Airtel Payment Bank CSP Dashboard Login is a secure portal for Airtel Payment Bank’s Customer Service Providers (CSPs) to access and manage their accounts. The dashboard provides access to various services such as account management, money transfer, bill payments, and more.

Airtel Payment Bank Retailer is a service that allows Airtel customers to open a bank account and access banking services such as money transfers, bill payments, and more. Customers can open an account at any Airtel store or through the Airtel website. The service is available in India, Bangladesh, and Sri Lanka.

Account Management:

- View account balance

- View transaction history

- Change personal information

- Manage beneficiaries

Money Transfer:

- Send money to other Airtel customers

- Send money to bank accounts

- Send money to mobile wallets

- Request money from other Airtel customers

- Request money from bank accounts

- Request money from mobile wallets

Bill Payments:

- Pay utility bills (electricity, water, gas)

- Pay credit card bills

- Pay insurance premiums

Here’s what I need to open an Airtel CSP account:

- Aadhaar card

- PAN card

- Bank account details

- Mobile number

- Email address

- Address proof (voter ID, driving license, etc.)

- Passport size photograph

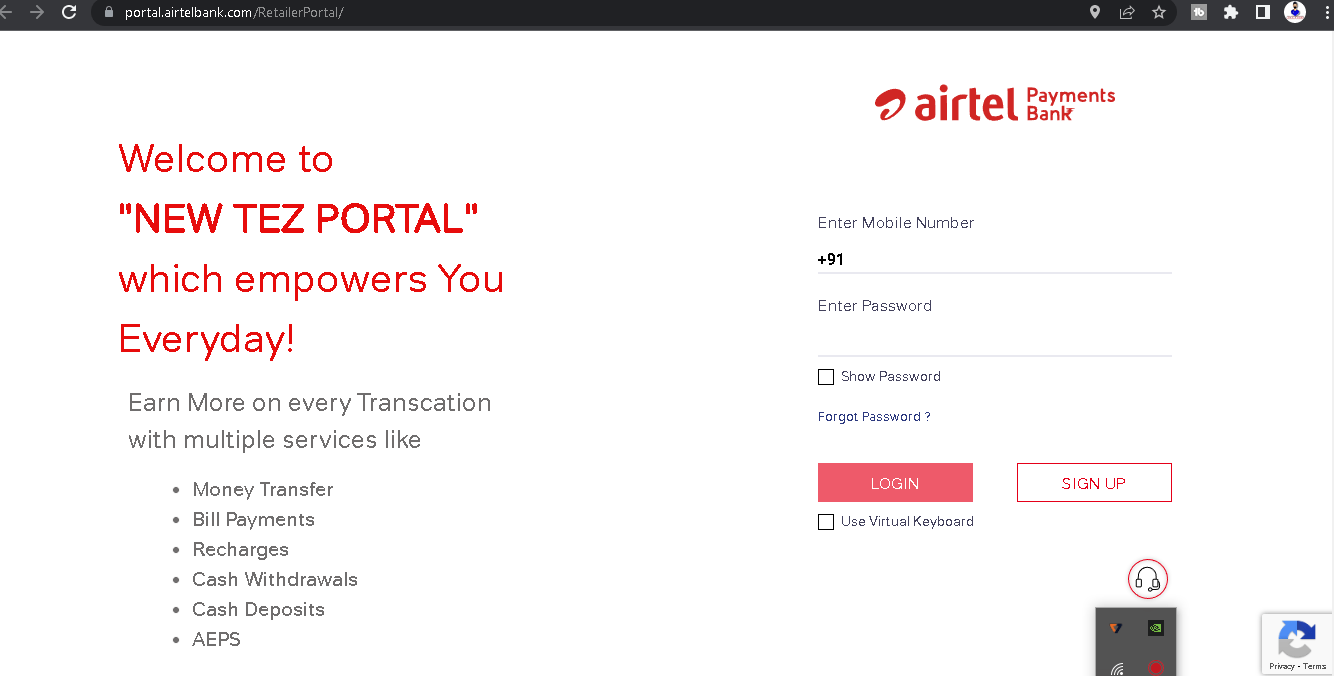

how to login to your Airtel CSP account:

1. Go to the Airtel Payment Bank CSP Dashboard website.

2. Enter your username and password.

3. Click the ‘Login’ button.

Airtel Payment Bank CSP: Empowering Individuals with Financial Inclusion!

Introduction: Airtel Payment Bank CSP (Customer Service Point) is a transformative initiative that aims to bring financial services to the fingertips of individuals across India. As a CSP, you can become a trusted partner of Airtel Payment Bank and offer a range of banking and financial services to your customers. In this article, we explore the details of Airtel Payment Bank CSP, highlighting its benefits, opportunities, and how it contributes to promoting financial inclusion in the country.

- Expanded Reach: By becoming an Airtel Payment Bank CSP, you can extend the reach of financial services to underserved areas and remote communities. With Airtel’s extensive network and digital infrastructure, you can bring banking services closer to the masses, enabling them to access basic financial services conveniently.

- Essential Banking Services: Airtel Payment Bank CSP empowers you to provide essential banking services to your customers. These services include account opening, cash deposits and withdrawals, fund transfers, bill payments, mobile recharges, and more. By offering these services, you become a one-stop solution for various banking needs within your community.

- Digital Payments and Aadhaar Enabled Payments: Airtel Payment Bank CSP allows you to offer digital payment solutions, encouraging your customers to embrace cashless transactions. With the Aadhaar Enabled Payment System (AEPS), your customers can make secure and hassle-free transactions using their Aadhaar-linked bank accounts, fostering financial inclusivity and reducing the dependency on cash.

- Commission and Incentives: As an Airtel Payment Bank CSP, you can earn attractive commissions and incentives on the transactions conducted through your CSP outlet. This serves as an additional revenue stream and rewards you for your efforts in promoting financial services and digital transactions within your community.

- Training and Support: Airtel Payment Bank provides comprehensive training and support to help you efficiently manage your CSP outlet. This includes guidance on account opening procedures, transaction processing, technology usage, and customer service. The training equips you with the necessary skills and knowledge to serve your customers effectively.

- Customer Trust and Brand Association: Partnering with Airtel Payment Bank, a trusted brand in the telecommunications industry, enhances your credibility and instills customer trust. Being associated with a reputable brand boosts the confidence of your customers in utilizing the banking services you offer, fostering long-term relationships and customer loyalty.

- Empowering Financial Inclusion: Airtel Payment Bank CSP plays a vital role in promoting financial inclusion by bridging the gap between traditional banking services and underserved communities. By offering accessible and affordable financial services, you contribute to empowering individuals, enabling them to participate in the formal economy and improve their overall financial well-being.

Conclusion: Airtel Payment Bank CSP provides an incredible opportunity to be at the forefront of financial inclusion in India. By becoming a CSP, you can offer essential banking services, facilitate digital transactions, and empower individuals with access to formal financial services. Airtel Payment Bank CSP not only opens new avenues for your business growth but also contributes to building a financially inclusive society where everyone can benefit from the advantages of banking services.

Following my social platform

| Web | www.mytechtrips.com |

| Join telegram channel | Click here |

| Join WhatsApp group | Click here |

| Click here | |

| Click here | |

| Youtube Channel 1 | Click here |

| Youtube Channel 2 | Click here |