Airline Insurance

118Q. Law of large numbers is worked out by which of the following?

Ans. Pooling of risk

119Q. Policy document is:

Ans. Legal contract

120Q. In life insurance which principle does not apply?

Ans. Insurable interest

121Q. Kailash is working with an MNC and has a co-worker Ramesh who helps

him in his work. In the absence of Ramesh Kailash’s work would suffer

significantly and he has to work on his own to complete his assignments. Which

of the statement is true with regard to

Ans. Insurable Interest exists between Kailash and Ramesh

122Q. What amount of insurable interest does an individual have in his own

life?

Ans. Up to the sum assured taken in the plan

123Q. The insurance company issues ____ after accepting proposal

Ans. First Premium Receipt

124Q. The _ of the policy states that the proposal declaration signed by

the proposer forms the basis of contract:

Ans. Preamble

125Q. Certificate from the village panchayat:

Ans. Will be considered as non-standard age proof

126Q. What are the 2 types of Age proof documents?

Ans. Standard & Non-Standard

127Q. Who fills up proposal form?

Ans. Proposer

128Q. When the life assured and the policyholder are one and the same how the

policy will be known?

Ans. Policy on own life

129Q.___ refers to the transfer of the title rights interest of the

insurance policy

Ans. Assignment

130Q. Appointee’s role

Ans. when Nominee is Minor

131Q. Even though the insurer may avoid the contract entirely “ab initio” for the

reason of misrepresentation or non-disclosure the Insurance Act 1938 gives a

protection to the policy holder making the policy in disputable after 2 years

(excepting for fraud)

Ans. Sec. 45 of the Insurance Act 1938

132Q. Shamsher has a health insurance policy of 1,00,000 individually and from

his company for 2,00,000. He falls sick and got hospitalized. His hospital bill ran

to 50,000. He claimed this amountfrom his individual policy. Also, he placed the

request with his company. His company has rejected the claim. What type of

contract is this?

Ans. Deemed contract

133Q. Nomination can be in favor of how many people?

Ans. It can be any number

134Q. Insurable Interest is deemed to exist in which of the following

relationship?(i) Husband and wife (ii) Parent and children (iii) Employer and

employees(iv) Brother and Sister.

Ans. (i), (ii) and (iii)

135Q. If a policy holder is not satisfied with terms and conditions of the policy

which she/he has received, then there is an option to return policy for

cancellation within…days from the date of receipt for policy by policyholder.

Ans. 15Days

136Q. Types of assignment:

Ans. Absolute & Conditional

137Q. Material facts are those:

Ans. That would influence the decision of the underwriter in accepting the risk

138Q. The main supplier of the material facts is:

Ans. The proposer as he is alone in the possession of full information about

himself

139Q. Duty of disclosure of material information rests with:

Ans. Insured and Insurer both

140Q. In case of life insurance, the insurable interest should exist:

Ans. At the time of taking the policy

141Q. A & B in enters into a Contract & B accepts the Contract with a condition.

Will this be considered as a Contract Between A& B?

Ans. Contract is created only when the acceptance is unconditional.

142Q. Proposal form & the Declaration signed by the proposer are called of the

contract: Ans. Basis

143Q. In which kind of policy the insurable interest should exist at the time of

claim:

Ans. Marine insurance

144Q. When does insurable interest exist in a life insurance contract?

Ans. inception of the contract

145Q. __ comes into existence when one party makes an offer which

the other party accepts unconditionally:

Ans. A Contract

146Q.. If a contract is signed by a 15 years old boy this contract will be:

Ans. Invalid

147Q. Mr. ABC buying Term insurance policy insurer should mention

Ombudsman address in which part of policy document?

Ans. Information statement

148Q. If a contract is signed by a 15 years old boy this contract will be:

Ans. Invalid

149Q. The condition that the policy holder should pay the premiums regularly is

mentioned in:

Ans. All of the above

150Q. For Quarterly mode of payment days of grace is:

Ans. 30 days

Q. Both the parties to a contract must agree and understand the same thing and

in the same sense which is called:

Ans. Consensusadidem

Q. Who should attest the thumb impression on the proposal form?

Ans. Proposer himself

Q. The process of making changes in the terms and conditions of the policy once

it is issued is called:

Ans. Amendments

Q. Utmost good faith envisages a positive duty to disclose accurately all

information that are:

Ans. Facts which are material to the risk being proposed

Q. The process of making changes in the terms and conditions of the policy once

it is issued is called:

Ans. Endorsements

Q. When an interim bonus is paid under with profit policy This normally

represents a bonus covering what period:

Ans. Previous valuation date to claim date

Q. The insurance contract is mainly an

Ans. Agreement enforceable by law

Q. Which of the following falls under voidable contract?

Ans. Fraud

Q. A policy has two nominations. What amount should be given to the two

nominees?

Ans. There is no specified limit like that

Q. Till what period is interim bonus valid:

Ans. Till the next declaration of bonus

Q. Insurable interest on one’s own life limited upto:

20 times of Gross Annual income

Ans. Unlimited

Q. Except Surrender how one policy holder can transfer money to a third party

barring Nominee?

Ans. By doing Assignment

Q. Two people with same term one person had more premium than other

because:

Ans. Health detioration

Q. Moral Hazard reflects the:

Ans. Habits and hobbies of proposer

Q.

Mr. Kumar’s wife is suffering from blood cancer Doctors lost their hope on her

live Mr. Kumar would like to take life insurance policy on wife’s name in order to

get monitory benefit. Insurance company rejects this proposal on the grounds of

Ans. All of the above

Q. Annual premium of an insurance product is Rs. 32,000 with 4% loading on

Quarterly mode of payment. What is the quarterly premium?

Ans. 8,320

Q. Proposal decision to be communicated to the client within

Ans. 30 days

Q.

Annual premium of an insurance product is Rs. 32 000 4% loading on Quarterly

mode of payment what is the quarterly premium

Ans. 8320

Q. Insurer appoints a candidate of this professional qualification who decides the amount of

premium in inusrance products

Ans. Advisor

Q. If the customer has invested money in a pension plan from company A and buys an annuity from

company B what is the nature of transaction

Ans. increasing annuity

Q. Income replacement methods equates Human Life Value (HLV) to:

Present value of future earnings

Q. If the annual premium for a plan is 32000 and a frequency loading of 4% is

added in a quarterly premium what is the instalment premium that needs to be

paid.

Ans. 8,320

Q. A human being is:

Ans. All of the above

Q. What is the special report that is asked by the underwriter from the officer of

the insurer?

Ans. Client confidential report

Q. Mr Ramesh invested Rs 50000 in pension policy. What is the percentage he can avail as

exemption in income tax

Ans. pension plan is eligible for tax exemption u/s 80C

Q. Within how many days will the underwriter needs to inform the policyholder regarding the status

of the proposal

Ans. 15 days

Q. What role an agent is likely to play in the process of underwriting?

Ans. To give truthful report to the insurer all about the life to be insured

Q. Who is the primary Underwriter?

Ans. Agent

Q. If the annual premium for a plan is 32000 and a frequency loading of 4% is added in a quarterly

premium what is the instalment premium that needs to be paid

Ans-

Q. Mr Sunil is doing premium calculation for his company as per which authority

is his profession related to:

Ans. Council of Actuaries

Q. In a 20 year with profit policy persistency Bonus is paid at the end of:

Ans. 20th year

Q. Two friends have taken same policy but their premiums are different. Why?

Ans. All the above

Q. Compound reversionary bonus of 4% will be calculated on:

Ans. Sum assured plus bonus till date

Q. As per the norms of risk assessment U/W both the parents of a policy holder

died in their early 30s due to Heart disease. What is the risk assessed?

Ans. Physical Hazard

Q. While calculating Human life value (HLV) two components need to be kept in

mind the one is take home salary and other is:

Ans. Estimated life expectancy

Q. Claim was settled. However full Sum assured not paid though the policy was

in force due to:

Lein

Ans.

Q. HLV is used as a Yardstick to determine:

The correct cover needed to compensate economical loss to their family in case

of Ans. death of the earning member

Q. In insurance HLV is a known abbreviated term. How the meaning of HLV can

best be described in relation to an income earning proposer?

Present value of the future earnings less personal expenses is the HLV of the

proposer

Q. Mr A wants insurance cover. But he is drinks alcohol frequently. What kind of

hazard you may categorize?

Ans. moral hazard

Q. Insurer appoints a candidate of this professional qualification who decides

the amount of premium in insurance products:

Ans. Actuary

Q. While calculating HLV along with future income no of years of work

increments in salary what is also to be taken in to account?

Ans. Discount rate

Q. Mr. A has a son who is 5 yrs and he wants to save funds for his education.

Both the parents are risk adverse. Which plan is suitable for them?

Ans. Endowment Plan

Q. Most plans offered by Indian insurance companies are a combination of:

Ans. Term insurance and whole life

Q. Why Annuities are reverse of Life Insurance?

Ans. Annuities cover contingency of Survival whereas Life insurance covers the

contingency of death

Q. Main Protection need of a client…:

Ans. Protection of Income

Q. Basic elements of an insurance plan are:

Ans. Maturity benefit and Death cover

Q. When maturity benefit is payable under a joint life Plan?

Ans. On survival of both or either of the life insured.

Q. Which plan covers the risk of living too long?

Ans. Retirement plan

Q. Income Tax Act 1961 provides for tax relief for various investments under

Section?

Ans. 80C

Q. Group insurance is a contract between…:

Ans. Employer & Insurance Company

Q. Who deducts premium in Salary Savings Scheme?

Ans. Employer

Q. The date on which the Title/rights under a policy passes on to the child on age

18 is called….:

Ans. Vesting date

Q. Which plan is suitable for those who cannot afford higher premium now but

can afford to pay higher premium later?

Ans. Convertible Term insurance

Q. Which is the most basic simplest & cheapest form of insurance?

Ans. Term insurance

Q. Why insurance needs require to be prioritized?

Ans. Resources are limited.

Q. Mr A submitted the proposal form. When will the risk begins for the

company?

Ans. On receipt of payment by agent

Q. Two People of the same policy Term one person pays more premium

because:

Ans. Higher Age

Q. What is maximum level of Insurance premium for which Income Tax benefit is

available:

Ans. 1,00,000

Q. Client has taken Joint Life Policy. Who are responsible in the contract?

Ans. Proposer & Wife

Q. Term insurance if best suited for the following need

Ans. education needs

Q. A Couple has 7 year kid & wants to Buy some Policy. Which is the best suitable

policy for his Son?

Ans. Child insurance plans can be taken out in the form of endowment plans

money-back plans or ULIPs

Q. Children policies come in 3 forms. What are they?

Ans. Endowment Money back & ULIP

Q. At the time of maturity quarter of the SA is paid though the policy was in

force:

Ans. Money back

Q. Mr. X wants a life cover for the term of 20 Yrs. Also, he wants a modest

amount if he survives through the term. Which plan should he buy?

Ans. Endowment plan

Q. Hari wants a constant life cover till his 31st birthday. But he can’t afford to pay

high premiums. The best suited products for him would be:

Ans. Term plan

Q. The option to receive maturity benefit in instalments under a ULIP is called..:

Ans. Settlement Option

Q. The period which does not provide risk cover in a Child plan is called…:

Ans. Commencement period

Q. To avail income tax exemption for premium paid sum insured under a policy

should be…:

Ans. 10 times

Q. Which life insurance plan offers both the benefits of Risk cover and

Investment?

Endowment policy

Ans. ULIP

Q. In endowment policy, we give SA + Bonus- :

Ans. Outstanding premium

Q. What is Inflation?

Ans. Increase in cost of living

Q. Samir is married and he has only one partner with dependant parents and no

child. Which should be his priority?

Ans. income protection

Q. With-profit policies can be given to:

Ans. Individual

Q. An Insurance agent suggests estate planning as a top priority for the customer. what stage of life

cycle the customer is in

Ans. A. Young married=

Q. Out of all the factors that affect the needs of different life stages of an

individual which is the most common factor that is likely to exist throughout the

life span of an individual?

Ans. Liability

Q. An elderly person wants to use tax efficient investment and invests in senior citizen saving

scheme. Its the impact in his taxation

Ans. His investment would be deducted from taxable income

Q. Investing in ULIP plans exempts a maximum up to what limit for Income Tax

Ans. 200000

Q. There is a family of four people both the husband and the wife are working.

They have two kinds aged 6 and 11 years. There is a tragedy in the family and

the husband passes away due to an accident. Which of the following saving

options should the wife go for post the death of her husband?

Ans. Children education planning

Q. Aditya wants to take home loan and his monthly take home is 80 000 what as a best practice

should be the maximum EMI

Ans. 32000

Q. Janvi borrows Rs 10 lacs from Geeta. She returns Rs 2 lacs in the next month. Geeta now plans to

take an insurance policy on life ofJanvi. Which of the statement is true?

Ans. Geeta can take the policy up to the extent of unpaid loan amount

Q. When an insurance company is not bound by the terms of the quotation during the set period?

Ans. When policy received

Q. Amit has taken a G-Sec and has parted with it mid way as he required the money with the

intention of not getting the interest. What will he get?

Ans. Principle with persistency bonus

Q. Is the payment of interim bonus made mandatory under section 112 of the insurance Act 1938

Ans. Yes

Q. A proposal of life insurance is not accepted in the absence of insurable interest which mainly

depends on the

Ans. blood relation between the proposer and the life insured

Q. Which of the following statement is not true?

Ans. Indemnity clause in insurance means insurance cannot be used to make profit

Q. A family consisting of husband wife and two children aged 6 and 10 what kind

of insurance plan can be suggested?

Ans. All of the above

Q. The main protection need of a 19-year-old is most likely to be:

Ans. self-protection.

Q. A Couple has 7 years old son what solution they would be looking for:

Ans. child education

Q. Naresh is married and his daughter Sneha is 3 years old. Which plan can he

take?

Ans. Term & Children plan

Q. What is the reason for which a self-employed should take an insurance

plan?

Ans. Control unstable income

Q. What to be considered while taking first policy?

Ans. All of the above

Q. Which one is not an asset?

Ans. House loan

Q. Mr. X fact find shows he need a term insurance for his future income

protection, a family health plan to cover medical needs, a children’s plan to

cover his son’s education and a endowment policy for his daughter’s marriage.

Which of these is the first priority?

Ans. Term Insurance

Q. The sole focus during a client’s fact-find session was healthcare requirements

and estate planning which main life stage is he most likely to fall into?

Ans. retirement

Q. Rajiv is married & has 4-year old son. Which insurance plan is suitable for

him?

Ans. Child plan

Q. Akash is an unmarried person and employed with company ABC and drawing

a handsome salary. He has no liabilities. What kind of plan can be suggested to

him?

Ans. ULIP

Q. Danny is married and has two children aged 6 and 10. His parents are aged

68 and 70. who all can be included in Family floater option of a health plan

Ans. Danny his wife and his children

Q. Rupkumar wants to take commutation option. What is the maximum amount

he can withdraw?

Ans. One third

Q. Implication of Daily Hospitalisation benefit plan

Ans. On the expenses incurred daily due to critical illness

Q. If there is no claim in a year, then what will be the benefit to the customer as

No Claim Bonus:

Ans. Discount in next year premium

Q. While calculating the pension figures required at the time of retirement, two

factors should be considered while planning. One is taxation and other is:

Ans. inflation

Q. How riders will help the customer in life insurance?

Ans. Allows policyholders to customize their insurance cover with additional

benefits

Q. Yash wants to take open market option in pension plan. What is the benefit?

Ans. To switch the underlying fund

Q. Critical illness rider was taken and the rider benefit has been claimed. The

rider benefit now gets:

Ans. Terminated

Q. Health insurance is needed because:

Ans. cost of healthcare has increased significantly

Q. The premium on all riders put together should not exceed:

Ans. 30% of the premium on the base policy

Q. In a health insurance plan, what feature is likely to cause the insurer to

decrease the renewal premium:

Ans. No claim bonus

Q. The premium for accidental death benefit rider must not exceed:

Ans. 30% of base policy premium

Q. Rajan and Rani has taken a family floater health insurance plan of 4 lacs. They

met with an accident and had a hospital bell of 6 lacs. Which is true for this

situation?

Ans. the maximum cover will be of 4 lacs

Q. Ramesh wants to buy 15 years pension plan for retirement. While calculating,

gaps required at the end the gratuity amount was completely ignored because

he is:

Ans. self employed

Q. Customer has opted for a 5 years guaranteed annuity option what will

happen to annuity if the customer survives for 5 years after the end of

guaranteed period:

Ans. Till he dies

Q. What frequencies can one take annuity?

Ans. Monthly, quarterly, Half-yearly, Yearly

Q. All ULIP pension plans have to give how much percentage as Guaranteed

returns:

Ans. 0.045

Q. In what proportion is the cover in a family floater plan shared:

Ans. no proportion

In term insurance, if critical illness rider claim happens then what will happen to

existing policy:

Ans. CI benefit will cease

Q. A person retiring within 3 months need return as pension. What kind of

investment plan he need to choose?

Ans. Immediate annuity

Q. Vishal and Sandeep applied for a health plan in XYZ Life Insurance company.

Vishal is asked to undergo medical check-up. But Sandeep is not asked to do so.

What will be most possible reason?

Ans. Sandeep has taken another policy from XYZ life insurance company

Q. Family floater health insurance plan covers:

Ans. all members of a family

Q. An individual need a lump sum at the age of retirement. The amount he need

to

invest annuity for the goal will depend on:

Ans. all the above

Q. Which factor needs to be kept in mind before deciding a child policy ?

Ans. Maturity Value

Q. What tax rate if any will be applicable to a life insurance policy holder for the maturity

proceeds of a Rs 50 000 life insurance policy

Ans. 0.2

Q. If 50000 is invested in Single Premium ULIP than what will be the minimum SA

applicable?

Ans. 75000

Q. In Group Insurance who is the Master Policyholder?

Ans. Employer & Employee

Q. Waiting period in a health insurance policy is to address:

Ans. Pre-existing illness

Q. Commutation is a feature of which type of policy:

Ans. Annuity

Q. The consensus ad idem mainly ensures that

Ans. It is the duty of the proposer to enquire about the terms and conditions of the policy

Q. Husband and wife jointly taking insurance policy what is the reason that they need not

mention nominee under this insurance policy

Ans. Joint Life Policy

Q. A person has taken a term insurance of 4 lacs. What is the maximum critical

illness rider he can take?

Ans. 4 lac

Q. The rider which is given by the insurance company and which pays for the

treatment cost in the event of hospitalization of the insured person is called?

Ans. hospitalization care rider

Q. What are the benefits to the policyholder under surgical care rider?

Ans. Treatment cost of surgery subject to terms and conditions

Q. A person Wants to invest in a FD for Tax benefit. How many years he has to

take the term of the FD?

Ans. 5 year

Q. What is the limit of tax benefit that can be availed of under Section 80C?

Ans. 1,00,000/-

Q. What is the advantage of converting physical gold assets to gold ETFs?

Ans. Liquidity

Q. From which investment, a person will have Capital Growth and Dividend?

Ans. Equity

Q. What is purpose of investing money in debt mutual fund?

Ans. fixed Income

Q. Under which section of the Income Tax Act can an individual get a deduction

from taxable income for Health Insurance?

Ans. 80D

Q. Ajit and Vijit are 2 friends paying same premium for health insurance. Why Ajit

has higher tax exemption eligibility than Vijit?

Ans. Ajit is above 65 years of age whereas Vijit is below 65

Q. Which is NOT the duty of Life Insurance Council?

Ans. Fixing price of insurance products

Q. __ has laid down the Code of Conduct for all agents:

Ans. Insurance Regulatory & Development Authority

Q. In underwriting the economic value of the person is determined by what

Ans. Human life value

Q. Mr. Kumar decides that is employees should have SSS scheme what type of

plan is SSS

Ans. Not a specific plan

Q. In cumulative bank deposit the interest that in normally compounded on

what basis.

Ans. Quarterly

Q. Anand received post taxation 5% return on his fixed deposit in bank if his net

return is 3%, what can be the reason

Ans. Inflation

Q. Which is the primary saving need among all saving needs?

Ans. Contingency/Emergency fund.

Q. An Investor has invested in Debt mutual fund he is ideally looking for:

Ans. Savings Income

Q. Regular savings creates a fund to meet adverse incidents in future. For

drawing a financial plan for savings needs of an individual without capital what is

the Fund which comes first?

Ans. Retirement fund

Q. Why IRDA allows free look in period cancellation?

Ans. To save clients from unethical agents

Q. Embedding Ethics means that:

Ans. Ensuring practice of ethics at all levels consistently and coherently

Q. Raju is a certified license holder under what circumstances he needs to hold

his certified license with him that is issued by IRDA:

Ans. under all circumstances

Q. Who monitors and evaluates the ethical practices of insurers?

Ans. Both the above

Q. A policy has been rejected by the company under direct intimation to the

customer and copy to the Agent. What is the next action of the Agent?

Ans. He has to explain the reasons for rejection to the customer

Q. More surrenders, lapses and cancellations during free look in period raises

doubts that the Company is doing _sales: Ans. Unethical Q. To redress the Grievances of the Policy Holders, a number of authorities have been formed. Which of the following authorities has been empowered to hear the complaints and adjudicate? Ans. Consumer Grievance Redressal Forum Q. Agent offering rebate may be fined with: Ans. Rs. 500 Q. AML program of every insurer to include _____ apart from procedure,

training and audit:

Ans. Appointment of Principal Compliance Officer

Q. To ensure that the premiums are paid out of a legitimate source of funds,

cash is accepted:

Ans. Upto 1,00,000

Q. Ethical practices lead to……:

Ans. Positive image for the company

Q. An Insurer advertises through daily newspaper. What type of marketing is

this?

Ans. Direct Selling

Q. Investments by NRI (Non-Resident Indian) will be:

Ans. High Risk

Q. Health ID cards are provided to all their policy holders in order to validate their identity at

the time of admission by

Ans. TPA

Q. The controler of insurance in India is

Ans. IRDA

Q. Rahul is appointed as Director of Life Insurance Company He cannot be an

Ans. Chief Actuary

Q. An advisor while explaining the policy and to sell he accepts to give a part of

his Agent’s Commission. What is the limit?

Ans. He cannot offer any commission

Q. The authority of COPA is limited to what amount at the District Level?

Ans. 20,00,000 /-

Q. It is the bounden duty of the Insurers to protect the interest of their

policyholders from proposal acceptance to claim payment because of the:

Ans. Regulations of IRDA

Q. Who can cancel the licence of an Agent if Agent violates code of conduct?

Ans. Life Insurance Council

Q. In MWP Act policy claim is paid to:

Ans. Trustee

Q. Consumer Forum at District level will hear complaints upto:

Ans. 20 lakhs

Q. For renewal of licence an Agent has to complete practical training for �.

Hours

Ans. 25 hours

Q. How much is the rebate allowed by IRDA to client?

Ans. Nil

Q. For renewal of licence an Agent has to complete practical training for �. Hours

Ans. 25 Hour

Q. An Actuary is a Fellow of

Ans. IAI

Q. Tariff Advisory Committee has been formed under

Ans. Insurance Act 1938

Q. A person operating without licence can be fined upto

Ans. 2000

Q. If a policy is endorsed under MWP Act the beneficiaries are wife and

Ans. Children

Q. IRDA decides on

Ans. All the above

Q. Board of Insurance is related to

Ans. IRDA

Q. What is the fee for a duplicate licence

Ans. 200

Q. What is Detariffication

Ans. Pricing of insurance products by the Agent

Q. Ravi was expecting a claim amount of Rs. 12,00,000 from insurer. But it was

rejected. He feels that the claim has been repudiated on wrong reasons. Which

consumer forum can he approach?

Ans. District Level

Q. An Agent offered his client that 75% of the first premium will be paid by him

out of commission. This offer of rebate on premium will be treated as: :

Ans. a breach of IRDA’s code of conduct

Q. Mr.Suresh dies one day before the grace period without paying the premium.

What is the claim payable?

Ans. Sum Assured less the undue premium

Q. What is the maturity claim payable under a ROP?

Ans. Return of Premium

Q. What is the main requirement for settlement of a death claim?

Ans. Proof of death

Q. What is a Claim?

Ans. A demand of the Insured to the Insurer

Q. What is recovery made from final claim settlement?

Ans. All the above

Q. An Insurer advertises through daily newspaper. What type of marketing is

this?

Ans. Direct Selling

Q. Payment of premiums by cash cannot exceed __:

Ans. Rs. 1,00,000

Q. The controller of insurance in India is:

Ans. IRDA

Q. Which is a claim?

Ans. All the above

Q. If there is no insurable interest, then the contract is:

Ans. Invalid contract

Q. Client died in 89th day from DOC. In which category he is not eligible for

claim?

Ans. Suicide

Q. When an insurance claim is valid?

Ans. All the above

Q. In which claim most frauds occur?

Ans. Death claim

Q. What is maturity claim payable under a ROP?

Ans. Maturity claim

Q. If there is no insurable interest then the contract is

Ans. All the above

Q. Mr. Customer has taken a policy and died before receiving the document

which was dispatched by the insurer? He is:

Ans. Entitled for full claim

Q. When annuity payments start under a deferred annuity plan?

Ans. Vesting date

Q. What is the death claim payable in case of ULIP?

Ans. Sum insured or Fund Value whichever is higher

Q. In a claim the customer got much more than theSumAssured. Why?

Ans. Nature of payment

Q. If a person is absconding, then after how many years will he be considered as

dead & SA paid to the nominee:

Ans. 7 years

Q. The fee for renewal of Agent licence is

Ans. 250

Q. Who regulates the Agent’s code of conduct?

Ans. IRDA

Q. In which type of claim investigation is necessary

Ans. Both early and Non-claim claims

Q. What is the maturity benefit payable if a ULIP matures?

Ans. Sum insured + Fund value

Q. A contract entered into a drunken person is ….:

Ans. Invalid contract

Q. A contract which has no effect on either of the contracting parties is:

Ans. Void contract

Q. What is the maximum time in which the insurer should settle a claim when all

documents are submitted?

Ans. 30 days

Q. When insurance contract is voidable?

Ans. Both the above

Q. Without submitting any form of claim a life insurance policy holder received

payments of maturity then what type of policy he is holding?

Ans. Money Back

Q. If notification of death is received 3 years after death then the claim can be

declared:

Ans. Death claim

Q. What is the death benefit if the person has multiple sums assured under

different policies?

Ans. Sum of all SA in different policies

Q. In case of confirmed accidental death, the benefit is paid in the form of:

Ans. Lump sum assured plus accidental sum assured

Q. If the policyholder dies before receipt of Survival Benefit claim then to whom

the Survival Benefit claim monies are payable?

Ans. Nominee

Q. The delay in settling claim by any insurance co as per IRDA norms has to

pay….% if the present bank interest rate is 5.2%:

Ans. 0.07%

Q. The policy under death claim is paid regardless of when death occurs is:

Ans. Endowment plan

Q. The latin term ‘void ab initio’ means:

Ans. null& void from the beginning

Q. No of days in which the death claim has to be paid after the necessary

documents have been received:

Ans. 30 days

Q. How much proportion of accumulated fund can be commuted in case of

annuity policies?

Ans. Upto 1/3rd

Q. If a person is missing, then after how many years will he be considered as

dead & SA paid to the nominee?

Ans. 7

Q. In case of Conditional Assignment, the claim monies can be paid to:

Ans. Assignee

Q. In case of a Paid up policy, what is the claim payable?

Ans. Fund value

Q. Third party insurance is compulsory under:

Ans. Motor vehicle Act 1988

Q. The Ombudsman can:

Ans. All the above

Q. In case of no fault liability the minimum compensation that will be paid to the

person injured due to motor vehicle without proving the fault of the driver is

Ans. Rs. 50,000/- for death and Rs 25,000/-for grievous hurt.

Q. A customer can approach an Ombudsman if:

Ans. The value of the claim is not above Rs 20 lakh

Q. The Consumer Protection Act was passed in:

Ans. 1986

Q. Protection of Policyholder’s Interest guidelines is published by:

Ans. IRDA

Q. LokAdalats were set up in June, 1985 with a view to:

Ans. All the above

Q. HIT and run cases means:

Ans. Vehicle and driver disappear after the accident and the liability is not known

Q. Consumer Court is a:

Ans. Quasi-judicial machinery

Q. A defect or deficiency is a:

Ans. All the above

Q. A Life Insurance Policy should contain:

Ans. All the above

Q. Free look option should be exercised within:

Ans. 15 days of purchase of the policy

Q. A survey or should submit his report generally within:

Ans. Within 30 days of appointment

Q. A General Insurance policy should contain:

Ans. All the above

Ans. Q. A Policy holder can register the following in his Policy:

All the above

Q. The Consumer protectection Act was passed in

Ans- 1986

Q. In case of delay of Claim settlement under Life Insurance Policy the company

shall

Ans. Pay interest on the claim amount at a rate which is 2% above the bank rate

Q. In case of General Insurance Policy Claims, the company will appoint:

Ans. Surveyor for assessing the loss

Q. When a customer cancels a policy under Free Look condition, the insurer will

refund:

Ans. The risk premium;

Q. Medical underwriting is necessary to prevent people from purchasing health

insurance coverage only when they are:

Ans. All the above

Q. Policy Bond is a very important document for the customer because:

Ans. It is a legal document containing the terms and conditions of the contract.

Q. Free look of an Insurance Policy means:

Ans. Policy holder can cancel the policy after purchasing it.

Q. RAP should NOT:

Ans. All the above

Q. An underwriter is a professional who has the ability to

Ans.

Q. RAP should conduct ethical business with:

Ans. All the above

Q. An underwriter is a professional who has the ability to:

Ans. Understand the risks to which the underwritten object is exposed

Q. After sales service in insurance includes the following:

Ans. All the above

Q. Cold canvassing in Insurance refers to:

Ans. Meeting a person not known and with whom he does not have any

introduction or any meeting in past

Q. Agents act as an intermediary between the:

Ans. Insurer and the Policyholder.

Q. Who amongst the following is a prospect for insurance

Ans. All the above

Q. An Insurance company should be a:

Ans. All the above

Q. Corporate agent Is a corporate body which acts as:

Ans. Agent for all Life and General Insurers

Q. A VLE can sell policies of:

Ans. All Life, Non-Life and health Insurance companies

Q. A public-sector company specialized for Risk Related to Crop insurance is:

Ans. Agriculture Insurance Company of India Limited

Q. A public-sector companythatspecializesin risks related to export credit is:

Ans. Export Credit and Guarantee Corporation of India

Q. Who manages the employees provident fund?

Ans. EPFO

Q. When a customer cancels a policy under Free Look condition the insurer will refund

Ans. Alltheabove

Q. Unethical selling includes:

Ans. All the above

Q. In case of General Insurance Policy Claims the company will appoint

Ans. Survey or for assessing the loss

Q. RAP can do the following:

Ans. All the above

Q. Fact finding sheet allows the agent to:

Ans. Analyse customer needs

Q. The rates of assumed annual growth to be shared in the benefit illustration

has been decided by which of the authority:

Ans. Life Insurance Council

Q. In order to fulfil the Know Your Customer Procedures, at what stage in the

financial planning process is the insurance agent most likely to request a copy of

the Customer’s photograph?

Ans. At the end of the presentation meeting

Q. A fact find is not intended to:

Ans. Reveal client’s personal secrets

Q. The agent can use the benefit illustration document to show the client the

projected growth of investment at the rate of:

Ans. 6% and 10%

Q. The client’s job profile and workplace play an important role in:

Ans. Fact find

Q. During fact finding what will be the next step after identifying clients need:

Ans. prioritize client needs

Q. What should an agent do in order to understand the mental state of client in

respect to his investment in savings products

Ans. Reviewing his existing Investments

Q. Assessment of needs does not include:

Ans. priorities of the agent

Q. Which plan should an agent suggest?

Ans. A plan based on needs of the client

Q. What is the period of award passed to the customer decided by

ombudsman?

Ans. 3 months

Q. For Logging a policy which document is more preferable – Baptism Certificate

or

Ans. Baptism Certificate

Q. What is the min age to enter into the contract of insurance?

Ans. 18

Q. Why does an insurer insist on age proof document? To assess:

Ans. Risk assessment

Q. In a joint life plan for a husband & wife, where should the agent’ principal

loyalty lay?

Ans. Insurance company, husband & wife

Q. Term insurance if best suited for the following need:

Ans. home loan

Q. What is to be considered while taking first policy?

Ans. All the above

Q. In fact-finding, why client’s income analysis is necessary?

To do financial planning according to the needs of the client

Q. What does the liabilities section list contain?

Ans. List the amounts of all the client’s debts

Q. The advantage/disadvantages within cumulative and fixed traditional deposits

pertain to-

Ans. Returns

Q. Mr.Ramesh invested Rs:50000 in pension policy, what is the percentage he

can avail as:

Ans. will depend on his income slab

Q. A satisfied client will lead to:

Ans. All the above

Q. Insurance Contract without any Insurable Interest will result?

Ans. Wagering Contract

Q. Benefit illustration is used to:

Ans. Show the client the nature of the product and its benefits

Q. Suresh wants to transfer his physical gold to gold exchange traded fund in

relation to access this change will:

Ans. Insure against uncertainties

Q. Suresh wants to transfer his physical gold to gold exchange traded fund in

relation to access this change will:

Ans. Increase his liquidity

Q. Suresh has adequate reserve capital with him and he wishes to protect his

income. Moreover, he feels that if he does not die then he would need the

amount. What type of plan should he opt for?

Ans. Pension plan

Q. A person wants to invest in a FD for Tax benefit. How many years he has to

take the term of the FD?

Ans. 5 Years

Q. KishanVikas’s payment gets cleared at:

Ans. Post office

Q. Where would you have to go if you wanted to buy a KisanVikasPatra?

Ans. Post Office

Q. Bank interest is accumulated:

Ans. Monthly

Q. What is the frequency of the crediting the interest which is given to the

customer in a cumulative deposit?

Ans. quarterly

Q. In the Life Insurance segment, there is:

Ans. One Life Insurance Company in the public sector

Q. Corporate agent Is a corporate body which acts as:

Ans. Agent for all Life and General Insurers

Q. Customer asks the agent to disclose the commission. The agent should:

Ans. disclose on demand

Q. Which is the training institute for providing training to insurance agents?

Ans. Insurance Institute of India

Q. Who licenses the insurance Broker?

Ans. IRDA

Q. In a cashless Medi-claim policy the claim amount is paid by the Insurance

company to the:

Ans. TPA

Q. TPA’s are authorized by the Insurer to:

Ans. all the above

Q. TPA should provide:

Ans. All the above

Q. Third Party Administrators operating in Health insurance sector are licensed

by IRDA under:

Ans. IRDA(Third Party-Health Services) Regulations of 2001

Q. Third Party Administrators are intermediaries providing:

Ans. Health insurance services on behalf of Insurance Companies

Q. Network Hospital in Health Insurance refers to:

Ans. Hospitals with which TPAs tie-up for cash less treatment

Q. If an Insurance company appoints a TPA under health Insurance:

Ans. The liability to settle the claim remains with the insurers

Q. A newspaper advertisement was issued regarding a insurance policy. This indicates that the

policy is

Ans. Transferred

Q. After which time limit insurance company is liable to interest to claims?

Ans. 30 days

Q. If a person is missing then after how many years will he be considered as dead & SA paid to the

nominee.

Ans. 7

Q. The Ombudsman’s powers are restricted to insurance contracts of what

value?

Ans. 20 Lakhs

Q. When a contract is voidable?

Ans. Good faith

Q. License of an agent was withdrawn in June 2010 due to malpractice. He can

reapply for his license in:

Ans. 2015

Q. Publicity and Advertisements material published by Insures should conform to

Ans. IRDA Meetings regulations

Q. What is the stipulated time frame within which an insurer is supposed to

respond after receiving any communication from its policyholder?

Ans. 10 days

Q. In the Life Insurance segment there is

Ans. Forty insurance companies in total

Q. A public sector company specialized for Risk Related to Crop insurance is

Ans. Agriculture Insurance Company of India Limited

Q. In the General Insurance segment there is

Ans. Four General Insurance companies in the public sector

Q. A public sector company, specialized for risks related to export credit is

Ans. Export Credit and Guarantee Corporation of India

Q. For the customer whose claim has been refused by the company the three

places where he/she should follow up are – Ombudsman IRDA Customer

Grievance Cell and :

Ans. Consumer Forum

Q. Karthik written to his insurer about non-settlement of a maturity claim. As per

regulations the insurer should reply to this within how many working days?

Ans. 10

Q. A policy holder submits cancellation of his term insurance policy. The insurer

accepts the form and fails to give the benefits. Policy holder writes to IRDA post

which the settlement should be made within?

Ans. 15 days

Q. Health ID cards are provided to all their policy holders to validate their

identity at the time of admission by:

Ans. Hospital

Q. The major duty of the TPA is

Ans. Claim Management

Q. Third Party Administrators operating in Health insurance sector are licensed

by:

Ans. IRDA

Q. Agents to do

Ans. Need based selling

Q. Underselling means

Ans. More bonuses

Q. An advisor while explaining the policy and to sell he accepts to give a part of his Agents

commission what is the limits

Ans. He can offer up to 50%

Q. More surrenders lapses and cancellations during free look in period raises more doubts that the

Company is doing Sales

Ans. Value

Q. Higher the number of lapses surrenders and cancellations will be doubts about Ethical practices of

insurers.

Ans. Either Higher or Lower

Q. Agent to make sure that he does not disclose any information about his client. How is this

described

Ans. Responsible

Q. Insurance companies are required to honor the awards passed by the Insurance Ombudsman

within how may days

Ans. 15 days

Q. As per Regulation for protection of Policyholder’s interest 2002 (IRDA) Which insurer will have a

grievance redressal System

Ans. It is optional

Q. A policy has been rejected by the company under direct intimation to the customer and copy to

the Agent what is the next action of the Agent

Ans. He has to explain the reasons for rejection to the customer

Q. As per IRDA regulations IGMS should be mandatory set up by:

Ans. By all insurers

Q. Ombudsman has to give his decision within how many days?

Ans. 3 Months

Q. An Award is passed by Ombudsman. In how many days it should be honored

by Insurance Co

Ans. 15 days

Q. The functions of the Insurance Ombudsman include

Ans. Conciliation and making awards

Q. If a case is already before the consumer forum then the ombudsman should

Ans. Give a joing decision with the consumer forum

Q. IGMS is a platform for registering complaints & mandatorily to be used by

Ans. all insurers

Q. What are the ways by which a policy holder can make complaints

Ans. E mail or Toll free Number

Q. Ombudsman has to pass an award within how much time

Ans. 3 months

Q. If a person chooses cumulative deposit than Recurring deposit difference will

be in:

Ans. Frequency of interest calculation

Q. If a person want to maintain emergency funds the best place is a bank or:

Ans. ULIP

Q. What period of time a client has to be invested to get tax benefit under postal

scheme?

Ans. 5 years

Q. What is purpose of investing money in debt mutual fund?

Liquidity

Q. Anand received post taxation 5% return on his fixed deposit in a bank. If his

net return is 3% what can be the reason?

Ans. Inflation

Q. If an Agent focusses on Commission, then it is:

Ans. Unethical

Q. Which body has created a call centre for logging a complaint?